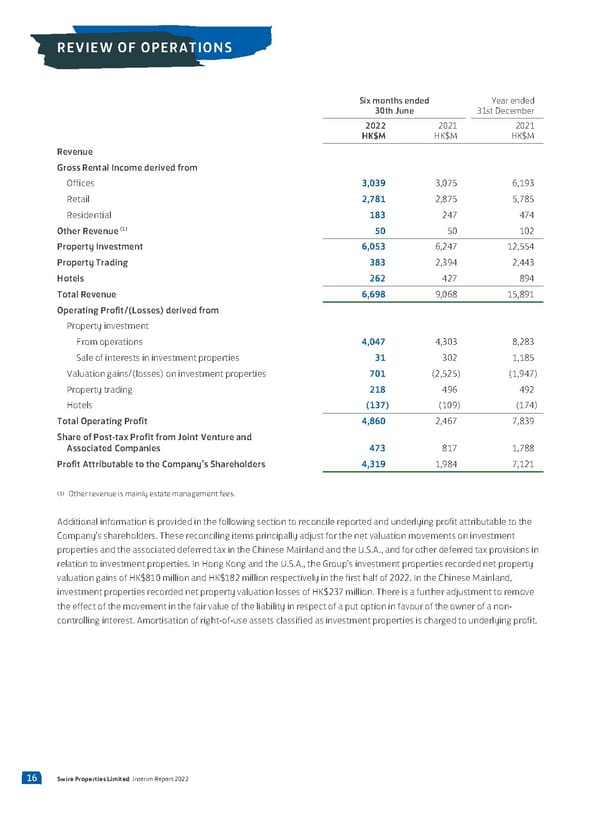

REVIEW OF OPERATIONS Six months ended Year ended 30th June 31st December 2022 2021 2021 HK$M HK$M HK$M Revenue Gross Rental Income derived from Offices 3,039 3,075 6,193 Retail 2,781 2,875 5,785 Residential 183 247 474 (1) Other Revenue 50 50 102 Property Investment 6,053 6,247 12,554 Property Trading 383 2,394 2,443 Hotels 262 427 894 Total Revenue 6,698 9,068 15,891 Operating Profit/(Losses) derived from Property investment From operations 4,047 4,303 8,283 Sale of interests in investment properties 31 302 1,185 Valuation gains/(losses) on investment properties 701 (2,525) (1,947) Property trading 218 496 492 Hotels (137) (109) (174) Total Operating Profit 4,860 2,467 7,839 Share of Post-tax Profit from Joint Venture and Associated Companies 473 817 1,788 Profit Attributable to the Company’s Shareholders 4,319 1,984 7,121 (1) Other revenue is mainly estate management fees. Additional information is provided in the following section to reconcile reported and underlying profit attributable to the Company’s shareholders. These reconciling items principally adjust for the net valuation movements on investment properties and the associated deferred tax in the Chinese Mainland and the U.S.A., and for other deferred tax provisions in relation to investment properties. In Hong Kong and the U.S.A., the Group’s investment properties recorded net property valuation gains of HK$810 million and HK$182 million respectively in the first half of 2022. In the Chinese Mainland, investment properties recorded net property valuation losses of HK$237 million. There is a further adjustment to remove the effect of the movement in the fair value of the liability in respect of a put option in favour of the owner of a non- controlling interest. Amortisation of right-of-use assets classified as investment properties is charged to underlying profit. 16 Swire Properties Limited Interim Report 2022

2022 Interim Report Page 17 Page 19

2022 Interim Report Page 17 Page 19