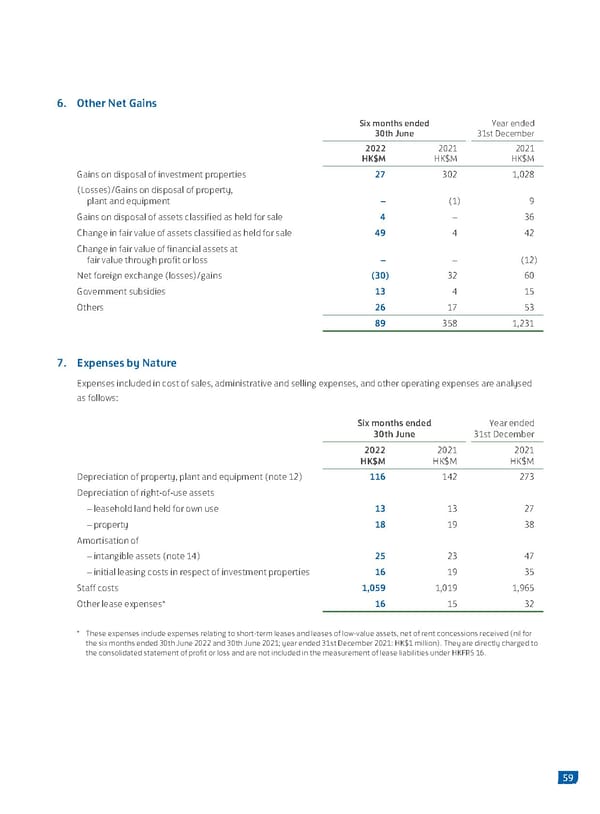

6. Other Net Gains Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Gains on disposal of investment properties 27 302 1,028 (Losses)/Gains on disposal of property, plant and equipment – (1) 9 Gains on disposal of assets classified as held for sale 4 – 36 Change in fair value of assets classified as held for sale 49 4 42 Change in fair value of financial assets at fair value through profit or loss – – (12) Net foreign exchange (losses)/gains (30) 32 60 Government subsidies 13 4 15 Others 26 17 53 89 358 1,231 7. Expenses by Nature Expenses included in cost of sales, administrative and selling expenses, and other operating expenses are analysed as follows: Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Depreciation of property, plant and equipment (note 12) 116 142 273 Depreciation of right-of-use assets – leasehold land held for own use 13 13 27 – property 18 19 38 Amortisation of – intangible assets (note 14) 25 23 47 – initial leasing costs in respect of investment properties 16 19 35 Staff costs 1,059 1,019 1,965 Other lease expenses* 16 15 32 * These expenses include expenses relating to short-term leases and leases of low-value assets, net of rent concessions received (nil for the six months ended 30th June 2022 and 30th June 2021; year ended 31st December 2021: HK$1 million). They are directly charged to the consolidated statement of profit or loss and are not included in the measurement of lease liabilities under HKFRS 16. 59

2022 Interim Report Page 60 Page 62

2022 Interim Report Page 60 Page 62