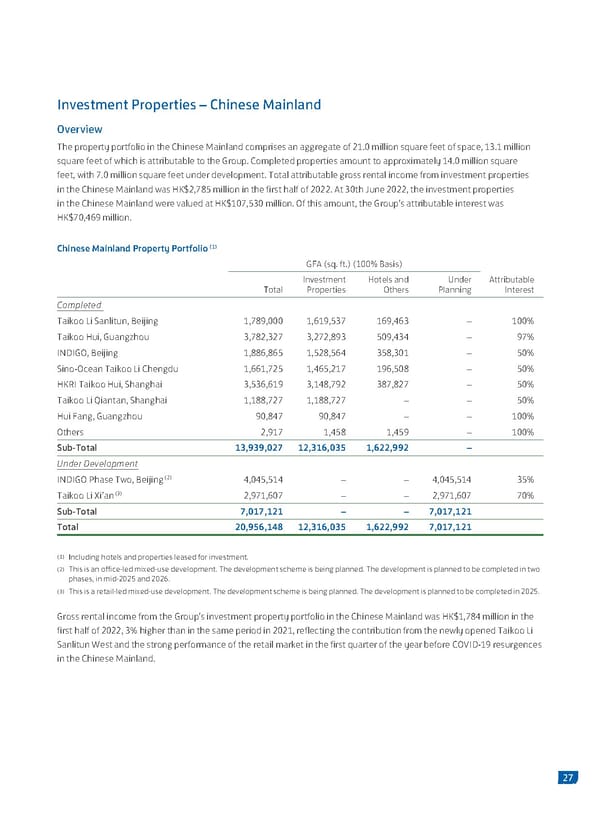

Investment Properties – Chinese Mainland Overview The property portfolio in the Chinese Mainland comprises an aggregate of 21.0 million square feet of space, 13.1 million square feet of which is attributable to the Group. Completed properties amount to approximately 14.0 million square feet, with 7.0 million square feet under development. Total attributable gross rental income from investment properties in the Chinese Mainland was HK$2,785 million in the first half of 2022. At 30th June 2022, the investment properties in the Chinese Mainland were valued at HK$107,530 million. Of this amount, the Group’s attributable interest was HK$70,469 million. Chinese Mainland Property Portfolio (1) GFA (sq. ft.) (100% Basis) Investment Hotels and Under Attributable Total Properties Others Planning Interest Completed Taikoo Li Sanlitun, Beijing 1,789,000 1,619,537 169,463 – 100% Taikoo Hui, Guangzhou 3,782,327 3,272,893 509,434 – 97% INDIGO, Beijing 1,886,865 1,528,564 358,301 – 50% Sino-Ocean Taikoo Li Chengdu 1,661,725 1,465,217 196,508 – 50% HKRI Taikoo Hui, Shanghai 3,536,619 3,148,792 387,827 – 50% Taikoo Li Qiantan, Shanghai 1,188,727 1,188,727 – – 50% Hui Fang, Guangzhou 90,847 90,847 – – 100% Others 2,917 1,458 1,459 – 100% Sub-Total 13,939,027 12,316,035 1,622,992 – Under Development (2) INDIGO Phase Two, Beijing 4,045,514 – – 4,045,514 35% Taikoo Li Xi’an (3) 2,971,607 – – 2,971,607 70% Sub-Total 7,017,121 – – 7,017,121 Total 20,956,148 12,316,035 1,622,992 7,017,121 (1) Including hotels and properties leased for investment. (2) This is an office-led mixed-use development. The development scheme is being planned. The development is planned to be completed in two phases, in mid-2025 and 2026. (3) This is a retail-led mixed-use development. The development scheme is being planned. The development is planned to be completed in 2025. Gross rental income from the Group’s investment property portfolio in the Chinese Mainland was HK$1,784 million in the first half of 2022, 3% higher than in the same period in 2021, reflecting the contribution from the newly opened Taikoo Li Sanlitun West and the strong performance of the retail market in the first quarter of the year before COVID-19 resurgences in the Chinese Mainland. 27

2022 Interim Report Page 28 Page 30

2022 Interim Report Page 28 Page 30