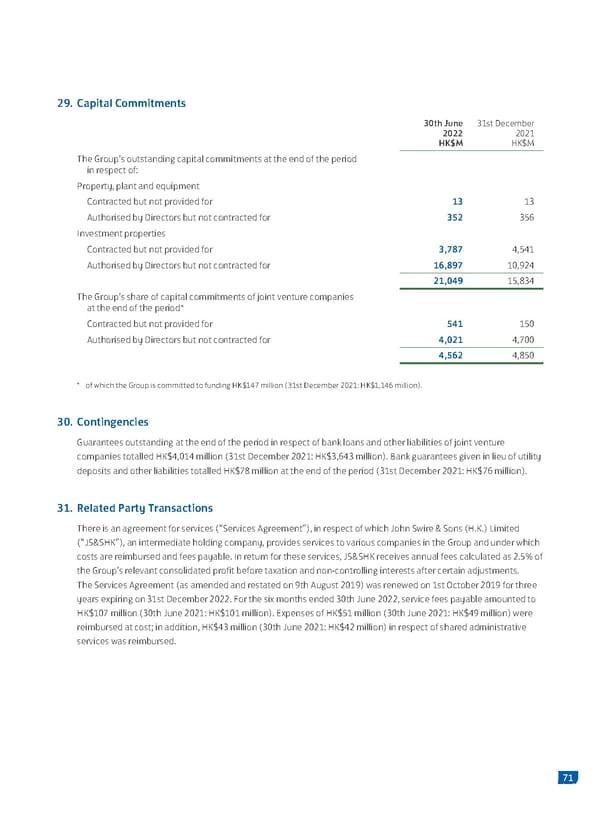

29. Capital Commitments 30th June 31st December 2022 2021 HK$M HK$M The Group’s outstanding capital commitments at the end of the period in respect of: Property, plant and equipment Contracted but not provided for 13 13 Authorised by Directors but not contracted for 352 356 Investment properties Contracted but not provided for 3,787 4,541 Authorised by Directors but not contracted for 16,897 10,924 21,049 15,834 The Group’s share of capital commitments of joint venture companies at the end of the period* Contracted but not provided for 541 150 Authorised by Directors but not contracted for 4,021 4,700 4,562 4,850 * of which the Group is committed to funding HK$147 million (31st December 2021: HK$1,146 million). 30. Contingencies Guarantees outstanding at the end of the period in respect of bank loans and other liabilities of joint venture companies totalled HK$4,014 million (31st December 2021: HK$3,643 million). Bank guarantees given in lieu of utility deposits and other liabilities totalled HK$78 million at the end of the period (31st December 2021: HK$76 million). 31. Related Party Transactions There is an agreement for services (“Services Agreement”), in respect of which John Swire & Sons (H.K.) Limited (“JS&SHK”), an intermediate holding company, provides services to various companies in the Group and under which costs are reimbursed and fees payable. In return for these services, JS&SHK receives annual fees calculated as 2.5% of the Group’s relevant consolidated profit before taxation and non-controlling interests after certain adjustments. The Services Agreement (as amended and restated on 9th August 2019) was renewed on 1st October 2019 for three years expiring on 31st December 2022. For the six months ended 30th June 2022, service fees payable amounted to HK$107 million (30th June 2021: HK$101 million). Expenses of HK$51 million (30th June 2021: HK$49 million) were reimbursed at cost; in addition, HK$43 million (30th June 2021: HK$42 million) in respect of shared administrative services was reimbursed. 71

2022 Interim Report Page 72 Page 74

2022 Interim Report Page 72 Page 74