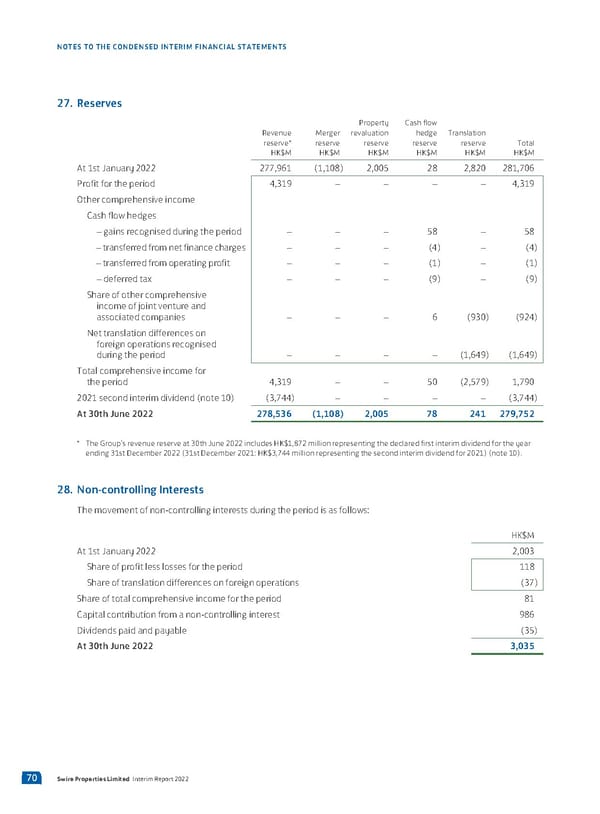

NOTES TO THE CONDENSED INTERIM FINANCIAL STATEMENTS 27. Reserves Property Cash flow Revenue Merger revaluation hedge Translation reserve* reserve reserve reserve reserve Total HK$M HK$M HK$M HK$M HK$M HK$M At 1st January 2022 277,961 (1,108) 2,005 28 2,820 281,706 Profit for the period 4,319 – – – – 4,319 Other comprehensive income Cash flow hedges – gains recognised during the period – – – 58 – 58 – transferred from net finance charges – – – (4) – (4) – transferred from operating profit – – – (1) – (1) – deferred tax – – – (9) – (9) Share of other comprehensive income of joint venture and associated companies – – – 6 (930) (924) Net translation differences on foreign operations recognised during the period – – – – (1,649) (1,649) Total comprehensive income for the period 4,319 – – 50 (2,579) 1,790 2021 second interim dividend (note 10) (3,744) – – – – (3,744) At 30th June 2022 278,536 (1,108) 2,005 78 241 279,752 * The Group’s revenue reserve at 30th June 2022 includes HK$1,872 million representing the declared first interim dividend for the year ending 31st December 2022 (31st December 2021: HK$3,744 million representing the second interim dividend for 2021) (note 10). 28. Non-controlling Interests The movement of non-controlling interests during the period is as follows: HK$M At 1st January 2022 2,003 Share of profit less losses for the period 118 Share of translation differences on foreign operations (37) Share of total comprehensive income for the period 81 Capital contribution from a non-controlling interest 986 Dividends paid and payable (35) At 30th June 2022 3,035 70 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 71 Page 73

2022 Interim Report Page 71 Page 73