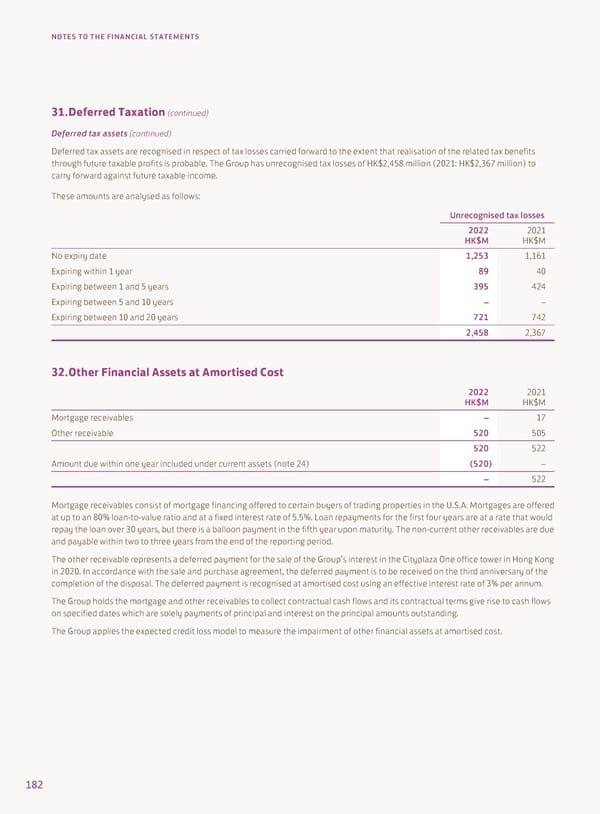

NOTES TO THE FINANCIAL STATEMENTS 31. Deferred Taxation (continued) Deferred tax assets (continued) Deferred tax assets are recognised in respect of tax losses carried forward to the extent that realisation of the related tax benefits through future taxable profits is probable. The Group has unrecognised tax losses of HK$2,458 million (2021: HK$2,367 million) to carry forward against future taxable income. These amounts are analysed as follows: Unrecognised tax losses 2022 2021 HK$M HK$M No expiry date 1,253 1,161 Expiring within 1 year 89 40 Expiring between 1 and 5 years 395 424 Expiring between 5 and 10 years – – Expiring between 10 and 20 years 721 742 2,458 2,367 32. Other Financial Assets at Amortised Cost 2022 2021 HK$M HK$M Mortgage receivables – 17 Other receivable 520 505 520 522 Amount due within one year included under current assets (note 24) (520) – – 522 Mortgage receivables consist of mortgage financing offered to certain buyers of trading properties in the U.S.A. Mortgages are offered at up to an 80% loan-to-value ratio and at a fixed interest rate of 5.5%. Loan repayments for the first four years are at a rate that would repay the loan over 30 years, but there is a balloon payment in the fifth year upon maturity. The non-current other receivables are due and payable within two to three years from the end of the reporting period. The other receivable represents a deferred payment for the sale of the Group’s interest in the Cityplaza One office tower in Hong Kong in 2020. In accordance with the sale and purchase agreement, the deferred payment is to be received on the third anniversary of the completion of the disposal. The deferred payment is recognised at amortised cost using an effective interest rate of 3% per annum. The Group holds the mortgage and other receivables to collect contractual cash flows and its contractual terms give rise to cash flows on specified dates which are solely payments of principal and interest on the principal amounts outstanding. The Group applies the expected credit loss model to measure the impairment of other financial assets at amortised cost. 182

Annual Report 2022 Page 183 Page 185

Annual Report 2022 Page 183 Page 185