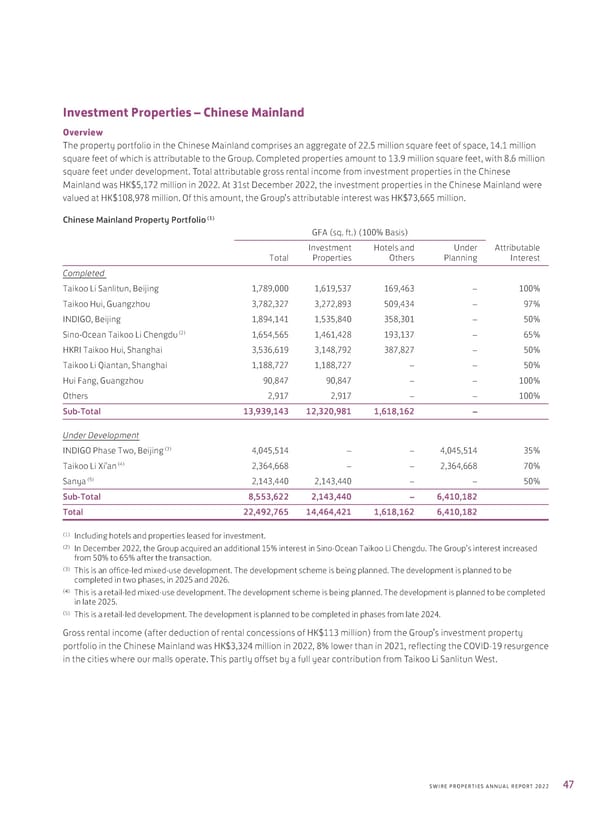

Investment Properties – Chinese Mainland Overview The property portfolio in the Chinese Mainland comprises an aggregate of 22.5 million square feet of space, 14.1 million square feet of which is attributable to the Group. Completed properties amount to 13.9 million square feet, with 8.6 million square feet under development. Total attributable gross rental income from investment properties in the Chinese Mainland was HK$5,172 million in 2022. At 31st December 2022, the investment properties in the Chinese Mainland were valued at HK$108,978 million. Of this amount, the Group’s attributable interest was HK$73,665 million. (1) Chinese Mainland Property Portfolio GFA (sq. ft.) (100% Basis) Investment Hotels and Under Attributable Total Properties Others Planning Interest Completed Taikoo Li Sanlitun, Beijing 1,789,000 1,619,537 169,463 – 100% Taikoo Hui, Guangzhou 3,782,327 3,272,893 509,434 – 97% INDIGO, Beijing 1,894,141 1,535,840 358,301 – 50% (2) 1,654,565 1,461,428 193,137 – 65% Sino-Ocean Taikoo Li Chengdu HKRI Taikoo Hui, Shanghai 3,536,619 3,148,792 387,827 – 50% Taikoo Li Qiantan, Shanghai 1,188,727 1,188,727 – – 50% Hui Fang, Guangzhou 90,847 90,847 – – 100% Others 2,917 2,917 – – 100% Sub-Total 13,939,143 12,320,981 1,618,162 – Under Development (3) INDIGO Phase Two, Beijing 4,045,514 – – 4,045,514 35% (4) Taikoo Li Xi’an 2,364,668 – – 2,364,668 70% (5) Sanya 2,143,440 2,143,440 – – 50% Sub-Total 8,553,622 2,143,440 – 6,410,182 Total 22,492,765 14,464,421 1,618,162 6,410,182 (1) Including hotels and properties leased for investment. (2) In December 2022, the Group acquired an additional 15% interest in Sino-Ocean Taikoo Li Chengdu. The Group’s interest increased from 50% to 65% after the transaction. (3) This is an office-led mixed-use development. The development scheme is being planned. The development is planned to be completed in two phases, in 2025 and 2026. (4) This is a retail-led mixed-use development. The development scheme is being planned. The development is planned to be completed in late 2025. (5) This is a retail-led development. The development is planned to be completed in phases from late 2024. Gross rental income (after deduction of rental concessions of HK$113 million) from the Group’s investment property portfolio in the Chinese Mainland was HK$3,324 million in 2022, 8% lower than in 2021, reflecting the COVID-19 resurgence in the cities where our malls operate. This partly offset by a full year contribution from Taikoo Li Sanlitun West. 47 SWIRE PROPERTIES ANNUAL REPORT 2022

Annual Report 2022 Page 48 Page 50

Annual Report 2022 Page 48 Page 50