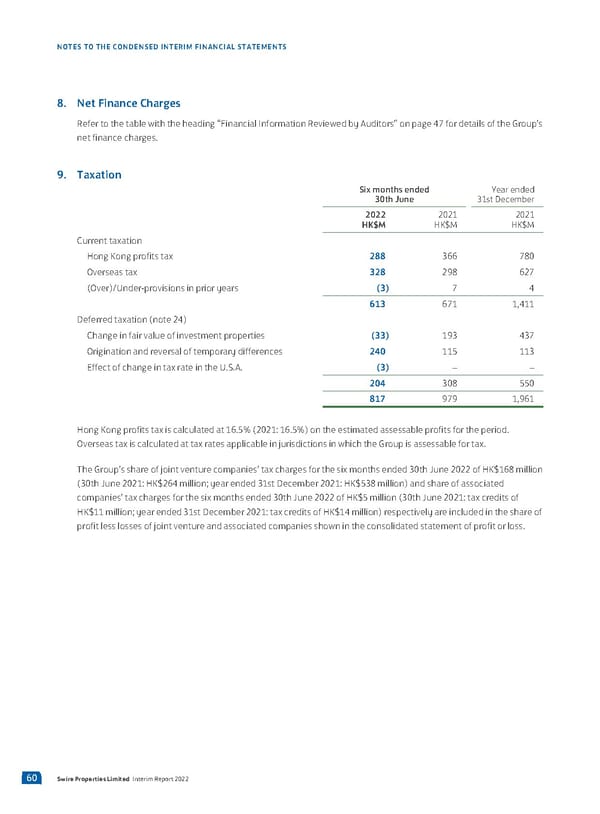

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS 8. Net Finance Charges Refer to the table with the heading “Financial Information Reviewed by Auditors” on page 47 for details of the Group’s net finance charges. 9. Taxation Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Current taxation Hong Kong profits tax 288 366 780 Overseas tax 328 298 627 (Over)/Under-provisions in prior years (3) 7 4 613 671 1,411 Deferred taxation (note 24) Change in fair value of investment properties (33) 193 437 Origination and reversal of temporary differences 240 115 113 Effect of change in tax rate in the U.S.A. (3) – – 204 308 550 817 979 1,961 Hong Kong profits tax is calculated at 16.5% (2021: 16.5%) on the estimated assessable profits for the period. Overseas tax is calculated at tax rates applicable in jurisdictions in which the Group is assessable for tax. The Group’s share of joint venture companies’ tax charges for the six months ended 30th June 2022 of HK$168 million (30th June 2021: HK$264 million; year ended 31st December 2021: HK$538 million) and share of associated companies’ tax charges for the six months ended 30th June 2022 of HK$5 million (30th June 2021: tax credits of HK$11 million; year ended 31st December 2021: tax credits of HK$14 million) respectively are included in the share of profit less losses of joint venture and associated companies shown in the consolidated statement of profit or loss. 60 Swire Properties Limited Interim Report 2022

2022 Interim Report | EN Page 61 Page 63

2022 Interim Report | EN Page 61 Page 63