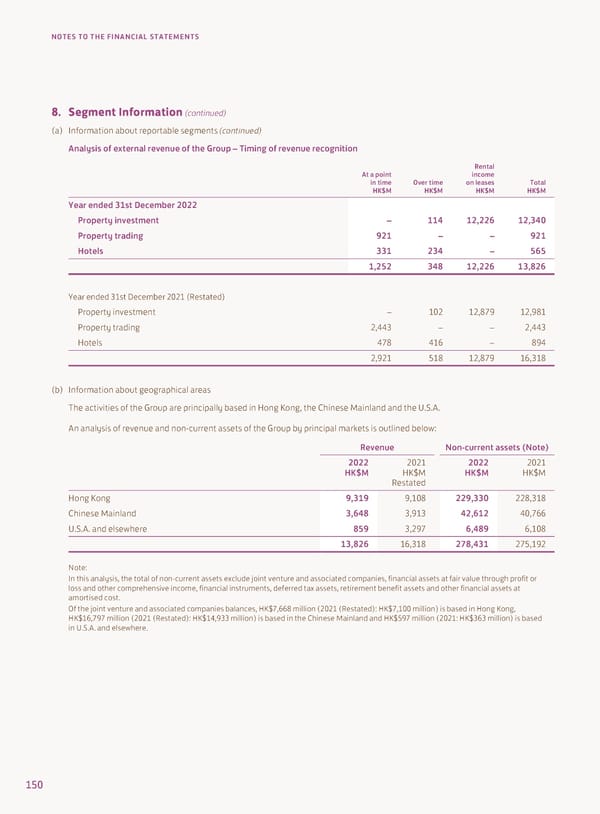

NOTES TO THE FINANCIAL STATEMENTS 8. Segment Information (continued) (a) Information about reportable segments (continued) Analysis of external revenue of the Group – Timing of revenue recognition Rental At a point income in time Over time on leases Total HK$M HK$M HK$M HK$M Year ended 31st December 2022 Property investment – 114 12,226 12,340 Property trading 921 – – 921 Hotels 331 234 – 565 1,252 348 12,226 13,826 Year ended 31st December 2021 (Restated) Property investment – 102 12,879 12,981 Property trading 2,443 – – 2,443 Hotels 478 416 – 894 2,921 518 12,879 16,318 (b) Information about geographical areas The activities of the Group are principally based in Hong Kong, the Chinese Mainland and the U.S.A. An analysis of revenue and non-current assets of the Group by principal markets is outlined below: Revenue Non-current assets (Note) 2022 2021 2022 2021 HK$M HK$M HK$M HK$M Restated Hong Kong 9,319 9,108 229,330 228,318 Chinese Mainland 3,648 3,913 42,612 40,766 U.S.A. and elsewhere 859 3,297 6,489 6,108 13,826 16,318 278,431 275,192 Note: In this analysis, the total of non-current assets exclude joint venture and associated companies, financial assets at fair value through profit or loss and other comprehensive income, financial instruments, deferred tax assets, retirement benefit assets and other financial assets at amortised cost. Of the joint venture and associated companies balances, HK$7,668 million (2021 (Restated): HK$7,100 million) is based in Hong Kong, HK$16,797 million (2021 (Restated): HK$14,933 million) is based in the Chinese Mainland and HK$597 million (2021: HK$363 million) is based in U.S.A. and elsewhere. 150

2022 Annual Report Page 151 Page 153

2022 Annual Report Page 151 Page 153