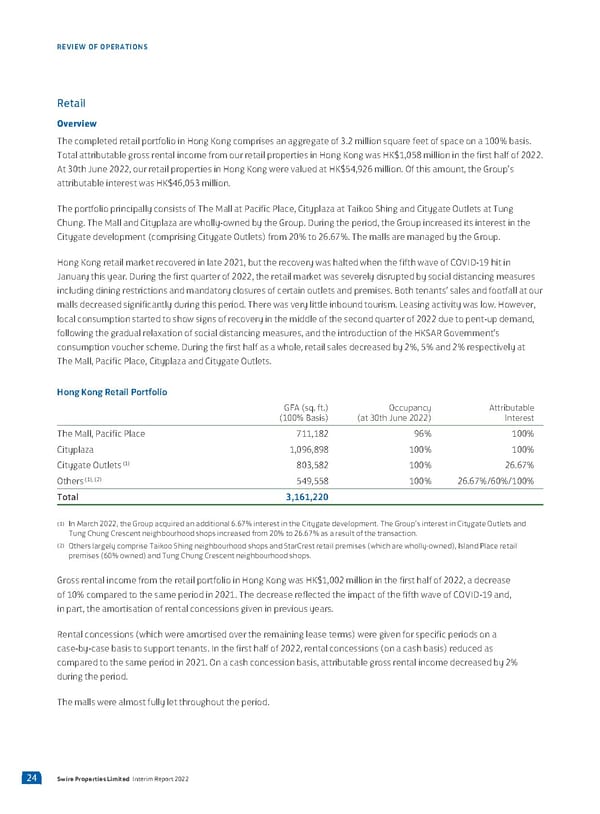

REVIEW OF OPERATIONS Retail Overview The completed retail portfolio in Hong Kong comprises an aggregate of 3.2 million square feet of space on a 100% basis. Total attributable gross rental income from our retail properties in Hong Kong was HK$1,058 million in the first half of 2022. At 30th June 2022, our retail properties in Hong Kong were valued at HK$54,926 million. Of this amount, the Group’s attributable interest was HK$46,053 million. The portfolio principally consists of The Mall at Pacific Place, Cityplaza at Taikoo Shing and Citygate Outlets at Tung Chung. The Mall and Cityplaza are wholly-owned by the Group. During the period, the Group increased its interest in the Citygate development (comprising Citygate Outlets) from 20% to 26.67%. The malls are managed by the Group. Hong Kong retail market recovered in late 2021, but the recovery was halted when the fifth wave of COVID-19 hit in January this year. During the first quarter of 2022, the retail market was severely disrupted by social distancing measures including dining restrictions and mandatory closures of certain outlets and premises. Both tenants’ sales and footfall at our malls decreased significantly during this period. There was very little inbound tourism. Leasing activity was low. However, local consumption started to show signs of recovery in the middle of the second quarter of 2022 due to pent-up demand, following the gradual relaxation of social distancing measures, and the introduction of the HKSAR Government’s consumption voucher scheme. During the first half as a whole, retail sales decreased by 2%, 5% and 2% respectively at The Mall, Pacific Place, Cityplaza and Citygate Outlets. Hong Kong Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 30th June 2022) Interest The Mall, Pacific Place 711,182 96% 100% Cityplaza 1,096,898 100% 100% (1) Citygate Outlets 803,582 100% 26.67% (1), (2) Others 549,558 100% 26.67%/60%/100% Total 3,161,220 (1) In March 2022, the Group acquired an additional 6.67% interest in the Citygate development. The Group’s interest in Citygate Outlets and Tung Chung Crescent neighbourhood shops increased from 20% to 26.67% as a result of the transaction. (2) Others largely comprise Taikoo Shing neighbourhood shops and StarCrest retail premises (which are wholly-owned), Island Place retail premises (60% owned) and Tung Chung Crescent neighbourhood shops. Gross rental income from the retail portfolio in Hong Kong was HK$1,002 million in the first half of 2022, a decrease of 10% compared to the same period in 2021. The decrease reflected the impact of the fifth wave of COVID-19 and, in part, the amortisation of rental concessions given in previous years. Rental concessions (which were amortised over the remaining lease terms) were given for specific periods on a case-by-case basis to support tenants. In the first half of 2022, rental concessions (on a cash basis) reduced as compared to the same period in 2021. On a cash concession basis, attributable gross rental income decreased by 2% during the period. The malls were almost fully let throughout the period. 24 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 25 Page 27

2022 Interim Report Page 25 Page 27