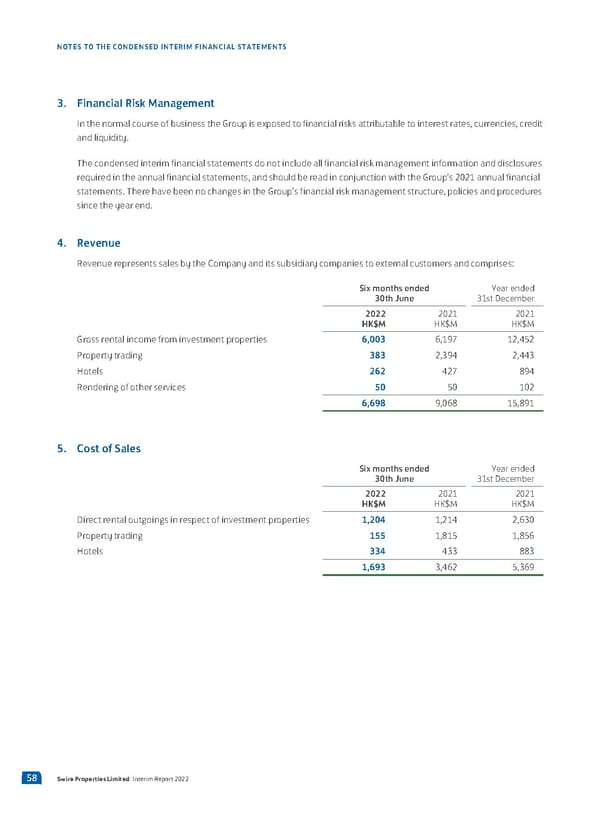

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS 3. Financial Risk Management In the normal course of business the Group is exposed to financial risks attributable to interest rates, currencies, credit and liquidity. The condensed interim financial statements do not include all financial risk management information and disclosures required in the annual financial statements, and should be read in conjunction with the Group’s 2021 annual financial statements. There have been no changes in the Group’s financial risk management structure, policies and procedures since the year end. 4. Revenue Revenue represents sales by the Company and its subsidiary companies to external customers and comprises: Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Gross rental income from investment properties 6,003 6,197 12,452 Property trading 383 2,394 2,443 Hotels 262 427 894 Rendering of other services 50 50 102 6,698 9,068 15,891 5. Cost of Sales Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Direct rental outgoings in respect of investment properties 1,204 1,214 2,630 Property trading 155 1,815 1,856 Hotels 334 433 883 1,693 3,462 5,369 58 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 59 Page 61

2022 Interim Report Page 59 Page 61