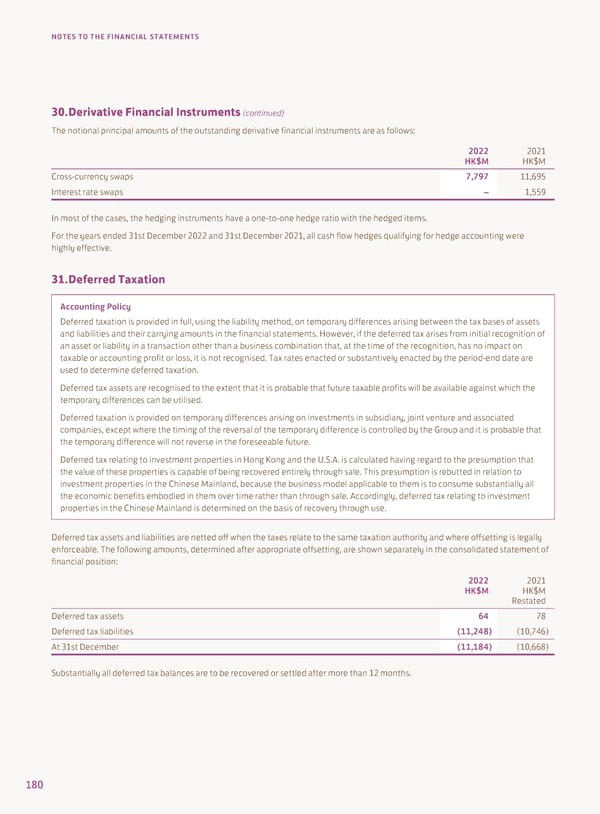

NOTES TO THE FINANCIAL STATEMENTS 30. Derivative Financial Instruments (continued) The notional principal amounts of the outstanding derivative financial instruments are as follows: 2022 2021 HK$M HK$M Cross-currency swaps 7,797 11,695 Interest rate swaps – 1,559 In most of the cases, the hedging instruments have a one-to-one hedge ratio with the hedged items. For the years ended 31st December 2022 and 31st December 2021, all cash flow hedges qualifying for hedge accounting were highly effective. 31. Deferred Taxation Accounting Policy Deferred taxation is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. However, if the deferred tax arises from initial recognition of an asset or liability in a transaction other than a business combination that, at the time of the recognition, has no impact on taxable or accounting profit or loss, it is not recognised. Tax rates enacted or substantively enacted by the period-end date are used to determine deferred taxation. Deferred tax assets are recognised to the extent that it is probable that future taxable profits will be available against which the temporary differences can be utilised. Deferred taxation is provided on temporary differences arising on investments in subsidiary, joint venture and associated companies, except where the timing of the reversal of the temporary difference is controlled by the Group and it is probable that the temporary difference will not reverse in the foreseeable future. Deferred tax relating to investment properties in Hong Kong and the U.S.A. is calculated having regard to the presumption that the value of these properties is capable of being recovered entirely through sale. This presumption is rebutted in relation to investment properties in the Chinese Mainland, because the business model applicable to them is to consume substantially all the economic benefits embodied in them over time rather than through sale. Accordingly, deferred tax relating to investment properties in the Chinese Mainland is determined on the basis of recovery through use. Deferred tax assets and liabilities are netted off when the taxes relate to the same taxation authority and where offsetting is legally enforceable. The following amounts, determined after appropriate offsetting, are shown separately in the consolidated statement of financial position: 2022 2021 HK$M HK$M Restated Deferred tax assets 64 78 Deferred tax liabilities (11,248) (10,746) At 31st December (11,184) (10,668) Substantially all deferred tax balances are to be recovered or settled after more than 12 months. 180

Annual Report 2022 Page 181 Page 183

Annual Report 2022 Page 181 Page 183