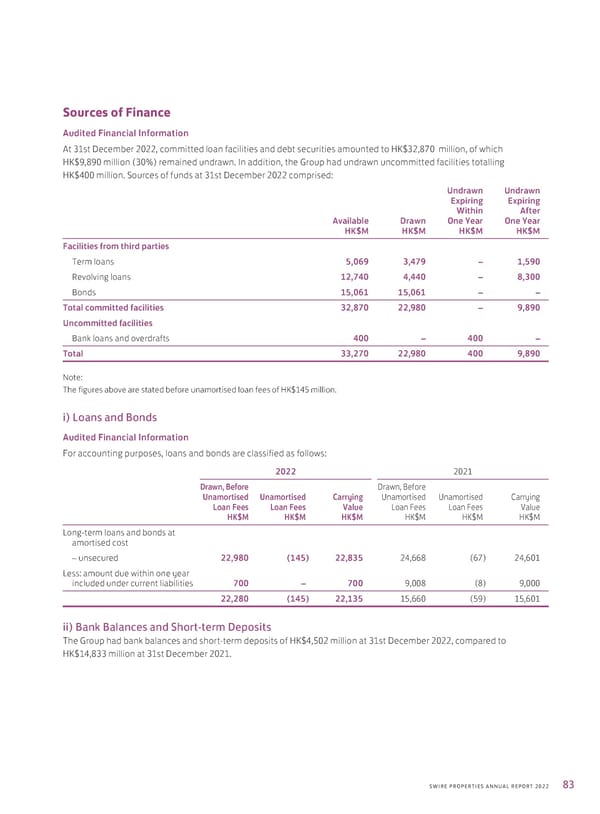

Sources of Finance Audited Financial Information At 31st December 2022, committed loan facilities and debt securities amounted to HK$32,870 million, of which HK$9,890 million (30%) remained undrawn. In addition, the Group had undrawn uncommitted facilities totalling HK$400 million. Sources of funds at 31st December 2022 comprised: Undrawn Undrawn Expiring Expiring Within After Available Drawn One Year One Year HK$M HK$M HK$M HK$M Facilities from third parties Term loans 5,069 3,479 – 1,590 Revolving loans 12,740 4,440 – 8,300 Bonds 15,061 15,061 – – Total committed facilities 32,870 22,980 – 9,890 Uncommitted facilities Bank loans and overdrafts 400 – 400 – Total 33,270 22,980 400 9,890 Note: The figures above are stated before unamortised loan fees of HK$145 million. i) Loans and Bonds Audited Financial Information For accounting purposes, loans and bonds are classified as follows: 2022 2021 Drawn, Before Drawn, Before Unamortised Unamortised Carrying Unamortised Unamortised Carrying Loan Fees Loan Fees Value Loan Fees Loan Fees Value HK$M HK$M HK$M HK$M HK$M HK$M Long-term loans and bonds at amortised cost – unsecured 22,980 (145) 22,835 24,668 (67) 24,601 Less: amount due within one year included under current liabilities 700 – 700 9,008 (8) 9,000 22,280 (145) 22,135 15,660 (59) 15,601 ii) Bank Balances and Short-term Deposits The Group had bank balances and short-term deposits of HK$4,502 million at 31st December 2022, compared to HK$14,833 million at 31st December 2021. 83 SWIRE PROPERTIES ANNUAL REPORT 2022

2022 Annual Report Page 84 Page 86

2022 Annual Report Page 84 Page 86