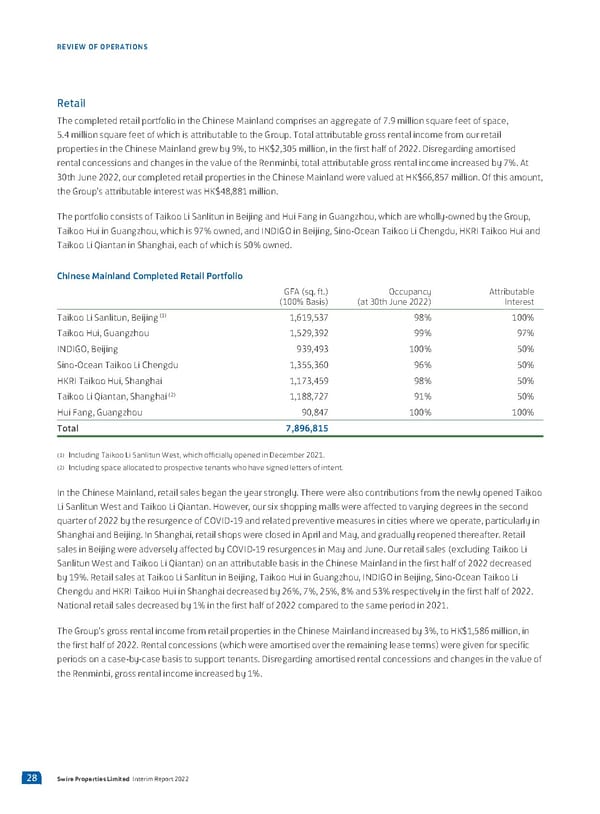

REVIEW OF OPERATIONS Retail The completed retail portfolio in the Chinese Mainland comprises an aggregate of 7.9 million square feet of space, 5.4 million square feet of which is attributable to the Group. Total attributable gross rental income from our retail properties in the Chinese Mainland grew by 9%, to HK$2,305 million, in the first half of 2022. Disregarding amortised rental concessions and changes in the value of the Renminbi, total attributable gross rental income increased by 7%. At 30th June 2022, our completed retail properties in the Chinese Mainland were valued at HK$66,857 million. Of this amount, the Group’s attributable interest was HK$48,881 million. The portfolio consists of Taikoo Li Sanlitun in Beijing and Hui Fang in Guangzhou, which are wholly-owned by the Group, Taikoo Hui in Guangzhou, which is 97% owned, and INDIGO in Beijing, Sino-Ocean Taikoo Li Chengdu, HKRI Taikoo Hui and Taikoo Li Qiantan in Shanghai, each of which is 50% owned. Chinese Mainland Completed Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest Taikoo Li Sanlitun, Beijing (1) 1,619,537 98% 100% Taikoo Hui, Guangzhou 1,529,392 99% 97% INDIGO, Beijing 939,493 100% 50% Sino-Ocean Taikoo Li Chengdu 1,355,360 96% 50% HKRI Taikoo Hui, Shanghai 1,173,459 98% 50% (2) Taikoo Li Qiantan, Shanghai 1,188,727 91% 50% Hui Fang, Guangzhou 90,847 100% 100% Total 7,896,815 (1) Including Taikoo Li Sanlitun West, which officially opened in December 2021. (2) Including space allocated to prospective tenants who have signed letters of intent. In the Chinese Mainland, retail sales began the year strongly. There were also contributions from the newly opened Taikoo Li Sanlitun West and Taikoo Li Qiantan. However, our six shopping malls were affected to varying degrees in the second quarter of 2022 by the resurgence of COVID-19 and related preventive measures in cities where we operate, particularly in Shanghai and Beijing. In Shanghai, retail shops were closed in April and May, and gradually reopened thereafter. Retail sales in Beijing were adversely affected by COVID-19 resurgences in May and June. Our retail sales (excluding Taikoo Li Sanlitun West and Taikoo Li Qiantan) on an attributable basis in the Chinese Mainland in the first half of 2022 decreased by 19%. Retail sales at Taikoo Li Sanlitun in Beijing, Taikoo Hui in Guangzhou, INDIGO in Beijing, Sino-Ocean Taikoo Li Chengdu and HKRI Taikoo Hui in Shanghai decreased by 26%, 7%, 25%, 8% and 53% respectively in the first half of 2022. National retail sales decreased by 1% in the first half of 2022 compared to the same period in 2021. The Group’s gross rental income from retail properties in the Chinese Mainland increased by 3%, to HK$1,586 million, in the first half of 2022. Rental concessions (which were amortised over the remaining lease terms) were given for specific periods on a case-by-case basis to support tenants. Disregarding amortised rental concessions and changes in the value of the Renminbi, gross rental income increased by 1%. 28 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 29 Page 31

2022 Interim Report Page 29 Page 31