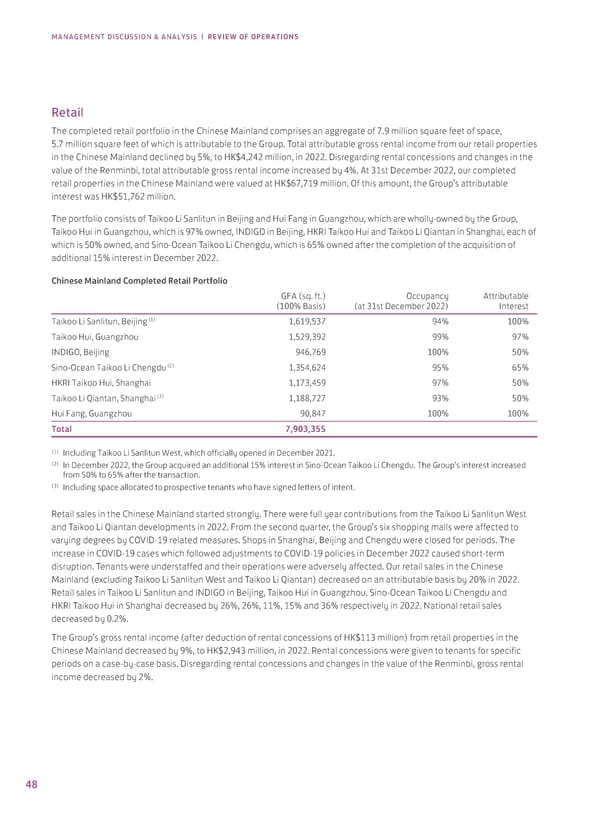

MANAGEMENT DISCUSSION & ANALYSIS | REVIEW OF OPERATIONS Retail The completed retail portfolio in the Chinese Mainland comprises an aggregate of 7.9 million square feet of space, 5.7 million square feet of which is attributable to the Group. Total attributable gross rental income from our retail properties in the Chinese Mainland declined by 5%, to HK$4,242 million, in 2022. Disregarding rental concessions and changes in the value of the Renminbi, total attributable gross rental income increased by 4%. At 31st December 2022, our completed retail properties in the Chinese Mainland were valued at HK$67,719 million. Of this amount, the Group’s attributable interest was HK$51,762 million. The portfolio consists of Taikoo Li Sanlitun in Beijing and Hui Fang in Guangzhou, which are wholly-owned by the Group, Taikoo Hui in Guangzhou, which is 97% owned, INDIGO in Beijing, HKRI Taikoo Hui and Taikoo Li Qiantan in Shanghai, each of which is 50% owned, and Sino-Ocean Taikoo Li Chengdu, which is 65% owned after the completion of the acquisition of additional 15% interest in December 2022. Chinese Mainland Completed Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 31st December 2022) Interest Taikoo Li Sanlitun, Beijing (1) 1,619,537 94% 100% Taikoo Hui, Guangzhou 1,529,392 99% 97% INDIGO, Beijing 946,769 100% 50% (2) Sino-Ocean Taikoo Li Chengdu 1,354,624 95% 65% HKRI Taikoo Hui, Shanghai 1,173,459 97% 50% (3) Taikoo Li Qiantan, Shanghai 1,188,727 93% 50% Hui Fang, Guangzhou 90,847 100% 100% Total 7,903,355 (1) Including Taikoo Li Sanlitun West, which officially opened in December 2021. (2) In December 2022, the Group acquired an additional 15% interest in Sino-Ocean Taikoo Li Chengdu. The Group’s interest increased from 50% to 65% after the transaction. (3) Including space allocated to prospective tenants who have signed letters of intent. Retail sales in the Chinese Mainland started strongly. There were full year contributions from the Taikoo Li Sanlitun West and Taikoo Li Qiantan developments in 2022. From the second quarter, the Group’s six shopping malls were affected to varying degrees by COVID-19 related measures. Shops in Shanghai, Beijing and Chengdu were closed for periods. The increase in COVID-19 cases which followed adjustments to COVID-19 policies in December 2022 caused short-term disruption. Tenants were understaffed and their operations were adversely affected. Our retail sales in the Chinese Mainland (excluding Taikoo Li Sanlitun West and Taikoo Li Qiantan) decreased on an attributable basis by 20% in 2022. Retail sales in Taikoo Li Sanlitun and INDIGO in Beijing, Taikoo Hui in Guangzhou, Sino-Ocean Taikoo Li Chengdu and HKRI Taikoo Hui in Shanghai decreased by 26%, 26%, 11%, 15% and 36% respectively in 2022. National retail sales decreased by 0.2%. The Group’s gross rental income (after deduction of rental concessions of HK$113 million) from retail properties in the Chinese Mainland decreased by 9%, to HK$2,943 million, in 2022. Rental concessions were given to tenants for specific periods on a case-by-case basis. Disregarding rental concessions and changes in the value of the Renminbi, gross rental income decreased by 2%. 48

Annual Report 2022 Page 49 Page 51

Annual Report 2022 Page 49 Page 51