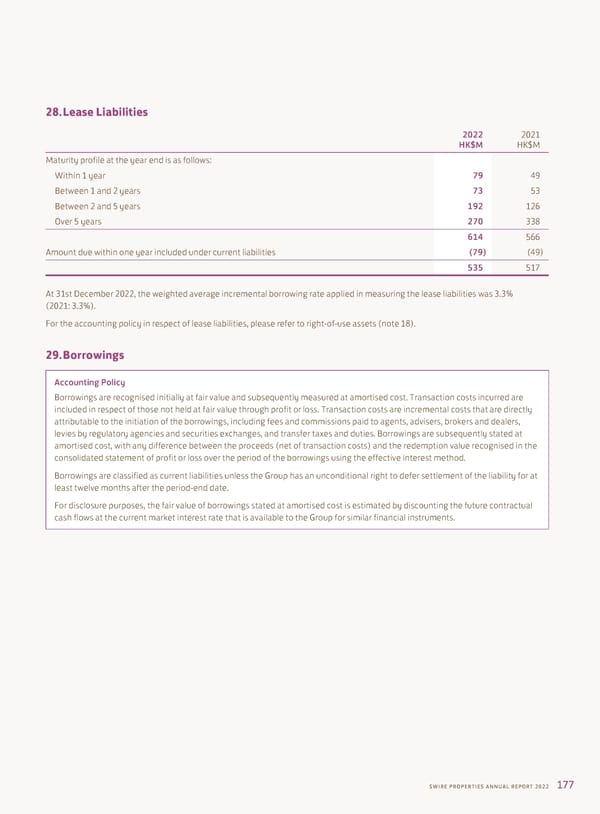

28. Lease Liabilities 2022 2021 HK$M HK$M Maturity profile at the year end is as follows: Within 1 year 79 49 Between 1 and 2 years 73 53 Between 2 and 5 years 192 126 Over 5 years 270 338 614 566 Amount due within one year included under current liabilities (79) (49) 535 517 At 31st December 2022, the weighted average incremental borrowing rate applied in measuring the lease liabilities was 3.3% (2021: 3.3%). For the accounting policy in respect of lease liabilities, please refer to right-of-use assets (note 18). 29. Borrowings Accounting Policy Borrowings are recognised initially at fair value and subsequently measured at amortised cost. Transaction costs incurred are included in respect of those not held at fair value through profit or loss. Transaction costs are incremental costs that are directly attributable to the initiation of the borrowings, including fees and commissions paid to agents, advisers, brokers and dealers, levies by regulatory agencies and securities exchanges, and transfer taxes and duties. Borrowings are subsequently stated at amortised cost, with any difference between the proceeds (net of transaction costs) and the redemption value recognised in the consolidated statement of profit or loss over the period of the borrowings using the effective interest method. Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability for at least twelve months after the period-end date. For disclosure purposes, the fair value of borrowings stated at amortised cost is estimated by discounting the future contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments. SWIRE PROPERTIES ANNUAL REPORT 2022 177

Annual Report 2022 Page 178 Page 180

Annual Report 2022 Page 178 Page 180