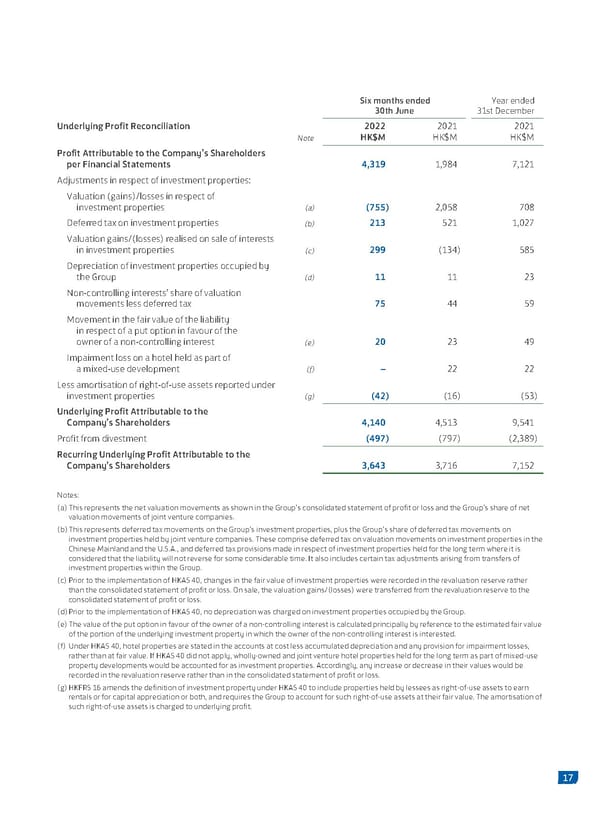

Six months ended Year ended 30th June 31st December Underlying Profit Reconciliation 2022 2021 2021 Note HK$M HK$M HK$M Profit Attributable to the Company’s Shareholders per Financial Statements 4,319 1,984 7,121 Adjustments in respect of investment properties: Valuation (gains)/losses in respect of investment properties (a) (755) 2,058 708 Deferred tax on investment properties (b) 213 521 1,027 Valuation gains/(losses) realised on sale of interests in investment properties (c) 299 (134) 585 Depreciation of investment properties occupied by the Group (d) 11 11 23 Non-controlling interests’ share of valuation movements less deferred tax 75 44 59 Movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest (e) 20 23 49 Impairment loss on a hotel held as part of a mixed-use development (f) – 22 22 Less amortisation of right-of-use assets reported under investment properties (g) (42) (16) (53) Underlying Profit Attributable to the Company’s Shareholders 4,140 4,513 9,541 Profit from divestment (497) (797) (2,389) Recurring Underlying Profit Attributable to the Company’s Shareholders 3,643 3,716 7,152 Notes: (a) This represents the net valuation movements as shown in the Group’s consolidated statement of profit or loss and the Group’s share of net valuation movements of joint venture companies. (b) This represents deferred tax movements on the Group’s investment properties, plus the Group’s share of deferred tax movements on investment properties held by joint venture companies. These comprise deferred tax on valuation movements on investment properties in the Chinese Mainland and the U.S.A., and deferred tax provisions made in respect of investment properties held for the long term where it is considered that the liability will not reverse for some considerable time. It also includes certain tax adjustments arising from transfers of investment properties within the Group. (c) Prior to the implementation of HKAS 40, changes in the fair value of investment properties were recorded in the revaluation reserve rather than the consolidated statement of profit or loss. On sale, the valuation gains/(losses) were transferred from the revaluation reserve to the consolidated statement of profit or loss. (d) Prior to the implementation of HKAS 40, no depreciation was charged on investment properties occupied by the Group. (e) The value of the put option in favour of the owner of a non-controlling interest is calculated principally by reference to the estimated fair value of the portion of the underlying investment property in which the owner of the non-controlling interest is interested. (f) Under HKAS 40, hotel properties are stated in the accounts at cost less accumulated depreciation and any provision for impairment losses, rather than at fair value. If HKAS 40 did not apply, wholly-owned and joint venture hotel properties held for the long term as part of mixed-use property developments would be accounted for as investment properties. Accordingly, any increase or decrease in their values would be recorded in the revaluation reserve rather than in the consolidated statement of profit or loss. (g) HKFRS 16 amends the definition of investment property under HKAS 40 to include properties held by lessees as right-of-use assets to earn rentals or for capital appreciation or both, and requires the Group to account for such right-of-use assets at their fair value. The amortisation of such right-of-use assets is charged to underlying profit. 17

2022 Interim Report Page 18 Page 20

2022 Interim Report Page 18 Page 20