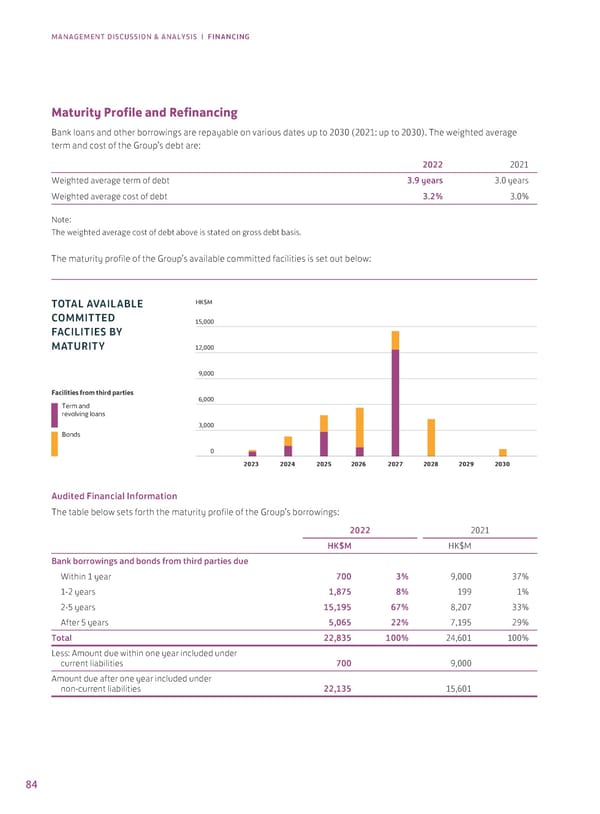

MANAGEMENT DISCUSSION & ANALYSIS | FINANCING Maturity Profile and Refinancing Bank loans and other borrowings are repayable on various dates up to 2030 (2021: up to 2030). The weighted average term and cost of the Group’s debt are: 2022 2021 Weighted average term of debt 3.9 years 3.0 years Weighted average cost of debt 3.2% 3.0% Note: The weighted average cost of debt above is stated on gross debt basis. The maturity profile of the Group’s available committed facilities is set out below: TOTAL AVAILABLE HK$M COMMITTED 15,000 FACILITIES BY MATURITY 12,000 9,000 Facilities from third parties 6,000 Term and revolving loans 3,000 Bonds 0 2023 2024 2025 2026 2027 2028 2029 2030 Audited Financial Information The table below sets forth the maturity profile of the Group’s borrowings: 2022 2021 HK$M HK$M Bank borrowings and bonds from third parties due Within 1 year 700 3% 9,000 37% 1-2 years 1,875 8% 199 1% 2-5 years 15,195 67% 8,207 33% After 5 years 5,065 22% 7,195 29% Total 22,835 100% 24,601 100% Less: Amount due within one year included under current liabilities 700 9,000 Amount due after one year included under non-current liabilities 22,135 15,601 84

2022 Annual Report Page 85 Page 87

2022 Annual Report Page 85 Page 87