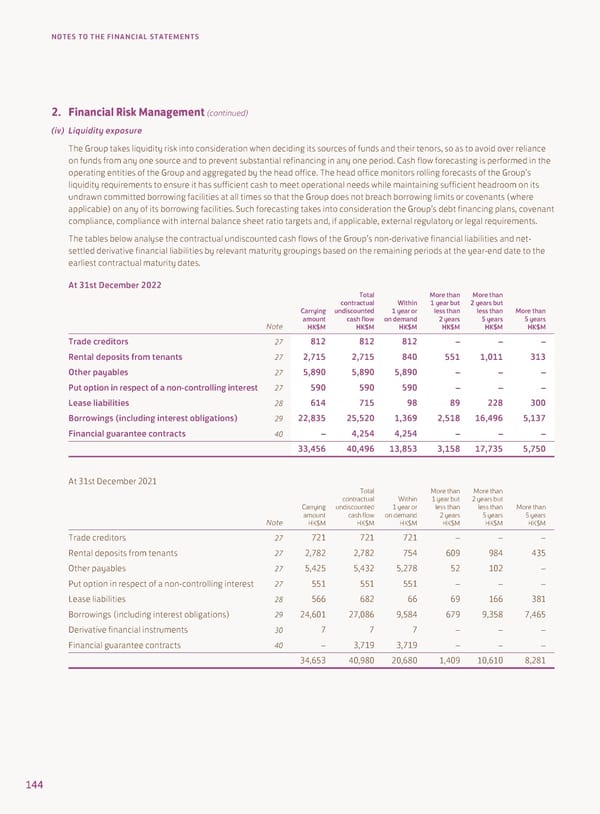

NOTES TO THE FINANCIAL STATEMENTS 2. Financial Risk Management (continued) (iv) Liquidity exposure The Group takes liquidity risk into consideration when deciding its sources of funds and their tenors, so as to avoid over reliance on funds from any one source and to prevent substantial refinancing in any one period. Cash flow forecasting is performed in the operating entities of the Group and aggregated by the head office. The head office monitors rolling forecasts of the Group’s liquidity requirements to ensure it has sufficient cash to meet operational needs while maintaining sufficient headroom on its undrawn committed borrowing facilities at all times so that the Group does not breach borrowing limits or covenants (where applicable) on any of its borrowing facilities. Such forecasting takes into consideration the Group’s debt financing plans, covenant compliance, compliance with internal balance sheet ratio targets and, if applicable, external regulatory or legal requirements. The tables below analyse the contractual undiscounted cash flows of the Group’s non-derivative financial liabilities and net- settled derivative financial liabilities by relevant maturity groupings based on the remaining periods at the year-end date to the earliest contractual maturity dates. At 31st December 2022 Total More than More than contractual Within 1 year but 2 years but Carrying undiscounted 1 year or less than less than More than Note amount cash flow on demand 2 years 5 years 5 years HK$M HK$M HK$M HK$M HK$M HK$M Trade creditors 27 812 812 812 – – – Rental deposits from tenants 27 2,715 2,715 840 551 1,011 313 Other payables 27 5,890 5,890 5,890 – – – Put option in respect of a non-controlling interest 27 590 590 590 – – – Lease liabilities 28 614 715 98 89 228 300 Borrowings (including interest obligations) 29 22,835 25,520 1,369 2,518 16,496 5,137 Financial guarantee contracts 40 – 4,254 4,254 – – – 33,456 40,496 13,853 3,158 17,735 5,750 At 31st December 2021 Total More than More than contractual Within 1 year but 2 years but Carrying undiscounted 1 year or less than less than More than Note amount cash flow on demand 2 years 5 years 5 years HK$M HK$M HK$M HK$M HK$M HK$M Trade creditors 27 721 721 721 – – – Rental deposits from tenants 27 2,782 2,782 754 609 984 435 Other payables 27 5,425 5,432 5,278 52 102 – Put option in respect of a non-controlling interest 27 551 551 551 – – – Lease liabilities 28 566 682 66 69 166 381 Borrowings (including interest obligations) 29 24,601 27,086 9,584 679 9,358 7,465 Derivative financial instruments 30 7 7 7 – – – Financial guarantee contracts 40 – 3,719 3,719 – – – 34,653 40,980 20,680 1,409 10,610 8,281 144

Annual Report 2022 Page 145 Page 147

Annual Report 2022 Page 145 Page 147