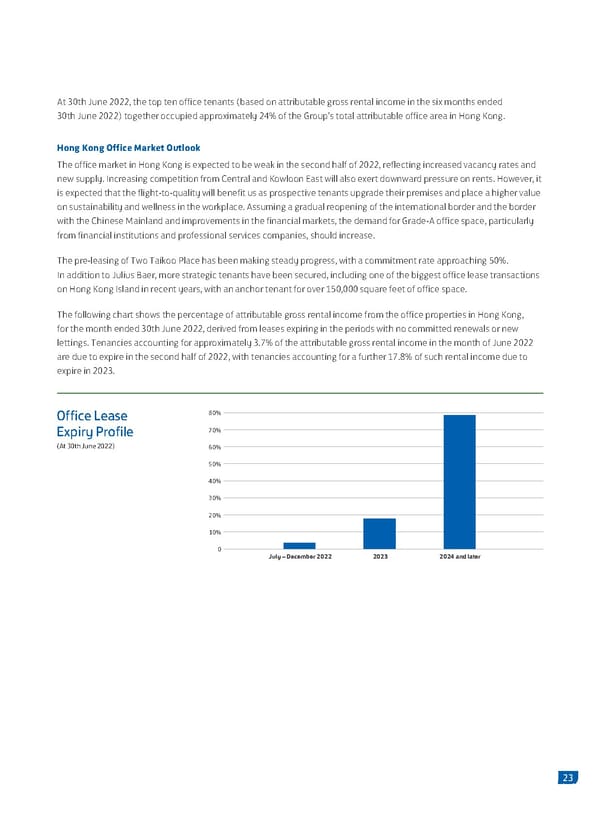

At 30th June 2022, the top ten office tenants (based on attributable gross rental income in the six months ended 30th June 2022) together occupied approximately 24% of the Group’s total attributable office area in Hong Kong. Hong Kong Office Market Outlook The office market in Hong Kong is expected to be weak in the second half of 2022, reflecting increased vacancy rates and new supply. Increasing competition from Central and Kowloon East will also exert downward pressure on rents. However, it is expected that the flight-to-quality will benefit us as prospective tenants upgrade their premises and place a higher value on sustainability and wellness in the workplace. Assuming a gradual reopening of the international border and the border with the Chinese Mainland and improvements in the financial markets, the demand for Grade-A office space, particularly from financial institutions and professional services companies, should increase. The pre-leasing of Two Taikoo Place has been making steady progress, with a commitment rate approaching 50%. In addition to Julius Baer, more strategic tenants have been secured, including one of the biggest office lease transactions on Hong Kong Island in recent years, with an anchor tenant for over 150,000 square feet of office space. The following chart shows the percentage of attributable gross rental income from the office properties in Hong Kong, for the month ended 30th June 2022, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 3.7% of the attributable gross rental income in the month of June 2022 are due to expire in the second half of 2022, with tenancies accounting for a further 17.8% of such rental income due to expire in 2023. Office Lease 80% Expiry Profile 70% (At 30th e 2022 60% 50% 40% 30% 20% 10% 0 July – December 2022 2023 2024 and later 23

2022 Interim Report Page 24 Page 26

2022 Interim Report Page 24 Page 26