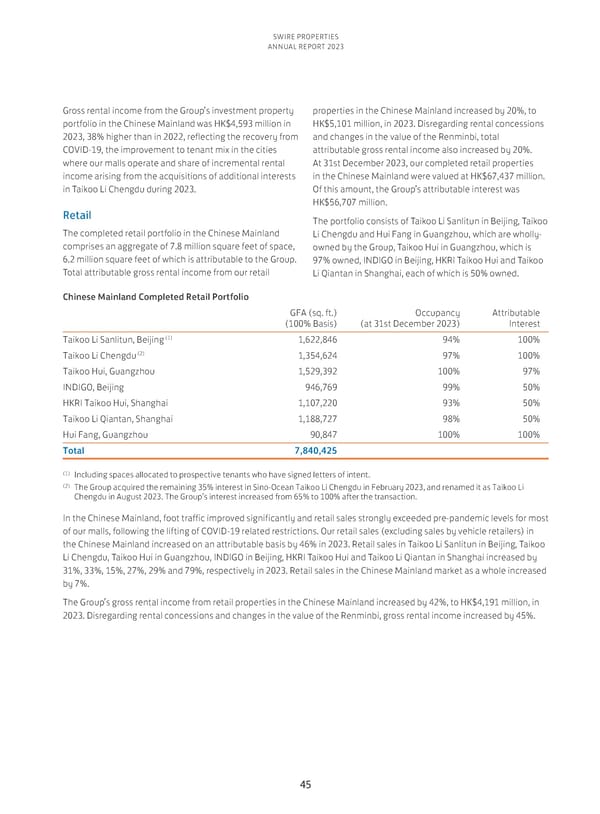

SWIRE PROPERTIES ANNUAL REPORT 2023 Gross rental income from the Group’s investment property properties in the Chinese Mainland increased by 20%, to portfolio in the Chinese Mainland was HK$4,593 million in HK$5,101 million, in 2023. Disregarding rental concessions 2023, 38% higher than in 2022, reflecting the recovery from and changes in the value of the Renminbi, total COVID-19, the improvement to tenant mix in the cities attributable gross rental income also increased by 20%. where our malls operate and share of incremental rental At 31st December 2023, our completed retail properties income arising from the acquisitions of additional interests in the Chinese Mainland were valued at HK$67,437 million. in Taikoo Li Chengdu during 2023. Of this amount, the Group’s attributable interest was HK$56,707 million. Retail The portfolio consists of Taikoo Li Sanlitun in Beijing, Taikoo The completed retail portfolio in the Chinese Mainland Li Chengdu and Hui Fang in Guangzhou, which are wholly- comprises an aggregate of 7.8 million square feet of space, owned by the Group, Taikoo Hui in Guangzhou, which is 6.2 million square feet of which is attributable to the Group. 97% owned, INDIGO in Beijing, HKRI Taikoo Hui and Taikoo Total attributable gross rental income from our retail Li Qiantan in Shanghai, each of which is 50% owned. Chinese Mainland Completed Retail Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 31st December 2023) Interest (1) Taikoo Li Sanlitun, Beijing 1,622,846 94% 100% (2) Taikoo Li Chengdu 1,354,624 97% 100% Taikoo Hui, Guangzhou 1,529,392 100% 97% INDIGO, Beijing 946,769 99% 50% HKRI Taikoo Hui, Shanghai 1,107,220 93% 50% Taikoo Li Qiantan, Shanghai 1,188,727 98% 50% Hui Fang, Guangzhou 90,847 100% 100% Total 7,840,425 (1) Including spaces allocated to prospective tenants who have signed letters of intent. (2) The Group acquired the remaining 35% interest in Sino-Ocean Taikoo Li Chengdu in February 2023, and renamed it as Taikoo Li Chengdu in August 2023. The Group’s interest increased from 65% to 100% after the transaction. In the Chinese Mainland, foot traffic improved significantly and retail sales strongly exceeded pre-pandemic levels for most of our malls, following the lifting of COVID-19 related restrictions. Our retail sales (excluding sales by vehicle retailers) in the Chinese Mainland increased on an attributable basis by 46% in 2023. Retail sales in Taikoo Li Sanlitun in Beijing, Taikoo Li Chengdu, Taikoo Hui in Guangzhou, INDIGO in Beijing, HKRI Taikoo Hui and Taikoo Li Qiantan in Shanghai increased by 31%, 33%, 15%, 27%, 29% and 79%, respectively in 2023. Retail sales in the Chinese Mainland market as a whole increased by 7%. The Group’s gross rental income from retail properties in the Chinese Mainland increased by 42%, to HK$4,191 million, in 2023. Disregarding rental concessions and changes in the value of the Renminbi, gross rental income increased by 45%. 45

Annual Report 2023 Page 46 Page 48

Annual Report 2023 Page 46 Page 48