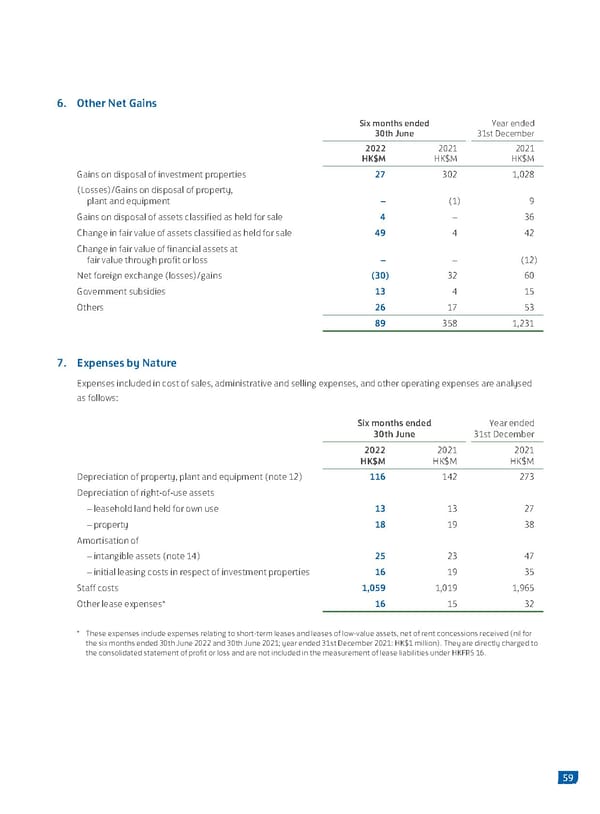

6. Other Net Gains Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Gains on disposal of investment properties 27 302 1,028 (Losses)/Gains on disposal of property, plant and equipment – (1) 9 Gains on disposal of assets classified as held for sale 4 – 36 Change in fair value of assets classified as held for sale 49 4 42 Change in fair value of financial assets at fair value through profit or loss – – (12) Net foreign exchange (losses)/gains (30) 32 60 Government subsidies 13 4 15 Others 26 17 53 89 358 1,231 7. Expenses by Nature Expenses included in cost of sales, administrative and selling expenses, and other operating expenses are analysed as follows: Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Depreciation of property, plant and equipment (note 12) 116 142 273 Depreciation of right-of-use assets – leasehold land held for own use 13 13 27 – property 18 19 38 Amortisation of – intangible assets (note 14) 25 23 47 – initial leasing costs in respect of investment properties 16 19 35 Staff costs 1,059 1,019 1,965 Other lease expenses* 16 15 32 * These expenses include expenses relating to short-term leases and leases of low-value assets, net of rent concessions received (nil for the six months ended 30th June 2022 and 30th June 2021; year ended 31st December 2021: HK$1 million). They are directly charged to the consolidated statement of profit or loss and are not included in the measurement of lease liabilities under HKFRS 16. 59

2022 Interim Report | EN Page 60 Page 62

2022 Interim Report | EN Page 60 Page 62