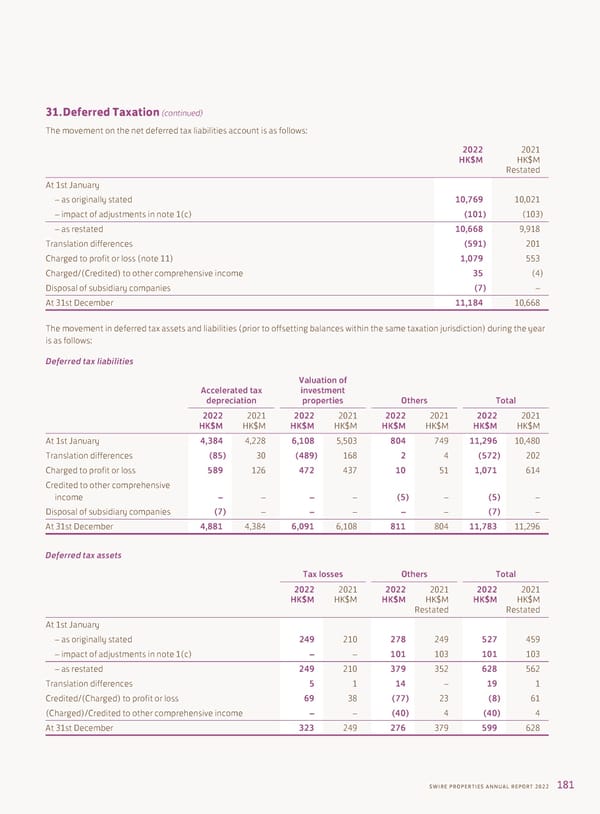

31. Deferred Taxation (continued) The movement on the net deferred tax liabilities account is as follows: 2022 2021 HK$M HK$M Restated At 1st January – as originally stated 10,769 10,021 – impact of adjustments in note 1(c) (101) (103) – as restated 10,668 9,918 Translation differences (591) 201 Charged to profit or loss (note 11) 1,079 553 Charged/(Credited) to other comprehensive income 35 (4) Disposal of subsidiary companies (7) – At 31st December 11,184 10,668 The movement in deferred tax assets and liabilities (prior to offsetting balances within the same taxation jurisdiction) during the year is as follows: Deferred tax liabilities Valuation of Accelerated tax investment depreciation properties Others Total 2022 2021 2022 2021 2022 2021 2022 2021 HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M At 1st January 4,384 4,228 6,108 5,503 804 749 11,296 10,480 Translation differences (85) 30 (489) 168 2 4 (572) 202 Charged to profit or loss 589 126 472 437 10 51 1,071 614 Credited to other comprehensive income – – – – (5) – (5) – Disposal of subsidiary companies (7) – – – – – (7) – At 31st December 4,881 4,384 6,091 6,108 811 804 11,783 11,296 Deferred tax assets Tax losses Others Total 2022 2021 2022 2021 2022 2021 HK$M HK$M HK$M HK$M HK$M HK$M Restated Restated At 1st January – as originally stated 249 210 278 249 527 459 – impact of adjustments in note 1(c) – – 101 103 101 103 – as restated 249 210 379 352 628 562 Translation differences 5 1 14 – 19 1 Credited/(Charged) to profit or loss 69 38 (77) 23 (8) 61 (Charged)/Credited to other comprehensive income – – (40) 4 (40) 4 At 31st December 323 249 276 379 599 628 SWIRE PROPERTIES ANNUAL REPORT 2022 181

Annual Report 2022 Page 182 Page 184

Annual Report 2022 Page 182 Page 184