Annual Report 2023

“Our vision is to be the leading sustainable development performer in our industry globally by 2030." – GUY BRADLEY, CHAIRMAN

Stock Code: 01972 Annual Report 2023

Cover image: TWO TAIKOO PLACE, HONG KONG

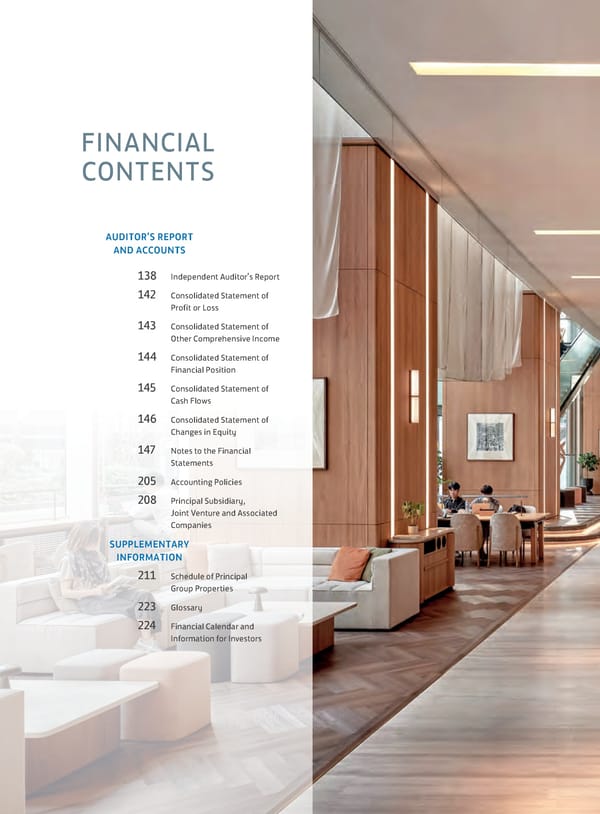

CONTENTS 2 Company Profile AUDITOR’S REPORT 6 2023 Highlights AND ACCOUNTS 12 Financial Highlights 138 Independent Auditor’s Report 13 Ten-Year Financial Summary 142 Consolidated Statement of 16 Chairman’s Statement Profit or Loss 20 Chief Executive’s Statement 143 Consolidated Statement of Other Comprehensive Income 24 Key Business Strategies 144 Consolidated Statement of Financial Position MANAGEMENT DISCUSSION & 145 Consolidated Statement of ANALYSIS Cash Flows 28 Review of Operations 146 Consolidated Statement of 74 Financial Review Changes in Equity 81 Financing 147 Notes to the Financial Statements 205 Accounting Policies CORPORATE GOVERNANCE & 208 Principal Subsidiary, Joint Venture SUSTAINABILITY and Associated Companies 92 Corporate Governance SUPPLEMENTARY 110 Risk Management INFORMATION 118 Directors and Officers 211 Schedule of Principal 120 Directors’ Report Group Properties 127 Sustainable Development 223 Glossary 224 Financial Calendar and Information for Investors

COMPANY PROFILE Swire Properties Limited (the “Company”) is a leading developer, owner and operator of mixed-use, principally commercial, properties in Hong Kong and the Chinese Mainland, with a record of creating long-term value by transforming urban areas. Our business comprises three elements: property investment, property trading, and hotel investment and management. 2

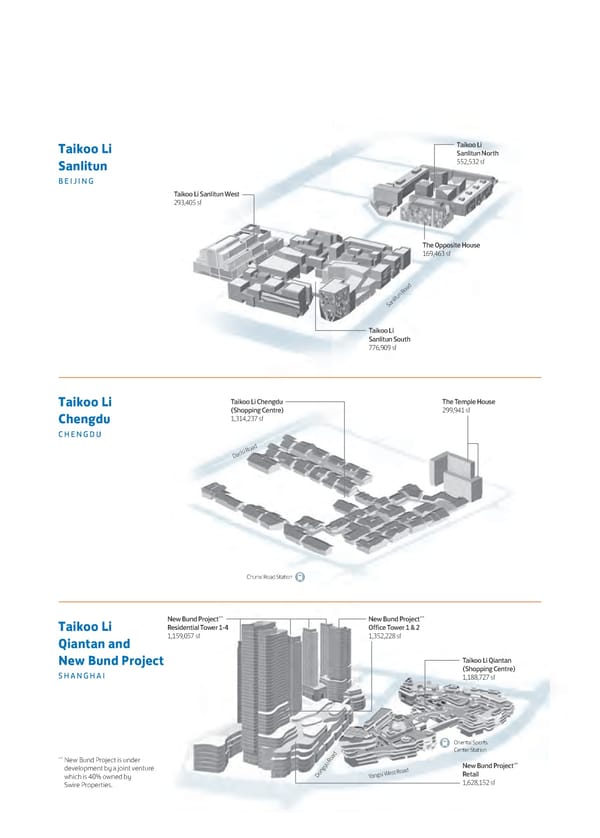

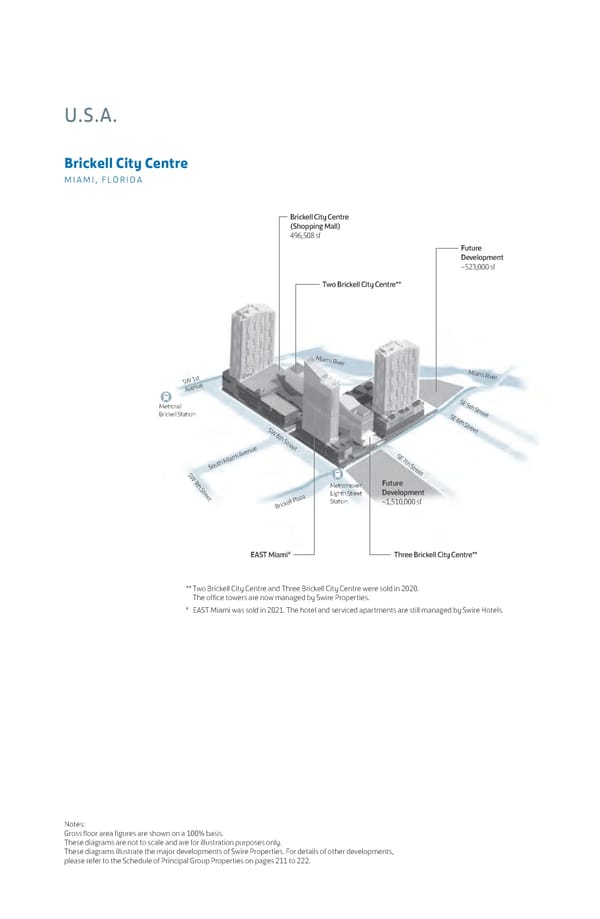

SWIRE PROPERTIES ANNUAL REPORT 2023 Founded in Hong Kong in 1972, the Company is listed on projects under development in Beijing, Shanghai, Sanya The Stock Exchange of Hong Kong Limited and, with its and Xi’an. Similar in scale to our developments in Hong subsidiaries, employs around 5,700 people. The Company’s Kong, our Chinese Mainland properties are in prime shopping malls are home to more than 2,200 retail outlets. locations with excellent transport connections. Its offices house a working population estimated to The Company has interests in the luxury and high quality exceed 70,000. residential markets in Hong Kong, the Chinese Mainland, In Hong Kong, we have spent over 50 years developing an Indonesia, Vietnam and Thailand. There are also land banks industrial area into what is now Taikoo Place and Cityplaza, in Miami, U.S.A. Swire Hotels develops and manages hotels one of Hong Kong’s largest business districts comprising in Hong Kong, the Chinese Mainland and the U.S.A., with a office space, the largest shopping mall on Hong Kong confirmed expansion plan to Japan. Island and a hotel. Pacific Place, built on the former Victoria The Company has a presence in the Brickell financial Barracks site, is one of Hong Kong’s premier retail and district in Miami, U.S.A., where it has investment properties. business addresses. In the Chinese Mainland, the Company The Company has offices in South East Asia which explore has six major commercial projects in operation in Beijing, opportunities in the property markets in the region. Guangzhou, Chengdu and Shanghai, and has several 3

CREATIVE TRANSFORMATION Captures what we do and how we do it. It underlines the creative mindset and long-term approach that enables us to seek out new perspectives, and original thinking that goes beyond the conventional. It also encapsulates our ability to unlock the potential of places and create vibrant destinations that can engender further growth and create sustainable value for our stakeholders. 4

SWIRE PROPERTIES ANNUAL REPORT 2023 5

03 2023 Swire Properties Arts Month returned. Continued partnership HIGHLIGHTS with Art Basel Hong Kong; and hosted the monumental work Gravity, the first offsite art installation from the Encounters sector, at Pacific Place. ArtisTree also celebrated this March event with the Urban Rocks exhibition. Hong Kong 07 08 09 Successfully priced the Company’s Announced a new name for New partnership with Lujiazui first public Renminbi “green dim sum” Taikoo Li Chengdu after the Group to develop Yangjing and bonds, making Swire Properties the acquisition of the remaining New Bund Mixed-use Projects first Hong Kong corporate to issue a interest completed. in Pudong. RMB-denominated public green bond. Chengdu Shanghai Hong Kong 11 11 Entered into agreements to sell Official groundbreaking for Taikoo Li Xi’an, 12 floors of One Island East to the a joint venture project. Securities and Futures Commission. Xi’an Hong Kong 6

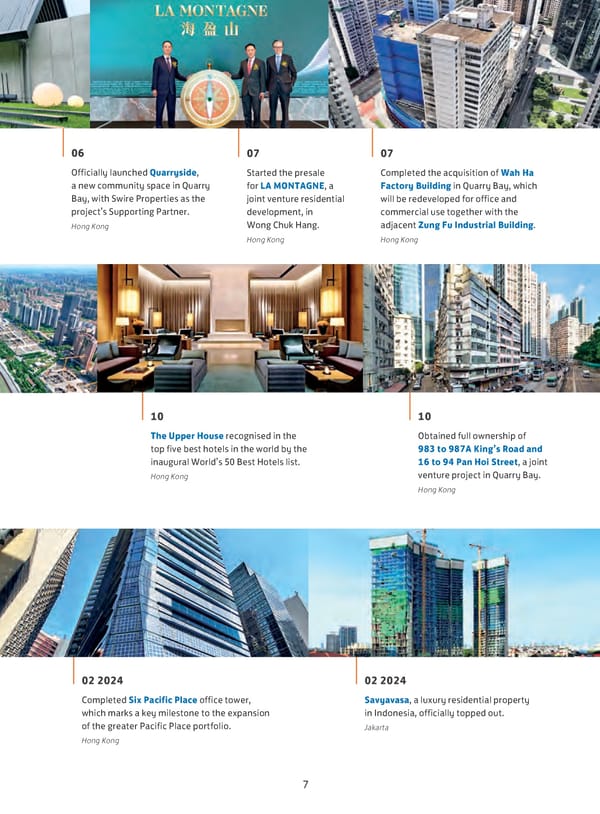

SWIRE PROPERTIES ANNUAL REPORT 2023 06 07 07 Officially launched Quarryside, Started the presale Completed the acquisition of Wah Ha a new community space in Quarry for LA MONTAGNE, a Factory Building in Quarry Bay, which Bay, with Swire Properties as the joint venture residential will be redeveloped for office and project’s Supporting Partner. development, in commercial use together with the Hong Kong Wong Chuk Hang. adjacent Zung Fu Industrial Building. Hong Kong Hong Kong 10 10 The Upper House recognised in the Obtained full ownership of top five best hotels in the world by the 983 to 987A King’s Road and inaugural World’s 50 Best Hotels list. 16 to 94 Pan Hoi Street, a joint Hong Kong venture project in Quarry Bay. Hong Kong 02 2024 02 2024 Completed Six Pacific Place office tower, Savyavasa, a luxury residential property which marks a key milestone to the expansion in Indonesia, officially topped out. of the greater Pacific Place portfolio. Jakarta Hong Kong 7

2023 HIGHLIGHTS 2023 SUSTAINABLE DEVELOPMENT HIGHLIGHTS “Our vision is to be the leading sustainable development performer in our industry globally by 2030.” – GUY BRADLEY, CHAIRMAN 8

SWIRE PROPERTIES ANNUAL REPORT 2023 Ranked 2nd globally in the Real Estate Management and Development Industry Ranked 1st globally in the “Environmental Dimension” score DJSI World constituent company for the 7th consecutive year Global Sector Leader (Mixed Use Sector) for the 7th consecutive year sector leader 2023 Global Development Sector Leader (Mixed Use Sector) for the 4th consecutive year No. 1 for the 6th consecutive year, and maintained the highest possible 2023-2024 rating – “AAA” S&P Sustainability Yearbook 2024 Top 10% S&P Global ESG Score S&P Sustainability Yearbook (China) 2023 Top 1% S&P (China) ESG Score Green Building Award 2023 by the Hong Kong 2023 Best Annual Reports Award by the Green Building Council and the Professional Hong Kong Management Association Green Building Council Sustainable Development (SD) Report 2022: Best Citygate won Grand Award in the Existing Environmental, Social and Governance Reporting Buildings Category (Facilities Management) (Property Development & Investment category) Six Pacific Place won Grand Award in the Annual Report 2022: Silver Award New Buildings Category (Projects under (General category) Construction and/or Design – Commercial) Taikoo Li Qiantan won Merit Award in the Best Corporate Governance and ESG New Buildings Category (Completed Projects – Awards 2023 by Hong Kong Institute of Commercial) Certified Public Accountants ESG Award – Non-Hang Seng Index 2023 Hong Kong Sustainability Award (Large Market Capitalisation) Category by the Hong Kong Management Association Grand Award FinanceAsia Achievement Awards 2023 House Awards – Best Issuer – ESG 2023 RICS Hong Kong Awards Deal Awards (Asia) – Best Sustainable Finance Sustainability Award Deal (Hong Kong SAR), Swire Properties Limited CNH3.2bn RegS senior unsecured green dim sum Hong Kong Green Building Council Zero- public bond offering Carbon-Ready Building Certification Scheme 17 buildings certified under the newly launched IFR Asia Awards 2023 scheme in 2023 Country awards – Renminbi Bond, Swire Properties’ RMB3.2bn dual-tranche green dim 2023 Randstad Employer Brand Awards sum bond Top 5 Most Attractive Employers in Hong Kong The Asset Triple A Sustainable Finance 2023 Gender Equality Global Report & Ranking Awards 2024 by Equileap Best Green Bond – Real Estate (Hong Kong SAR), Top 10 List Swire Properties CNH3.2bn dual-tranche green dim sum bond 9

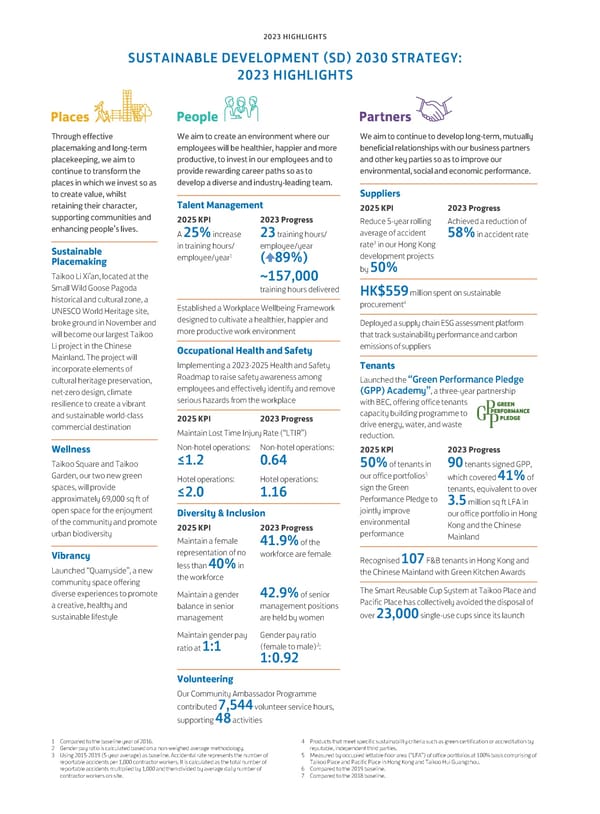

Places Places People 2023 HIGHLIGHTS SUSTAINABLE DEVELOPMENT (SD) 2030 STRATEGY: 2023 HIGHLIGHTS Places People Partners Through effective We aim to create an environment where our We aim to continue to develop long-term, mutually placemaking and long-term employees will be healthier, happier and more beneficial relationships with our business partners placekeeping, we aim to productive, to invest in our employees and to and other key parties so as to improve our continue to transform the provide rewarding career paths so as to environmental, social and economic performance. places in which we invest so as develop a diverse and industry-leading team. to create value, whilst Suppliers retaining their character, Talent Management Performance 2025 KPI 2023 Progress supporting communities and 2025 KPI 2023 Progress (Environment) People Reduce 5-year rolling Achieved a reduction of enhancing people’s lives. Partners average of accident A 25% increase 23 training hours/ 58% in accident rate 3 Sustainable in training hours/ employee/year rate in our Hong Kong 1 development projects Placemaking employee/year ( 89%) by Taikoo Li Xi’an, located at the ~157,000 50% Small Wild Goose Pagoda training hours delivered HK$559 million spent on sustainable historical and cultural zone, a Performance Established a Workplace Wellbeing Framework procurement4 UNESCO World Heritage site, Performance (Economic) broke ground in November and designed to cultivate a healthier, happier and Deployed a supply chain ESG assessment platform (Environment) Partners more productive work environment will become our largest Taikoo that track sustainability performance and carbon Li project in the Chinese Occupational Health and Safety emissions of suppliers Mainland. The project will Implementing a 2023-2025 Health and Safety Tenants incorporate elements of Roadmap to raise safety awareness among cultural heritage preservation, employees and effectively identify and remove Launched the “Green Performance Pledge net-zero design, climate serious hazards from the workplace (GPP) Academy”, a three-year partnership resilience to create a vibrant Performance with BEC, offering office tenants and sustainable world-class capacity building programme to Performance 2025 KPI 2023 Progress commercial destination (Economic) drive energy, water, and waste (Environment) Maintain Lost Time Injury Rate (“LTIR”) reduction. Wellness Non-hotel operations: Non-hotel operations: 2025 KPI 2023 Progress Taikoo Square and Taikoo ≤1.2 0.64 50% of tenants in 90 tenants signed GPP, Garden, our two new green 5 Hotel operations: Hotel operations: our office portfolios which covered 41% of spaces, will provide ≤2.0 1.16 sign the Green tenants, equivalent to over approximately 69,000 sq ft of Performance Pledge to 3.5 million sq ft LFA in open space for the enjoyment jointly improve Performance Diversity & Inclusion our office portfolio in Hong of the community and promote environmental Kong and the Chinese (Economic) 2025 KPI 2023 Progress urban biodiversity Maintain a female 41.9% of the performance Mainland Vibrancy representation of no workforce are female 107 F&B tenants in Hong Kong and less than 40% in Recognised Launched “Quarryside”, a new the workforce the Chinese Mainland with Green Kitchen Awards community space offering The Smart Reusable Cup System at Taikoo Place and diverse experiences to promote Maintain a gender 42.9% of senior Pacific Place has collectively avoided the disposal of a creative, healthy and balance in senior management positions over sustainable lifestyle management are held by women 23,000 single-use cups since its launch Maintain gender pay Gender pay ratio 2 ratio at 1:1 (female to male) : 1:0.92 Volunteering Our Community Ambassador Programme contributed 7,544 volunteer service hours, supporting 48 activities 1 Compared to the baseline year of 2016. 4 Products that meet specific sustainability criteria such as green certification or accreditation by 2 Gender pay ratio is calculated based on a non-weighed average methodology. reputable, independent third parties. 3 Using 2015-2019 (5-year average) as baseline. Accidental rate represents the number of 5 Measured by occupied lettable floor area (“LFA”) of office portfolios at 100% basis comprising of reportable accidents per 1,000 contractor workers. It is calculated as the total number of Taikoo Place and Pacific Place in Hong Kong and Taikoo Hui Guangzhou. reportable accidents multiplied by 1,000 and then divided by average daily number of 6 Compared to the 2019 baseline. contractor workers on-site. 7 Compared to the 2018 baseline.

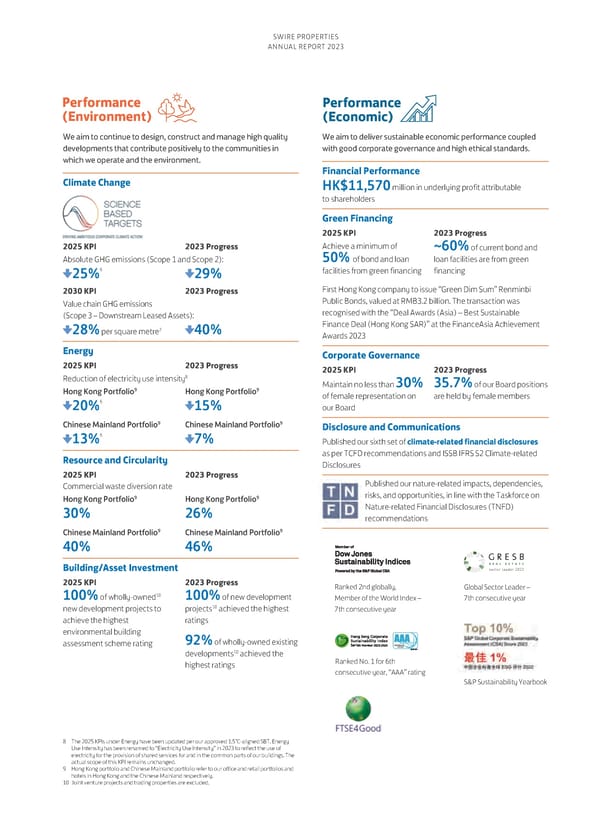

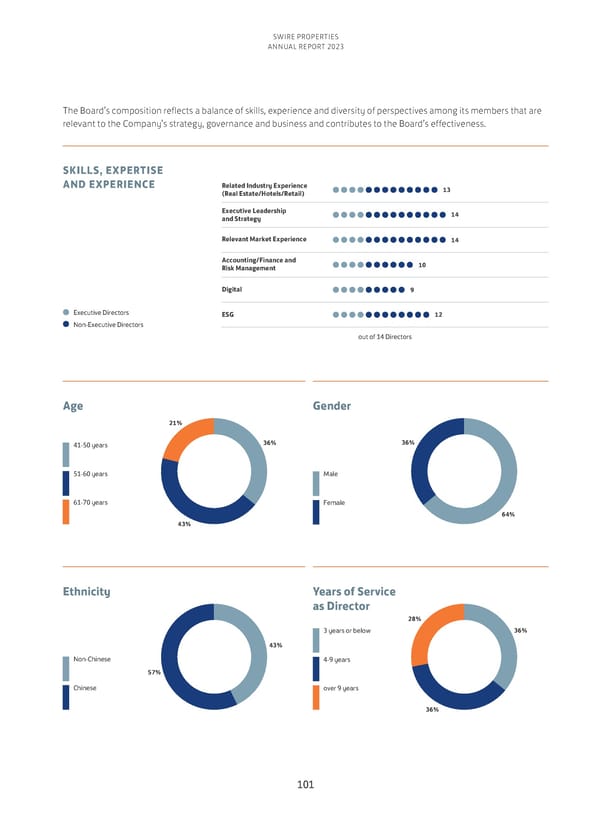

Places Places People People Partners Partners Performance (Environment) SWIRE PROPERTIES ANNUAL REPORT 2023 Performance Performance (Environment) (Economic) We aim to continue to design, construct and manage high quality We aim to deliver sustainable economic performance coupled developments that contribute positively to the communities in with good corporate governance and high ethical standards. which we operate and the environment. Financial Performance Climate Change HK$11,570 million in underlying profit attributable Performance to shareholders (Economic) Green Financing 2025 KPI 2023 Progress 2025 KPI 2023 Progress Achieve a minimum of ~60% of current bond and Absolute GHG emissions (Scope 1 and Scope 2): 50% of bond and loan loan facilities are from green 25%6 29% facilities from green financing financing 2030 KPI 2023 Progress First Hong Kong company to issue “Green Dim Sum” Renminbi Value chain GHG emissions Public Bonds, valued at RMB3.2 billion. The transaction was (Scope 3 – Downstream Leased Assets): recognised with the “Deal Awards (Asia) – Best Sustainable 7 Finance Deal (Hong Kong SAR)” at the FinanceAsia Achievement 28% per square metre 40% Awards 2023 Energy Corporate Governance 2025 KPI 2023 Progress 2025 KPI 2023 Progress 8 Reduction of electricity use intensity Maintain no less than 30% 35.7% of our Board positions 9 9 Hong Kong Portfolio Hong Kong Portfolio of female representation on are held by female members 20%6 15% our Board 9 9 Chinese Mainland Portfolio Chinese Mainland Portfolio Disclosure and Communications 13%6 7% Published our sixth set of climate-related financial disclosures Resource and Circularity as per TCFD recommendations and ISSB IFRS S2 Climate-related Disclosures 2025 KPI 2023 Progress Published our nature-related impacts, dependencies, Commercial waste diversion rate risks, and opportunities, in line with the Taskforce on 9 9 Hong Kong Portfolio Hong Kong Portfolio Nature-related Financial Disclosures (TNFD) 30% 26% recommendations 9 9 Chinese Mainland Portfolio Chinese Mainland Portfolio 40% 46% Building/Asset Investment sector leader 2023 2025 KPI 2023 Progress Ranked 2nd globally, Global Sector Leader – 10 100% of wholly-owned 100% of new development Member of the World Index – 7th consecutive year 10 new development projects to projects achieved the highest 7th consecutive year achieve the highest ratings environmental building 92% of wholly-owned existing assessment scheme rating 2023-2024 10 developments achieved the Ranked No. 1 for 6th highest ratings consecutive year, “AAA” rating S&P Sustainability Yearbook 8 The 2025 KPIs under Energy have been updated per our approved 1.5°C-aligned SBT. Energy Use Intensity has been renamed to “Electricity Use Intensity” in 2023 to reflect the use of electricity for the provision of shared services for and in the common parts of our buildings. The actual scope of this KPI remains unchanged. 9 Hong Kong portfolio and Chinese Mainland portfolio refer to our office and retail portfolios and hotels in Hong Kong and the Chinese Mainland respectively. 10 Joint venture projects and trading properties are excluded.

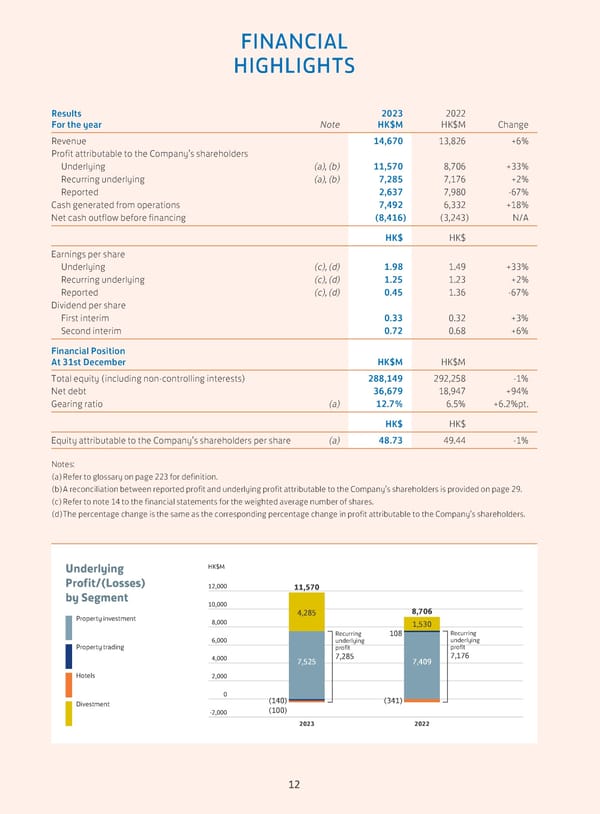

FINANCIAL HIGHLIGHTS Results 2023 2022 For the year Note HK$M HK$M Change Revenue 14,670 13,826 +6% Profit attributable to the Company’s shareholders Underlying (a), (b) 11,570 8,706 +33% Recurring underlying (a), (b) 7,285 7,176 +2% Reported 2,637 7,980 -67% Cash generated from operations 7,492 6,332 +18% Net cash outflow before financing (8,416) (3,243) N/A HK$ HK$ Earnings per share Underlying (c), (d) 1.98 1.49 +33% Recurring underlying (c), (d) 1.25 1.23 +2% Reported (c), (d) 0.45 1.36 -67% Dividend per share First interim 0.33 0.32 +3% Second interim 0.72 0.68 +6% Financial Position At 31st December HK$M HK$M Total equity (including non-controlling interests) 288,149 292,258 -1% Net debt 36,679 18,947 +94% Gearing ratio (a) 12.7% 6.5% +6.2%pt. HK$ HK$ Equity attributable to the Company’s shareholders per share (a) 48.73 49.44 -1% Notes: (a) Refer to glossary on page 223 for definition. (b) A reconciliation between reported profit and underlying profit attributable to the Company’s shareholders is provided on page 29. (c) Refer to note 14 to the financial statements for the weighted average number of shares. (d) The percentage change is the same as the corresponding percentage change in profit attributable to the Company’s shareholders. Underlying HK$M Profit/(Losses) by Segment 12,000 11,570 10,000 8,706 Property investment 4,285 8,000 1,530 Recurring 108 Recurring 6,000 underlying underlying Property trading profit profit 4,000 7,525 7,285 7,409 7,176 Hotels 2,000 0 (140) (341) Divestment (100) -2,000 2023 2022 12

TEN-YEAR FINANCIAL SUMMARY 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M STATEMENT OF PROFIT OR LOSS Revenue Property investment 10,456 10,857 10,902 11,380 12,254 12,410 12,635 12,981 12,340 13,525 Property trading 3,842 4,463 4,760 5,833 1,061 516 312 2,443 921 166 Hotels 1,089 1,127 1,130 1,345 1,404 1,296 641 894 565 979 15,387 16,447 16,792 18,558 14,719 14,222 13,588 16,318 13,826 14,670 Profit Attributable to the Company’s Shareholders Property investment 6,029 6,231 5,938 6,671 8,732 10,061 8,839 8,654 8,025 7,325 Property trading 1,020 1,089 1,199 1,111 99 (18) (87) 601 171 (169) Hotels 30 (303) (117) (43) (41) (70) (524) (307) (341) (100) Change in fair value of investment properties 2,437 7,055 8,030 26,218 19,876 3,450 (4,645) (1,836) 125 (4,419) 9,516 14,072 15,050 33,957 28,666 13,423 3,583 7,112 7,980 2,637 Dividends for the year 3,861 4,154 4,154 4,505 4,914 5,148 5,324 5,558 5,850 6,143 Retained profit 5,655 9,918 10,896 29,452 23,752 8,275 (1,741) 1,554 2,130 (3,506) STATEMENT OF FINANCIAL POSITION Net Assets Employed Property investment 226,607 235,917 248,466 283,045 299,659 289,185 282,257 288,246 293,752 300,678 Property trading 8,210 7,452 6,616 3,942 4,143 7,789 7,249 9,637 11,612 17,334 Hotels 7,801 7,928 7,520 7,738 7,394 7,229 7,243 6,061 5,841 6,816 242,618 251,297 262,602 294,725 311,196 304,203 296,749 303,944 311,205 324,828 Financed by Equity attributable to the Company’s shareholders 207,691 216,247 225,369 257,381 279,275 286,927 288,216 291,624 289,211 285,082 Non-controlling interests 856 1,702 1,856 1,997 2,016 1,984 1,928 1,986 3,047 3,067 Net debt 34,071 33,348 35,377 35,347 29,905 15,292 6,605 10,334 18,947 36,679 242,618 251,297 262,602 294,725 311,196 304,203 296,749 303,944 311,205 324,828 HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ HK$ Earnings per share 1.63 2.41 2.57 5.80 4.90 2.29 0.61 1.22 1.36 0.45 Dividends per share 0.66 0.71 0.71 0.77 0.84 0.88 0.91 0.95 1.00 1.05 Equity attributable to shareholders per share 35.50 36.97 38.52 44.00 47.74 49.05 49.27 49.85 49.44 48.73 RATIOS Return on average equity attributable to the Company’s shareholders 4.6% 6.6% 6.8% 14.1% 10.7% 4.7% 1.2% 2.5% 2.7% 0.9% Gearing ratio 16.3% 15.3% 15.6% 13.6% 10.6% 5.3% 2.3% 3.5% 6.5% 12.7% Interest cover – times 8.96 13.56 15.48 38.81 33.29 28.85 12.93 20.78 48.26 9.96 Dividend payout ratio 40.6% 29.5% 27.6% 13.3% 17.1% 38.4% 148.6% 78.1% 73.3% 233.0% UNDERLYING Profit (HK$M) 7,152 7,078 7,112 7,834 10,148 24,130 12,166 9,532 8,706 11,570 Return on average equity attributable to the Company’s shareholders 3.5% 3.3% 3.2% 3.2% 3.8% 8.5% 4.2% 3.3% 3.0% 4.0% Earnings per share (HK$) 1.22 1.21 1.22 1.34 1.73 4.12 2.08 1.63 1.49 1.98 Interest cover – times 7.58 7.75 8.89 10.68 12.58 48.16 32.10 32.96 74.74 26.76 Dividend payout ratio 54.0% 58.7% 58.4% 57.5% 48.4% 21.3% 43.8% 58.3% 67.2% 53.1% Notes: 1. The information for all years is shown in accordance with the Group’s current accounting policies and disclosure practices. Consequently figures for years prior to 2023 may be different from those originally presented. 2. The equity attributable to the Company’s shareholders and the returns by segment for 2023 and 2022 are shown in the Financial Review – Investment Appraisal and Performance Review on page 80. 3. Underlying profit is discussed on pages 29 to 31. 4. Refer to Glossary on page 223 for definitions and ratios. 13

TEN-YEAR FINANCIAL SUMMARY Revenue HK$M 20,000 15,000 Property investment 10,000 Property trading 5,000 Hotels 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Net Assets HK$M Employed 350,000 300,000 250,000 Property investment 200,000 Property trading 150,000 Hotels 100,000 50,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Dividends and HK$ Underlying Earnings 4.5 Per Share 4.0 3.5 3.0 2.5 2.0 1.5 Dividends per share 1.0 0.5 Underlying earnings per share 0.0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 14

SWIRE PROPERTIES ANNUAL REPORT 2023 Profit Attributable to HK$M The Company’s 36,000 Shareholders 30,000 24,000 Property Hotels 18,000 investment 12,000 Property Change in fair trading value of investment 6,000 properties 0 Total attributable profit Total underlying profit -6,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Total Equity and HK$M Net Debt 350,000 300,000 250,000 200,000 Total equity 150,000 Net debt 100,000 50,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Returns on % Average Equity 20 15 10 5 Group Group – underlying 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 15

CHAIRMAN’S STATEMENT We are encouraged by the post-pandemic recovery that we are seeing across the majority of our key markets. Whilst there are challenges ahead, we remain optimistic and see potential for sustainable growth in 2024 and beyond. Dear shareholders, This was a pivotal year for the city’s recovery, and we Despite the challenging economic and geopolitical will continue to partner with the HKSAR Government environment, our strategy remains unchanged. In Hong and all our stakeholders to contribute to Hong Kong’s Kong, we will continue to expand and reinforce Taikoo Place long-term prosperity. and Pacific Place, our core commercial portfolios. In the The Chinese Mainland remains an important engine of Chinese Mainland, we will continue to leverage our “Taikoo global economic growth. We currently operate six Li” and “Taikoo Hui” brands to scale up our presence, with a world-class developments in four key cities, and five focus on retail-led mixed-use developments in Tier-1 and new large-scale projects are now under construction. emerging Tier-1 cities. Our residential trading strategy is to We intend to double our gross floor area in the Chinese acquire appropriate sites for development of luxury and Mainland by 2032. high quality residential projects across Hong Kong, We are also making great strides on the ESG front. the Chinese Mainland and South East Asia. We are recognised as a leader in sustainability, ranking To that end in 2022, the Company announced a plan to second globally on the Dow Jones Sustainability World invest HK$100 billion over ten years, with a target Index in 2023. We are pleased to be helping to put Hong allocation of HK$30 billion to Hong Kong, HK$50 billion to Kong on the world map for innovative sustainability the Chinese Mainland and HK$20 billion to residential solutions, and we remain committed to our ambitious trading projects, including South East Asia. 2023 was a 1.5°C-aligned science-based targets, and to supporting milestone year for Swire Properties. We made significant the wider industry in our collective transition to net zero. progress with our HK$100 billion investment plan, with As we look ahead to 2024, we anticipate new almost 60% of the plan now committed to new and challenges, particularly given current macro-economic ongoing projects. uncertainties. However, we remain greatly encouraged Since the reopening of the borders we have seen a steady by our strong performance in 2023, and we are economic recovery in Hong Kong, thanks to the lifting of all optimistic about the opportunities and the growth travel restrictions and pandemic measures, and various key potential in the future under our HK$100 billion initiatives led by the HKSAR Government. We have been investment plan. pleased to see the gradual return in business and leisure travel, which supports Hong Kong’s status as a major international financial centre and tourism hub. 16

SWIRE PROPERTIES ANNUAL REPORT 2023 Profits and Sustained Expanding our Hong Kong Dividend Growth Office Portfolio Our underlying profit attributable to shareholders Under our HK$100 billion investment plan, HK$30 billion increased by HK$2,864 million from HK$8,706 million in has been allocated to grow our flagship developments 2022 to HK$11,570 million in 2023, primarily reflecting in Hong Kong. We are continuing to invest in the the gain on disposal of nine floors of One Island East in development of a Global Business District at Taikoo Hong Kong. Our recurring underlying profit increased by Place. Our recently completed triple Grade-A office HK$109 million from HK$7,176 million in 2022 to tower, Two Taikoo Place, is now 62% committed. HK$7,285 million in 2023, which principally reflected the The latest phase of Taikoo Place’s redevelopment will strong recovery of our retail portfolio and hotels in Hong be completed in the first half of 2024, and we will soon Kong and the Chinese Mainland. be unveiling an expansive, green, open space to Our reported profit attributable to shareholders in 2023 promote biodiversity, in addition to new elevated was HK$2,637 million, compared with HK$7,980 million in walkways, al fresco dining concepts and year-round arts 2022. There was a fair value loss on investment and cultural events. Taikoo Place is raising the bar once properties of HK$4,401 million in 2023 as compared to a again in line with our placemaking vision, and we are fair value gain on investment properties of HK$1,573 excited to see our plans coming to fruition this year. million in 2022. A change in the fair value of investment In December 2023, we completed the sale of nine floors properties is non-cash in nature and will not have any of office space at One Island East to our anchor tenant, impact on our operating cash flow nor on our underlying the Securities and Futures Commission (“SFC”), a deal profit attributable to shareholders. Our balance sheet which testifies to Taikoo Place’s status as a preferred remains strong. The overall financial position of the location for the financial sector. Company remains healthy and the change is not expected to have any impact on our investment strategy. We will continue to expand Taikoo Place, and our We declared a second interim dividend for 2023 of strategic acquisition of the Zung Fu Industrial Building HK$0.72 per share. This, together with the first interim and Wah Ha Factory Building will enable us to develop dividend of HK$0.33 per share paid in October 2023, our masterplan for the district and to continue our amounts to a full year dividend of HK$1.05 per share, office story. representing a 5% increase over the dividends for 2022. We are also making good progress on scaling our Pacific The second interim dividend for 2023 will be paid on Place portfolio, as the CBD progressively shifts towards Thursday, 2nd May 2024 to shareholders registered at the expanded Admiralty transport hub. To further the close of business on the record date, being Friday, enhance the connectivity of Pacific Place, we are 5th April 2024. Shares of the Company will be traded constructing a new footbridge between Pacific Place ex-dividend from Tuesday, 2nd April 2024. and Harcourt Garden, which will be completed by 2025. Our policy is to deliver sustainable growth in dividends We have completed Six Pacific Place, our newest and to pay out approximately half of our underlying profit Grade-A office tower, and we remain committed to in ordinary dividends over time. With the benefit of our further development of the Pacific Place neighborhood planned investments, we aim to deliver mid-single digit in the future. annual growth in dividends. 17

CHAIRMAN'S STATEMENT Recovery for Hong Kong Retail In November, we broke ground on Taikoo Li Xi’an, our We saw a strong recovery in our Hong Kong retail largest “Taikoo Li” project in the Chinese Mainland to date. business in 2023, with a significant growth in sales and in This is our first investment in Xi’an, and we have dedicated some cases, a return to pre-pandemic sales levels. This is considerable resources to researching the historical an extremely encouraging result after the challenges of background of this unique site, in order to create a truly the pandemic, and we are optimistic for the year ahead. world-class cultural landmark in the city. We believe the HKSAR Government’s initiatives to We are also making good progress on our retail-led promote Hong Kong’s tourism and to boost local development in Haitang Bay, Sanya, which will be our first consumption, in particular in staging world-class events, resort-style shopping mall and a new luxury tourist will continue to have a positive impact on footfall and destination for Hainan. sales in our malls in the long run. In Beijing, INDIGO Phase Two, a new commercial landmark We are pleased with our retail recovery despite the in Chaoyang District is under development, and will feature challenging conditions, and we attribute the growth to seven office towers in addition to a lifestyle hotel and the long-term partnerships with our tenants, which have innovative retail concepts. Our pioneering development of led to exciting collaborations to create new experiences One Taikoo Place and Two Taikoo Place has served as for our customers. We have also been investing in our inspiration for the project, and we aim to deliver a high loyalty programmes, and our local loyalty membership quality, vibrant commercial hub in the capital. increased by over 30% in 2023 compared to the previous We recently announced two significant investments in year. We remain committed to the digital transformation Shanghai’s Pudong District – a new mixed-use project of our business, combining the use of technology with opposite Taikoo Li Qiantan in the New Bund Area and personalised services to reinforce customer loyalty and another large-scale project on the Yangjing waterfront to provide an exceptional retail experience in our malls. along the Huangpu River. These will be our third and fourth New Investments in the large-scale developments in Shanghai, which is now our largest area of operation in the Chinese Mainland. These Chinese Mainland two projects also mark our first foray into the premium The Chinese Mainland is an increasingly important residential market in the Chinese Mainland. market for us, and our mixed-use investments are a key With Hong Kong as our home base, we have a well- driver of our profit growth. We are continuing to make established presence in the Greater Bay Area. We are good progress in building a strong pipeline under the currently developing a new House Collective hotel in HK$50 billion investment plan which we have earmarked Shenzhen Bay, Nanshan district, and are actively exploring for the Chinese Mainland. Our Taikoo Li and Taikoo Hui further investment opportunities in the Greater Bay Area. branded retail developments are all well-established Our Residential Pipeline destinations in their respective cities, and we are expanding our footprint with five new large-scale Our HK$100 billion investment plan also includes an projects in Tier-1 and emerging Tier-1 cities. We are very allocation of HK$20 billion for the proposed development pleased to have had the opportunity to complete the of our residential pipeline in Hong Kong and South East acquisition of the remaining interest in Taikoo Li Asia over the next decade. We have made significant Chengdu, one of our flagship malls in the Chinese progress over the past year, and have built up an exciting Mainland. 18

SWIRE PROPERTIES ANNUAL REPORT 2023 pipeline in Hong Kong. In 2023, in conjunction with our joint Youth empowerment is also a core focus of our community venture partners, we launched LA MONTAGNE, a new care, and we have been active in developing and luxury residential development at The Southside in Wong sponsoring various initiatives to provide opportunities Chuk Hang. for young people in Hong Kong. In South East Asia, we announced our first investment in As Hong Kong recovers in the wake of the pandemic, the residential market in Bangkok in early 2023, to develop we are working closely with the HKSAR Government and a prime site at one of the city’s most prestigious addresses. our partners to boost the local economy with special In addition to three projects currently under development community initiatives. In 2023, these included the in Ho Chi Minh City, Vietnam and in Jakarta, Indonesia, we Summer Festival at the new Quarryside community space, are exploring new residential opportunities in Singapore. as well as our annual White Christmas Street Fair, which was extended over two weekends with longer opening Leadership in ESG & hours for the public. We hope these efforts will continue to Community Investment provide a platform for homegrown businesses whilst supporting the city’s economic recovery. ESG and sustainable development remain at the top of our agenda, and we are collaborating closely with our Outlook stakeholders and setting ambitious targets across the business. We have received international recognition for We are encouraged by the post-pandemic recovery that we our achievements, and we continue to explore new are seeing across the majority of our key markets. Whilst solutions to improve our business and to support the there are challenges ahead, we remain optimistic and see wider industry. potential for sustainable growth in 2024 and beyond. In 2023, we became the first Hong Kong corporate to issue We will continue to focus on realising our HK$100 billion a public “dim sum” green bond of RMB3.2 billion to fund investment plan and on delivering our pipeline of mixed- eligible projects. The proceeds from these bonds will use and residential projects across our core markets in enable us to develop projects with the highest green Hong Kong, the Chinese Mainland and South East Asia. credentials, and in the long term, pave the way for Swire We see long-term potential for these markets, and we Properties to pioneer new ground in sustainability. will continue to seek new investment opportunities in Over the past year, we have also piloted the adoption of an the future. internal carbon pricing (“ICP”) mechanism. This innovative I should like to express my appreciation to our approach will help determine the potential impact of shareholders, our valued partners and to the wider carbon emissions from our investments and quantify community for your continued support. Most of all, carbon risks to our operations, allowing us to reallocate thanks must go to the team at Swire Properties for their capital to low-carbon investments. exceptional work and dedication this past year. We remain fully invested in working with local communities. Our colleagues, their friends and families are at the heart of Guy Bradley Swire Properties’ Community Ambassador Programme, and Chairman they continue to demonstrate commitment and passion for Hong Kong, 14th March 2024 giving back to our communities. 19

CHIEF EXECUTIVE’S STATEMENT We continue to make very good progress on our HK$100 billion investment plan, with almost 60% of the plan now committed to new projects to drive our long-term growth in all our key markets. Dear shareholders, 2023 Financial Results at a Glance We are encouraged by the recovery we have seen across Our underlying profit increased by HK$2,864 million from several of our key businesses in 2023, following the lifting HK$8,706 million in 2022 to HK$11,570 million in 2023, of pandemic-related restrictions. Despite macro-economic which mainly reflected the gain on the disposal of nine and geopolitical uncertainties, we remain optimistic for our floors of One Island East in Hong Kong. Recurring business in the year ahead. underlying profit was HK$7,285 million in 2023, compared As the Chairman has outlined, we continue to make very with HK$7,176 million in 2022. good progress on our HK$100 billion investment plan, with Our recurring underlying profit from property investment almost 60% of the plan now committed to new projects to increased in 2023, due primarily to higher retail rental drive our long-term growth in all our key markets. income from Hong Kong and the Chinese Mainland, and Looking forward to 2024, we are advancing our ambitious partly offset by lower office rental income from Hong Kong. plans for Taikoo Place in Hong Kong as it continues its Our Hong Kong retail portfolio has recovered remarkably transformation into a Global Business District. In the well, with an improvement in consumer sentiment, thanks Chinese Mainland, our retail developments are landmarks to the lifting of all travel restrictions and pandemic related in their respective cities, and we are making good headway control measures. Our investment in marketing and loyalty with several new projects in the pipeline, including initiatives, together with digitally-advanced campaigns to Taikoo Li Xi’an, our retail complex in Sanya, two major interact with customers, have all contributed to significant mixed-use developments in Shanghai and INDIGO Phase business recovery in our malls in Hong Kong during the Two in Beijing. year. Sales have improved and returned to pre-pandemic We remain committed to achieving our SD 2030 goals. We levels in some of our malls. are participating in pioneering global initiatives to mitigate In Hong Kong, the office market remains weak, given climate and nature risks, and piloting new sustainability increased availability (due to vacancy and new supply), solutions across all our portfolios. We will continue to work and demand for office space remains subdued, reflecting closely with our business partners to advance our SD continued economic uncertainty and the high interest rate agenda, as we work towards our long term goal of net zero environment. Nevertheless, our office portfolio has emissions by 2050. We are also accelerating the digital remained resilient with solid occupancy, due to the high transformation of our business, and embracing new sustainability standards of our office buildings. Leasing technologies to keep pace with market developments. activity has picked up since the reopening of the borders, with increased requests for viewings. 20

SWIRE PROPERTIES ANNUAL REPORT 2023 In the Chinese Mainland, foot traffic has improved Admiralty, we have completed Six Pacific Place, which has a significantly and retail sales have exceeded pre-pandemic commitment rate of approximately 40%, and we obtained levels for most of our malls since pandemic-related the occupation permit for the tower in February 2024. restrictions were lifted. Our office portfolio has proven to be In the Chinese Mainland, sales figures strongly exceeded resilient despite a weak office market. pre-pandemic levels across most of our malls. In the wake We recorded a small underlying loss from our property of this robust recovery, we expect 2024 to be a year of trading activities in 2023 as a result of sales and marketing market stabilisation, and we continue to hold a positive expenses incurred for several residential trading projects. outlook in the medium to long term. We are encouraged by Our hotel business in Hong Kong and the Chinese Mainland the current trends in consumer spending and domestic recovered strongly following the lifting of travel restrictions travel, and expect to see a further boost in the year ahead. and the reopening of the borders. We are excited to be establishing a presence in two important cities in the Chinese Mainland – Xi’an, the Our Future Prospects ancient capital of China with immense historical and We have been encouraged by the strong recovery of our economic significance; and Sanya, which is emerging as malls in Hong Kong, and we expect that footfall and one of the most popular domestic travel retail destinations tenants’ sales will continue to improve despite economic in the country. We have also significantly expanded our uncertainties and a volatile stock market. With our strong footprint in Shanghai with two new large-scale, mixed-use marketing campaigns and attractive loyalty programme developments in the city’s Pudong New Area. With four initiatives, we anticipate that the sales momentum will projects now in operation and under development across continue in 2024. Shanghai, we are pleased to be launching our premium residential brand in the city while opening up the Chinese The office market in Hong Kong is expected to remain Mainland market for further opportunities. subdued in 2024, on the back of weak demand and We also hold a positive outlook on the long-term prospects increased availability. Increasing competition from Central for the Greater Bay Area, which is experiencing significant and Kowloon East will continue to exert downward pressure development momentum. We are actively exploring new on rents across our portfolio. However we expect our office opportunities in Shenzhen, with plans for a new, ultra- spaces, with their industry-leading ESG certifications and luxury hotel under The House Collective brand, and we excellent amenity provisions, will continue to benefit from have signed a Strategic Framework Cooperation the ‘flight-to-quality’ trend. Agreement with the Futian District Government to explore Assuming improvements in the financial markets, and an new prospects. increase in economic activity, we expect the demand for Looking at residential opportunities, the Hong Kong market Grade-A office space, particularly from financial institutions remains soft amidst economic uncertainties, and we expect and professional services companies, to recover. that market confidence may take some time to recover. We will reach a major milestone this year with the However, we anticipate demand to remain resilient in the completion of the current redevelopment phase of Taikoo medium to long term, due to local demand and limited Place. Our new Taikoo Square will be a unique showcase of supply. We launched our newest project on Hong Kong urban biodiversity, alongside increased connectivity via our Island, LA MONTAGNE with our joint venture partners in new elevated walkways, and outdoor dining amenities to 2023, and 52 units have been sold to date. serve our vibrant office community in Quarry Bay. In 21

CHIEF EXECUTIVE'S STATEMENT We are also actively looking to expand our residential 40-member Taskforce on TNFD, we are proud to have portfolio in South East Asia under our HK$100 billion plan. supported the creation of this pioneering disclosure We are focused on the four major cities of Jakarta in framework, which will help companies to integrate nature- Indonesia, Ho Chi Minh City in Vietnam, Bangkok in related considerations into their investment decisions and Thailand and Singapore, and expect these markets to business operations. remain stable in 2024, due to increased urbanisation and a Our work continues, and we are on track to achieve our limited supply of luxury residential properties. ambitious 1.5°C-aligned science-based targets. We remain We expect the performance of our hotels in Hong Kong and focused on collaborating closely with our business partners the Chinese Mainland to continue to improve with more through various programmes to meet shared sustainability international visitors in 2024. In September, we were goals. These include the Green Kitchen Initiative for F&B delighted to have The Upper House ranked fourth on The tenants in our retail portfolios, and our proprietary Green World’s 50 Best Hotels list, a remarkable achievement for Performance Pledge (“GPP”) programme for office tenants. Swire Hotels. Both programmes have received a strong positive response We are moving forward with the next phase of growth for from our tenants, achieving significant results in energy The House Collective and EAST brands, with several savings, improved water efficiency and water diversion exciting projects in the pipeline, including The House rates. In 2023 we launched the “GPP Academy”, Collective hotels in Tokyo, Shenzhen and Xi’an. We have a three-year collaboration with the Hong Kong Business also been making good progress with our asset-light, Environment Council (“BEC”) which will enable our office third-party management model as we explore potential tenants to share industry knowledge and best practices to new sites with suitable partners. improve their sustainability capabilities. We also became the first real estate company in Hong Collective Measures Towards Net Zero Kong and the Chinese Mainland to launch a supply chain We continue to focus on our pioneering sustainability work sustainability engagement programme, in partnership with and our commitment to building vibrant communities, in EcoVadis. Through this collaboration, we are empowering order to realise our vision to be the leading performer in our suppliers to improve their own ESG performance and our industry globally by 2030. increase resilience, working collectively towards the global net zero goal. As an industry leader, we are taking a holistic approach to mitigating climate-related risk, and reducing our carbon Taikoo Place: Sustainability in Action footprint. We continue to invest in innovative solutions for Now more than ever, it is crucial that we, as an industry, our future, and our achievements are being recognised take steps to minimise our impact on the environment. locally, regionally and globally, including our number two The redevelopment of Taikoo Place has been a showcase ranking in the Dow Jones Sustainability World Index 2023. of our work in sustainable building development, and the We are also pioneering new ground as an early adopter of next phase of this project will highlight our extensive work the Taskforce on Nature-related Financial Disclosures in biophilic design. (“TNFD”). As the only Hong Kong representative of the 22

SWIRE PROPERTIES ANNUAL REPORT 2023 Together with the Taikoo Garden, the new Taikoo Square The past year also saw the successful conclusion of the will span approximately 69,000 square feet of green open two-year “Bi-city Youth Cultural Leadership Programme”, space, which has been carefully cultivated to improve local our long-term partnership with The Hong Kong Palace biodiversity with over 100 mostly native plant species. Museum, which has helped to foster closer ties and cultural We are excited to open this new garden to the public, and exchange between students in Hong Kong and Beijing. hope that it will act as a catalyst to inspire others in the industry to integrate a nature-oriented mindset in their Outlook urban planning. With our strong financial position and robust pipeline of Supporting our Local Communities new projects, we are confident in our outlook for 2024. This is an exciting period for our business, and we will continue We are committed to creating a positive impact across to make strides with our investment strategy as we grow our business. 2023 was another remarkable year for our our presence in our core markets of Hong Kong, the Community Ambassadors, who have expanded their Chinese Mainland and South East Asia. community work to focus on wellness for patients and their We look forward to reaching major milestones in the caregivers. In October, the team partnered with medical year ahead, including the unveiling of the next phase experts at Hong Kong University Stroke to host the in the redevelopment of our Taikoo Place as a Global “Together We Care for Stroke” exhibition at Cityplaza, Business District. which helped to raise awareness of stroke prevention and provided free health check-ups for the public. They also Our achievements this year would not have been possible launched the one-year “Care for our Carers” project in without the inspiring efforts of our colleagues. They remain collaboration with the YWCA, to provide much-needed critical to realising our SD 2030 targets and to our overall support to caregivers. These are just some of the important success. Looking ahead to 2024 and beyond, we will initiatives which the team has hosted this year. We are continue to prioritise our people, with new initiatives immensely proud of all their efforts. including training and development opportunities to The launch of Quarryside in 2023 has also had a catalytic support them as we enter a new phase of growth for effect on the Quarry Bay community. The new space has our business. I would like to thank our talented team at rapidly become a vibrant community hub, with over 200 Swire Properties for making this a memorable year, as well events hosted since its opening in July 2023. Looking as our shareholders, partners and the community for your ahead, we hope to further utilise the space for more ongoing support. community-led events in the district. Empowering youth remains a key priority for our Tim Blackburn community work. In 2023 we continued the Swire Chief Executive Properties Placemaking Academy (“SPPA”), which saw Hong Kong, 14th March 2024 10 university students design our White Christmas Street Fair under the mentorship of leading industry figures and our own senior management team. We also launched the inaugural Placemaking Academy Junior Programme for secondary students, a collaboration with the E-League of the Eastern District Office of the Home Affairs Department. 23

KEY BUSINESS STRATEGIES As a leading developer, owner and operator of mixed-use, principally commercial, properties in Hong Kong and the Chinese Mainland, our strategic objective is sustainable growth in shareholder value in the long term. To achieve this objective, we employ five strategies. 1. Create long-term value by conceiving, with a view to the long term, to maintain consistently designing, developing, owning and high levels of service and to enhance and reinforce managing transformational mixed-use our assets. By doing so, we believe that we will and other projects in urban areas maximise the occupancy and earnings potential of our properties. We will continue to design projects which we believe Tenants increasingly scrutinise the sustainable will have the necessary scale, mix of uses and transport development credentials of landlords and buildings. links to become key commercial destinations and to We aim to be at the forefront of sustainable transform the areas in which they are situated. development by designing energy efficient buildings through the innovative use of design, materials and 2. Maximise the earnings and value of our new technology, and by engagement with tenants and completed properties through active others with whom we do business. asset management and by reinforcing 3. Develop luxury and high quality our assets through enhancement, residential property activities redevelopment and new additions We manage our completed properties actively We will look to acquire appropriate sites for (including by optimising the mix of retail tenants and development of luxury and high quality residential early renewal negotiations with office tenants) and projects for trading and investment in the markets in which we operate. 24

SWIRE PROPERTIES ANNUAL REPORT 2023 4. Focus principally on Hong Kong and the While we will continue to concentrate on Hong Kong Chinese Mainland and the Chinese Mainland, we intend to expand selectively in South East Asia. In Hong Kong, we will continue to focus on reinforcing our existing investment property assets and on seeking 5. Manage our capital base conservatively new sites suitable for transformative developments We intend to maintain a strong balance sheet with a and for residential projects. view to investing in and financing our projects in a We aim to replicate in the Chinese Mainland our disciplined and targeted manner. success in Hong Kong. We intend to take a measured We aim to maintain exposure to a range of debt approach to land purchases in the Chinese Mainland maturities and a range of debt types and lenders. Our and will focus on developments where we can secure current debt profile reflects a mix of revolving and term sites through early engagement with local bank loans and medium term notes. governments who recognise our strengths in developing large-scale mixed-use projects. In implementing the above strategies, the principal risks We will seek residential development opportunities in and uncertainties facing the Group are that the economies the Chinese Mainland. These are likely to be ancillary in which it operates (in particular Hong Kong and the to our mixed-use developments. However, in the right Chinese Mainland) will not perform as well in the future as locations and cities we may also consider standalone they have in the past and the uncertainties as to whether residential development opportunities. Our residential this will happen. developments will be aimed at buyers of luxury and high quality properties, where we believe we have a competitive advantage. 25

MANAGEMENT DISCUSSION & ANALYSIS

TWO TAIKOO PLACE, HONG KONG

REVIEW OF OPERATIONS 2023 2022 HK$M HK$M Revenue Gross Rental Income derived from Office 5,835 6,003 Retail 7,143 5,849 Residential 430 374 (1) Other Revenue 117 114 Property Investment 13,525 12,340 Property Trading 166 921 Hotels 979 565 Total Revenue 14,670 13,826 Operating Profit/(Losses) derived from Property investment From operations 8,261 7,702 Sale of interests in investment properties (60) 571 Fair value (losses)/gains in respect of investment properties (2,829) 801 Property trading (89) 209 Hotels (103) (259) Total Operating Profit 5,180 9,024 Share of Post-tax (Losses)/Profit from Joint Venture and Associated Companies (292) 1,455 Profit Attributable to the Company’s Shareholders 2,637 7,980 (1) Other revenue is mainly estate management fees. Additional information is provided in the following section to reconcile reported and underlying profit attributable to the Company’s shareholders. These reconciling items principally adjust for the fair value movements on investment properties and the associated deferred tax in the Chinese Mainland and the U.S.A., and for other deferred tax provisions in relation to investment properties. In Hong Kong and the Chinese Mainland, the Group’s investment properties recorded fair value losses of HK$3,638 million and HK$920 million respectively in 2023. In the U.S.A., investment properties recorded fair value gain of HK$166 million. There are further adjustments to remove the effect of the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest and remeasurement gains on interests in joint venture companies which became subsidiary companies after completion of acquisition. Amortisation of right-of-use assets classified as investment properties is charged to underlying profit. 28

SWIRE PROPERTIES ANNUAL REPORT 2023 2023 2022 Underlying Profit Reconciliation Note HK$M HK$M Profit Attributable to the Company’s Shareholders per Financial Statements 2,637 7,980 Adjustments in respect of investment properties: Fair value losses/(gains) in respect of investment properties (a) 4,392 (1,726) Deferred tax on investment properties (b) 461 1,402 Fair value gains realised on sale of interests in investment properties (c) 4,398 915 Depreciation of investment properties occupied by the Group (d) 22 22 Non-controlling interests’ share of fair value movements less deferred tax 8 144 Movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest (e) 39 49 Remeasurement gains on interests in joint venture companies which became subsidiary companies after completion of acquisition (f) (306) – Less amortisation of right-of-use assets reported under investment properties (g) (81) (80) Underlying Profit Attributable to the Company’s Shareholders 11,570 8,706 Profit from divestment (4,285) (1,530) Recurring Underlying Profit Attributable to the Company’s Shareholders 7,285 7,176 Notes: (a) This represents the fair value movements as shown in the Group’s consolidated statement of profit or loss and the Group’s share of fair value movements of joint venture and associated companies. (b) This represents deferred tax movements on the Group’s investment properties, plus the Group’s share of deferred tax movements on investment properties held by joint venture and associated companies. These comprise deferred tax on fair value movements on investment properties in the Chinese Mainland and the U.S.A., and deferred tax provisions made in respect of investment properties held for the long-term where it is considered that the liability will not reverse for some considerable time. It also includes certain tax adjustments arising from transfers of investment properties within the Group. (c) Prior to the implementation of HKAS 40, changes in the fair value of investment properties were recorded in the revaluation reserve rather than the consolidated statement of profit or loss. On sale, the fair value gains/(losses) were transferred from the revaluation reserve to the consolidated statement of profit or loss. (d) Prior to the implementation of HKAS 40, no depreciation was charged on investment properties occupied by the Group. (e) The value of the put option in favour of the owner of a non-controlling interest is calculated principally by reference to the estimated fair value of the portion of the underlying investment property in which the owner of the non-controlling interest is interested. (f) The remeasurement gains on interests in joint venture companies were calculated principally by reference to the estimated market value of the underlying properties portfolio of the joint venture companies, netting off with all related cumulative exchange difference. (g) HKFRS 16 amends the definition of investment property under HKAS 40 to include properties held by lessees as right-of-use assets to earn rentals or for capital appreciation or both, and requires the Group to account for such right-of-use assets at their fair value. The amortisation of such right-of-use assets is charged to underlying profit. 29

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Underlying Profit Movement in HK$M Underlying Profit 12,000 +116 -248 11,570 +2,755 +241 10,000 8,706 8,000 Underlying profit Increase in losses in 2022 from property 6,000 trading Increase in profit Decrease in losses 4,000 from divestment from hotels Increase in profit Underlying profit 2,000 from property in 2023 investment 0 2023 2022 Our reported profit attributable to shareholders in 2023 was In Hong Kong, the retail portfolio has significantly HK$2,637 million, compared to a profit of HK$7,980 million recovered, following the lifting of all travel restrictions and in 2022. There was a fair value loss on investment pandemic related control measures, together with the properties (after deducting non-controlling interests) of investment in marketing, digital and loyalty initiatives. HK$4,401 million in 2023, compared with a fair value gain Despite a weak office market (reflecting subdued demand on investment properties (after deducting non-controlling and increased supply), the office portfolio in Hong Kong interests) of HK$1,573 million in 2022, principally due to has proved to be resilient with solid occupancy, as a result the decrease in the fair value gain on the retail investment of the high sustainability standards of the office buildings. properties in the Chinese Mainland and the fair value loss In the Chinese Mainland, foot traffic improved significantly on the investment properties under development (as and retail sales strongly exceeded pre-pandemic levels opposed to a fair value gain for 2022). for most of our malls, after the COVID-19 associated Underlying profit attributable to shareholders (which restrictions were lifted. principally adjusts for changes in fair value of investment In the U.S.A., retail sales and gross rental income were properties) increased by HK$2,864 million from HK$8,706 strong. million in 2022 to HK$11,570 million in 2023. The increase The small underlying loss from property trading in 2023 principally reflected the profit on disposal of certain office was primarily a result of sales and marketing expenses floors in Hong Kong. incurred for several residential trading projects. Recurring underlying profit (which excludes the profit from The hotel businesses in Hong Kong and the Chinese divestment) was HK$7,285 million in 2023, compared with Mainland recovered strongly following the lifting of HK$7,176 million in 2022. COVID-19 measures and the full reopening of the border. Recurring underlying profit from property investment There was solid performance in the U.S.A. hotels. increased in 2023. This mainly reflected higher retail rental income from Hong Kong and the Chinese Mainland, partly offset by lower office rental income from Hong Kong. 30

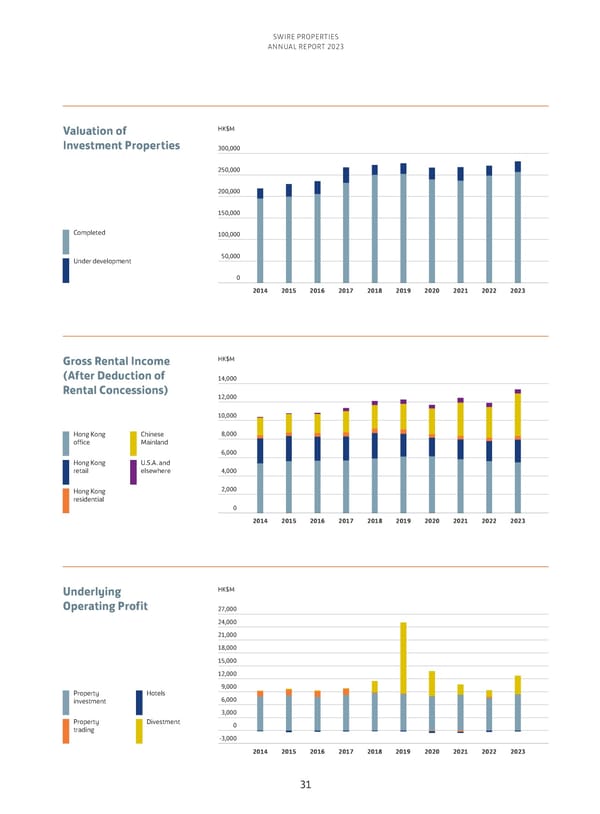

SWIRE PROPERTIES ANNUAL REPORT 2023 Valuation of HK$M Investment Properties 300,000 250,000 200,000 150,000 Completed 100,000 Under development 50,000 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Gross Rental Income HK$M (After Deduction of 14,000 Rental Concessions) 12,000 10,000 Hong Kong Chinese 8,000 office Mainland 6,000 Hong Kong U.S.A. and retail elsewhere 4,000 Hong Kong 2,000 residential 0 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Underlying HK$M Operating Profit 27,000 24,000 21,000 18,000 15,000 12,000 Property Hotels 9,000 investment 6,000 3,000 Property Divestment 0 trading -3,000 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 31

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Attributable GFA Completed Investment (000 sq. ft.) Property and Hotel 35,000 Portfolio by Location 30,000 25,000 Hong Kong 20,000 15,000 Chinese Mainland 10,000 U.S.A. 5,000 0 2023 2024 2025 2026 2027 2028 2029 2030 and later Attributable GFA Completed Investment (000 sq. ft.) Property and Hotel 35,000 Portfolio by Type 30,000 25,000 20,000 15,000 Office Hotels/Residential/ Serviced apartments 10,000 Retail Under planning 5,000 0 2023 2024 2025 2026 2027 2028 2029 2030 and later HK$100 Billion Commitment for new projects Investment Plan 58% COMMITTED Hong Kong Chinese Mainland Committed Residential trading projects (including in Remaining target South East Asia) 0 10 20 30 40 50 Target (HK$ Bn) 32

SWIRE PROPERTIES ANNUAL REPORT 2023 In March 2022, the Company announced a plan to invest In February 2023, the Group acquired a 40% interest in a HK$100 billion over ten years in development projects in site located on Wireless Road in Lumphini sub-district in Hong Kong and the Chinese Mainland and in residential Pathum Wan district, Bangkok for a consideration of trading projects (including in South East Asia). The target approximately THB2.4 billion. In partnership with City allocation is HK$30 billion to Hong Kong, HK$50 billion to Realty Co. Ltd., the site is expected to be developed for the Chinese Mainland and HK$20 billion to residential residential use with a site area of approximately 136,000 trading projects (including in South East Asia). At 8th square feet. March 2024 approximately HK$58 billion of the planned In June 2023, the Group announced plans to develop a investments had been committed (HK$11 billion to luxury residential and hospitality project in Miami, which Hong Kong, HK$37 billion to the Chinese Mainland and will include the redevelopment of the existing Mandarin HK$10 billion to residential trading projects). Major Oriental Miami hotel. The project, which has been branded committed projects are residential developments at Chai as The Residences at The Mandarin Oriental, Miami, will Wan Inland Lot No. 178, at 269 Queen’s Road East, at consist of two towers at the southernmost point of Brickell 983-987A King’s Road and 16-94 Pan Hoi Street in Hong Key. The first tower will comprise luxury private residences Kong, and at Wireless Road in Bangkok, a retail-led mixed- managed by Mandarin Oriental. The second tower will use development in Xi’an, a retail-led development in comprise a new Mandarin Oriental hotel as well as private Sanya, mixed-use developments in the Yangjing and residences and hotel residences. Sales reservations were New Bund in Shanghai, office and other commercial use launched in December 2023. developments at 8 Shipyard Lane and at 1067 King’s Road in Hong Kong. Uncommitted projects include further In July 2023, the Group obtained full ownership of Wah Ha retail-led mixed-use projects in Tier 1 and emerging Tier 1 Factory Building in Quarry Bay, Hong Kong. Together with cities in the Chinese Mainland, including Guangzhou and the adjacent wholly-owned Zung Fu Industrial Building, Beijing, with a plan to double our gross floor area in the the two sites are intended to be redeveloped for office and Chinese Mainland, further expansion at Pacific Place and other commercial uses. Taikoo Place in Hong Kong as well as further residential In July 2023, a joint venture company in which the Group trading projects in Hong Kong, the Chinese Mainland, holds a 25% interest started the pre-sales of LA Miami and South East Asia. MONTAGNE, a residential development in Wong Chuk Key Developments Hang, Hong Kong. Superstructure works of the development are in progress. In December 2022, the Group entered into three In September 2023, the Group successfully bid and entered conditional agreements with the Sino-Ocean group to into equity transfer agreements to acquire a 40% equity acquire further interests in Taikoo Li Chengdu (formerly interest in each of the Shanghai Yangjing Mixed-use Project known as Sino-Ocean Taikoo Li Chengdu). Under the first and the Shanghai New Bund Mixed-use Project, from agreement (which was completed in December 2022), Shanghai Lujiazui Group Co., Ltd and Shanghai Qiantan the Group’s interest in Taikoo Li Chengdu increased from International Commercial Area Investment Group Co., Ltd 50% to 65%. Under the second agreement (which was (“Lujiazui Group”), respectively. The consideration was completed in February 2023), the Group’s interest in the RMB6,594 million for the Shanghai Yangjing Mixed-use property management of Taikoo Li Chengdu increased to Project and RMB3,116 million for the Shanghai New Bund 100%. Under the third agreement (which was completed in Mixed-use Project. The two sites will be developed into February 2023), the Group’s interest in the investment large-scale, mixed-use projects, including retail, office and properties of Taikoo Li Chengdu increased to 100%. premium residential components. The Yangjing and The consideration was RMB1,000 million under the first New Bund projects have an expected gross floor area of agreement, RMB59 million under the second agreement approximately 4,200,000 and 4,100,000 square feet and RMB4,491 million under the third agreement. respectively. The transactions were completed in November 2023. 33

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS In October 2023, a joint venture company in which the Portfolio Overview Group holds a 50% interest obtained full ownership of The aggregate gross floor area (“GFA”) attributable the sites in 983-987A King’s Road and 16-94 Pan Hoi to the Group at 31st December 2023 was approximately Street in Quarry Bay. The sites are intended to be 39.1 million square feet. redeveloped for residential and retail uses. In November 2023, the Group entered into agreements Of the aggregate GFA attributable to the Group, for the sale of twelve office floors (42nd to 54th floors approximately 34.4 million square feet are investment excluding the 49th floor) at One Island East in Quarry properties and hotels, comprising completed investment Bay, Hong Kong to the Securities and Futures properties and hotels of approximately 24.4 million square Commission (“SFC”) for a total consideration of HK$5.4 feet and investment properties under development or held billion. The completion of the sale of the nine floors for future development of approximately 10.0 million (45th to 54th floors excluding the 49th floor) currently square feet. In Hong Kong, the investment property and occupied by SFC took effect in December 2023. The hotel portfolio comprise approximately 14.2 million square completion for the 43rd floor will take place not earlier feet attributable to the Group of primarily Grade-A office than 31st December 2025 and not later than 31st and retail premises, hotels, serviced apartments and other December 2026 while the completion for the 44th floor luxury residential accommodation. In the Chinese will take place not earlier than 31st December 2026 and Mainland, the Group has interests in ten major commercial not later than 31st December 2027, and the completion developments in prime locations in Beijing, Guangzhou, for the 42nd floor will take place not earlier than 31st Chengdu, Shanghai, Xi’an and Sanya. These developments December 2027 and not later than 31st December 2028. are expected to comprise approximately 18.1 million The total GFA of the twelve floors is approximately square feet of attributable GFA when they are all 300,000 square feet. completed. Of this, 10.6 million square feet has already been completed. Outside of Hong Kong and the Chinese In February 2024, the Group obtained the occupation Mainland, the investment property portfolio comprises the permit for Six Pacific Place. Six Pacific Place, the newest Brickell City Centre development in Miami, U.S.A. addition to Pacific Place, is an office tower with an The tables below illustrate the GFA (or expected GFA) aggregate GFA of approximately 223,000 square feet. attributable to the Group of the investment property and hotel portfolio at 31st December 2023. Completed Investment Properties and Hotels (GFA attributable to the Group in million square feet) Residential/ Serviced Under Office Retail Hotels(1) Apartments Planning Total Hong Kong 9.2 2.6 0.8 0.6 – 13.2 Chinese Mainland 2.9 6.2 1.3 0.2 – 10.6 U.S.A. – 0.3 0.3 – – 0.6 Total 12.1 9.1 2.4 0.8 – 24.4 34

SWIRE PROPERTIES ANNUAL REPORT 2023 Investment Properties and Hotels Under Development or Held for Future Development (expected GFA attributable to the Group in million square feet) Residential/ Serviced Under Office Retail Hotels(1) Apartments Planning Total Hong Kong 0.2 – – – 0.8 1.0 Chinese Mainland 1.6 2.1 0.1 – 3.7 7.5 (2) U.S.A. – – – – 1.5 1.5 Total 1.8 2.1 0.1 – 6.0 10.0 Total Investment Properties and Hotels (GFA (or expected GFA) attributable to the Group in million square feet) Residential/ Serviced Under Office Retail Hotels(1) Apartments Planning Total Total 13.9 11.2 2.5 0.8 6.0 34.4 (1) Hotels are accounted for in the financial statements under property, plant and equipment and, where applicable, the leasehold land portion is accounted for under right-of-use assets. (2) This property is accounted for under properties held for development in the financial statements. The trading portfolio comprises completed units available for sale at EIGHT STAR STREET in Hong Kong and The River in Vietnam. There are nine residential projects under development, four in Hong Kong, two in the Chinese Mainland, one in Indonesia, one in Vietnam and one in Thailand. There is also a plan to develop a residential project on part of our land banks in Miami, U.S.A. The table below illustrates the GFA (or expected GFA) attributable to the Group of the trading property portfolio at 31st December 2023. Trading Properties (GFA (or expected GFA) attributable to the Group in million square feet) Under Development Completed or Held for Development(1) Development Total Hong Kong 0.0 1.1 1.1 Chinese Mainland – 0.5 0.5 U.S.A. and elsewhere 0.0 3.1 3.1 Total 0.0 4.7 4.7 (1) Completed development in Hong Kong comprises EIGHT STAR STREET and completed development in U.S.A. and elsewhere comprises The River in Vietnam. 35

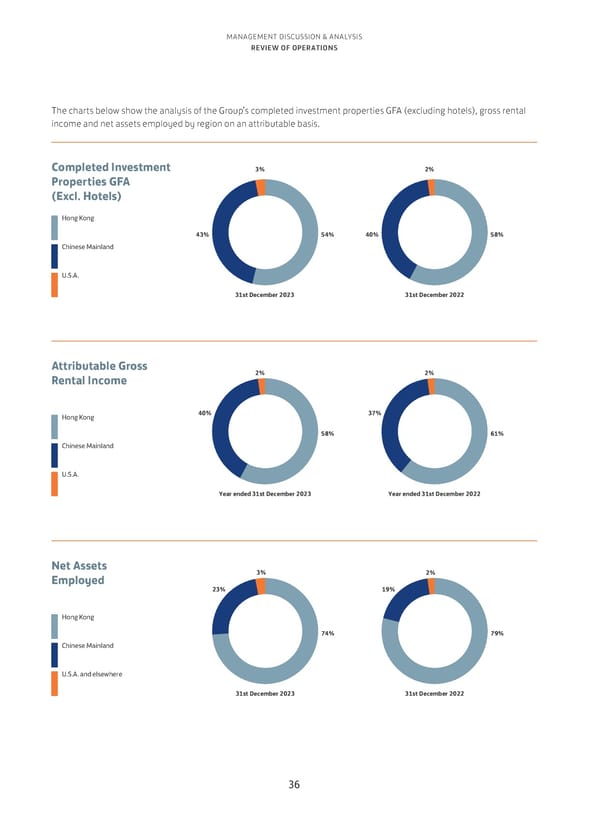

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS The charts below show the analysis of the Group’s completed investment properties GFA (excluding hotels), gross rental income and net assets employed by region on an attributable basis. Completed Investment 3% 2% Properties GFA (Excl. Hotels) Hong Kong 43% 54% 40% 58% Chinese Mainland U.S.A. 31st December 2023 31st December 2022 Attributable Gross 2% 2% Rental Income Hong Kong 40% 37% 58% 61% Chinese Mainland U.S.A. Year ended 31st December 2023 Year ended 31st December 2022 Net Assets 3% 2% Employed 23% 19% Hong Kong 74% 79% Chinese Mainland U.S.A. and elsewhere 31st December 2023 31st December 2022 36

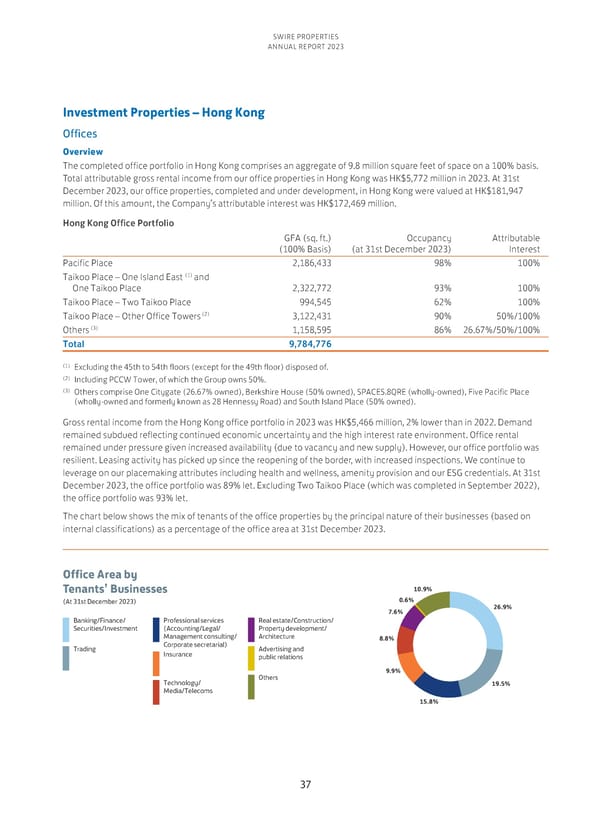

SWIRE PROPERTIES ANNUAL REPORT 2023 Investment Properties – Hong Kong Offices Overview The completed office portfolio in Hong Kong comprises an aggregate of 9.8 million square feet of space on a 100% basis. Total attributable gross rental income from our office properties in Hong Kong was HK$5,772 million in 2023. At 31st December 2023, our office properties, completed and under development, in Hong Kong were valued at HK$181,947 million. Of this amount, the Company’s attributable interest was HK$172,469 million. Hong Kong Office Portfolio GFA (sq. ft.) Occupancy Attributable (100% Basis) (at 31st December 2023) Interest Pacific Place 2,186,433 98% 100% (1) and Taikoo Place – One Island East One Taikoo Place 2,322,772 93% 100% Taikoo Place – Two Taikoo Place 994,545 62% 100% (2) 3,122,431 90% 50%/100% Taikoo Place – Other Office Towers (3) 1,158,595 86% 26.67%/50%/100% Others Total 9,784,776 (1) Excluding the 45th to 54th floors (except for the 49th floor) disposed of. (2) Including PCCW Tower, of which the Group owns 50%. (3) Others comprise One Citygate (26.67% owned), Berkshire House (50% owned), SPACES.8QRE (wholly-owned), Five Pacific Place (wholly-owned and formerly known as 28 Hennessy Road) and South Island Place (50% owned). Gross rental income from the Hong Kong office portfolio in 2023 was HK$5,466 million, 2% lower than in 2022. Demand remained subdued reflecting continued economic uncertainty and the high interest rate environment. Office rental remained under pressure given increased availability (due to vacancy and new supply). However, our office portfolio was resilient. Leasing activity has picked up since the reopening of the border, with increased inspections. We continue to leverage on our placemaking attributes including health and wellness, amenity provision and our ESG credentials. At 31st December 2023, the office portfolio was 89% let. Excluding Two Taikoo Place (which was completed in September 2022), the office portfolio was 93% let. The chart below shows the mix of tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 31st December 2023. Office Area by Tenants’ Businesses 10.9% (At 31st December 2023) 0.6% 7.6% 26.9% Banking/Finance/ Professional services Real estate/Construction/ Securities/Investment (Accounting/Legal/ Property development/ Management consulting/ Architecture 8.8% Trading Corporate secretarial) Advertising and Insurance public relations Others 9.9% Technology/ 19.5% Media/Telecoms 15.8% 37

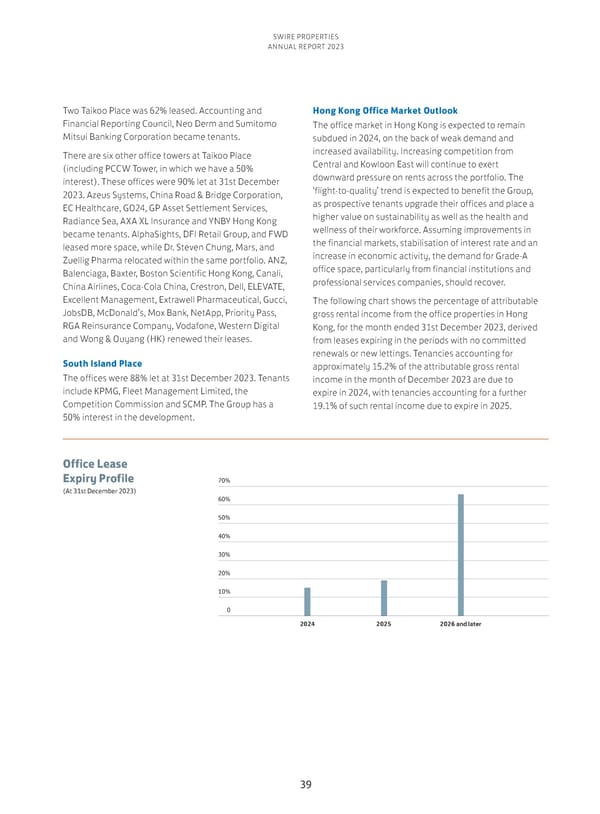

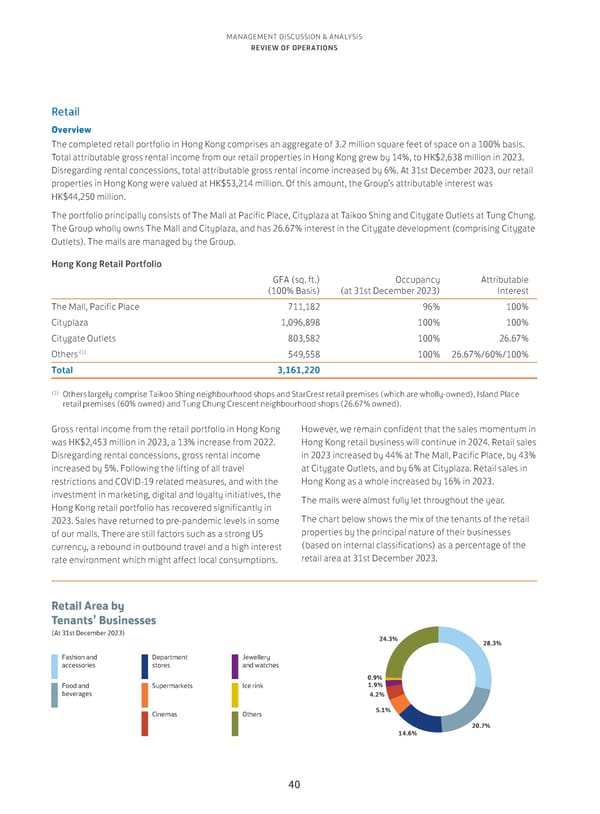

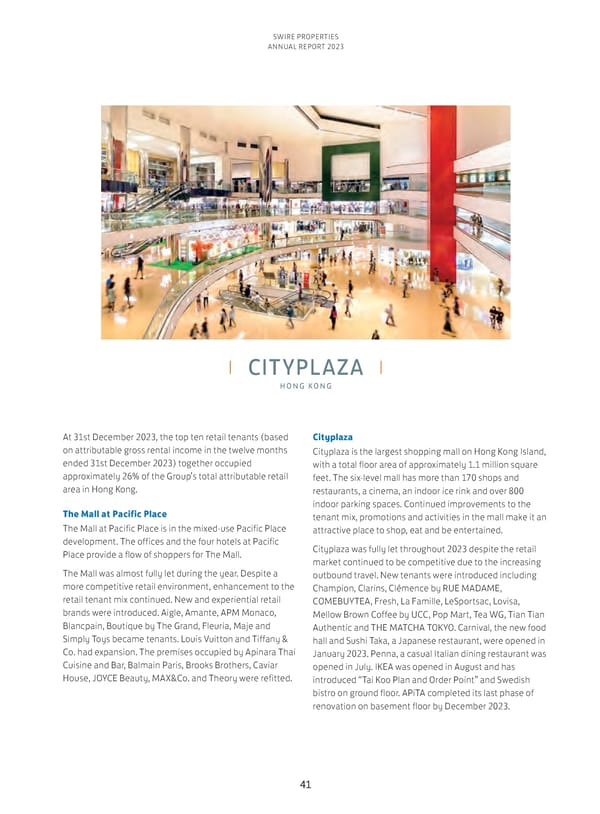

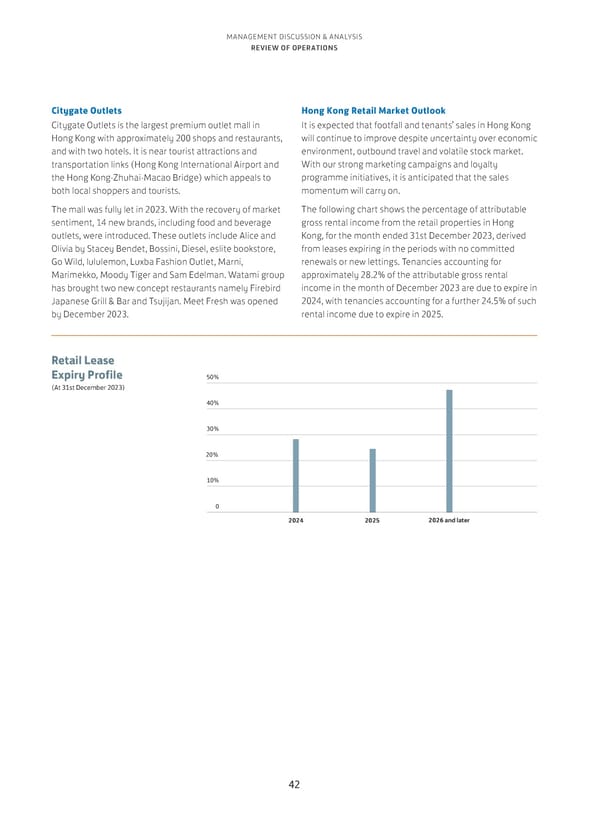

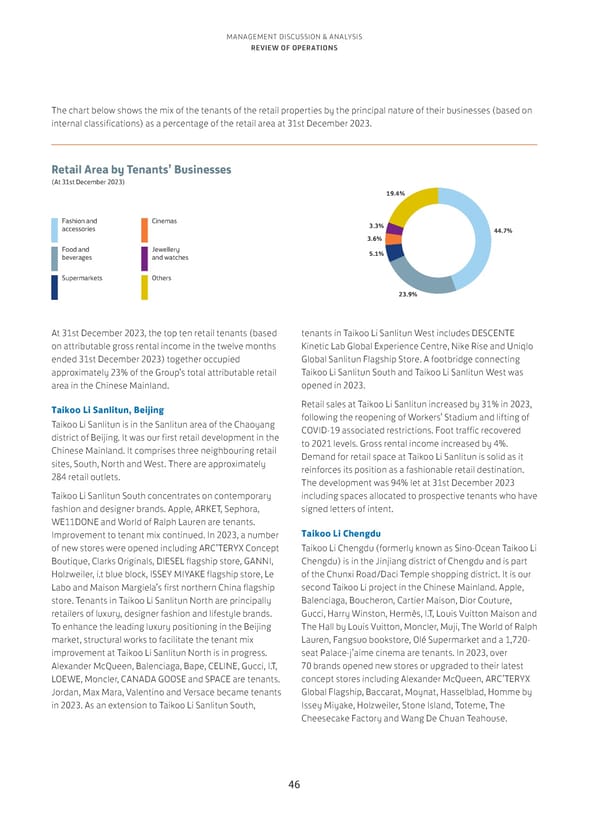

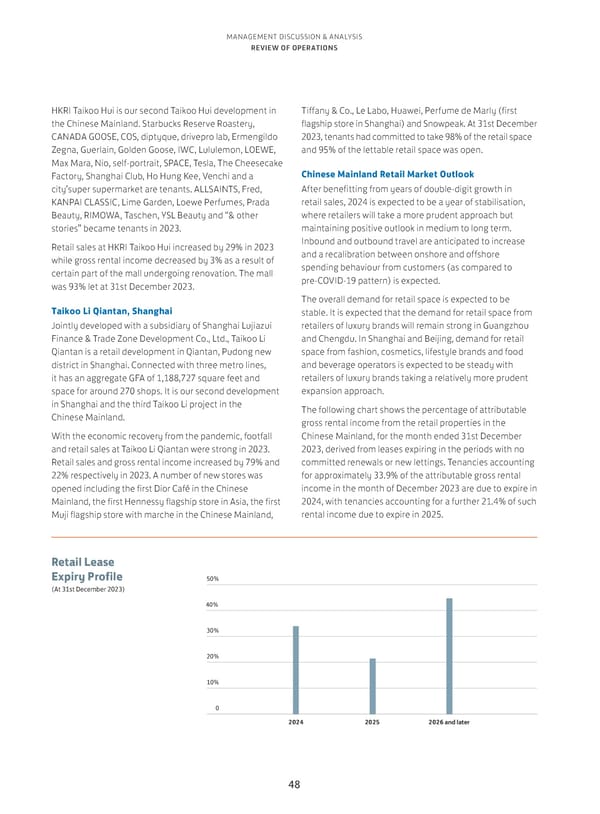

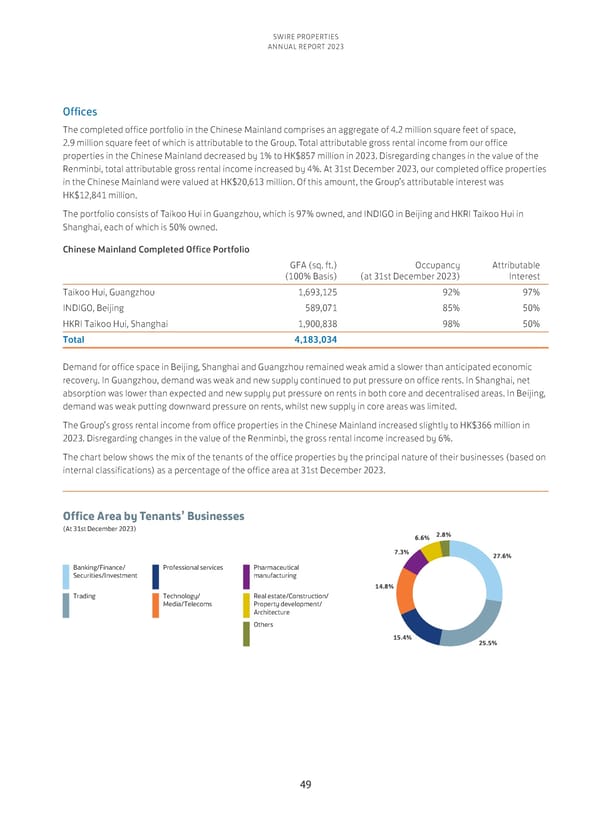

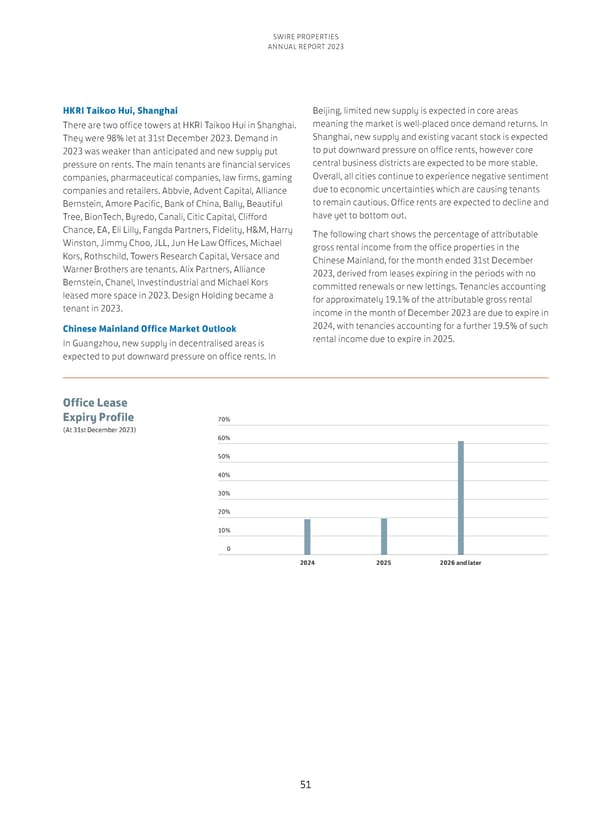

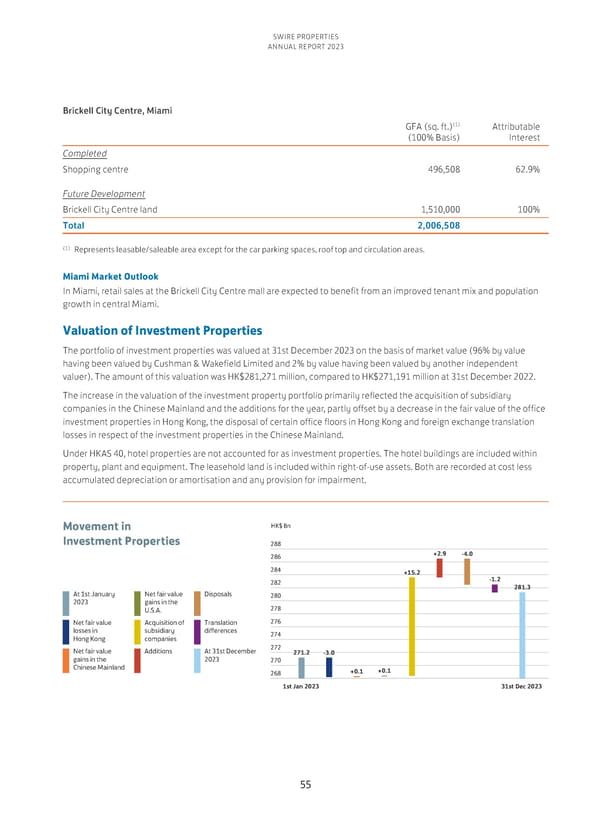

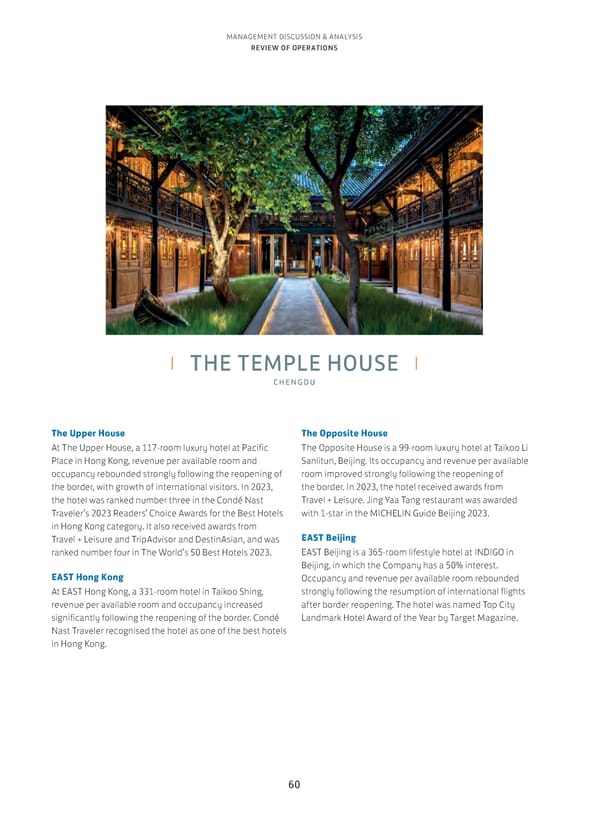

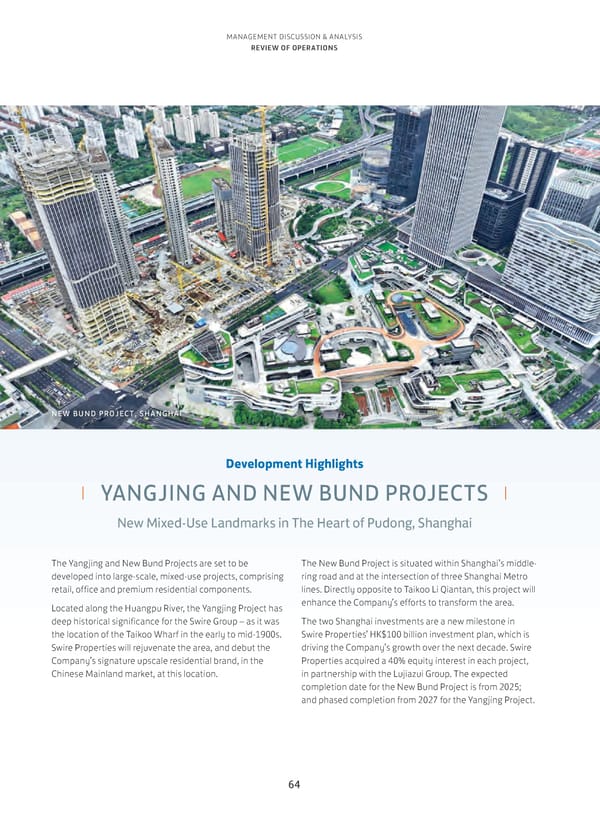

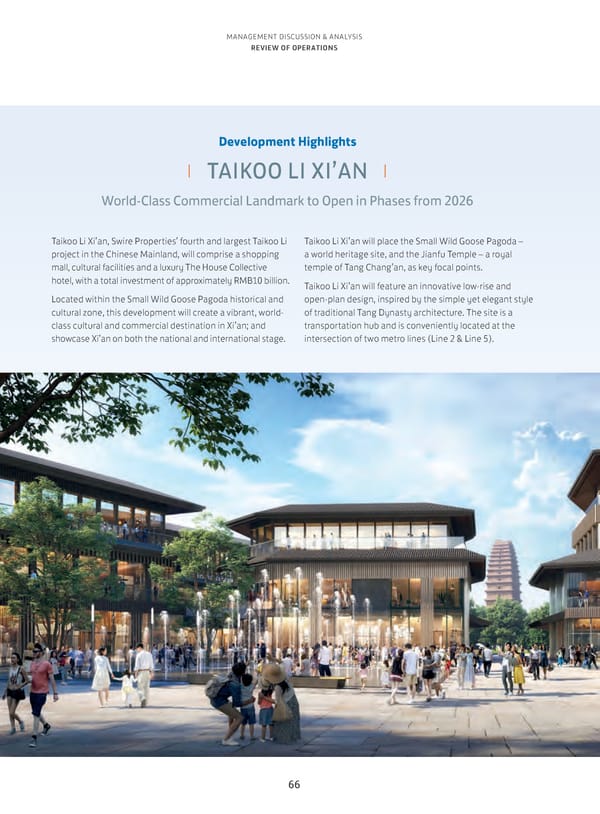

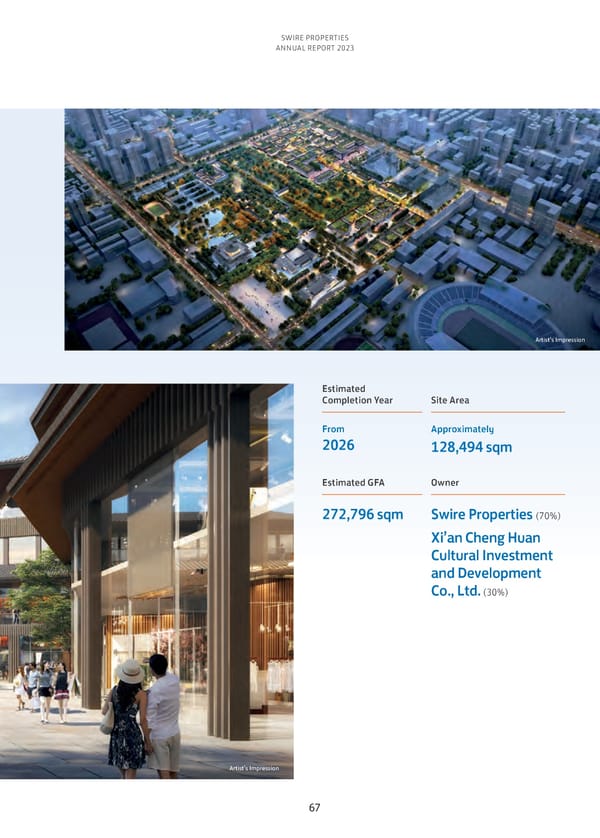

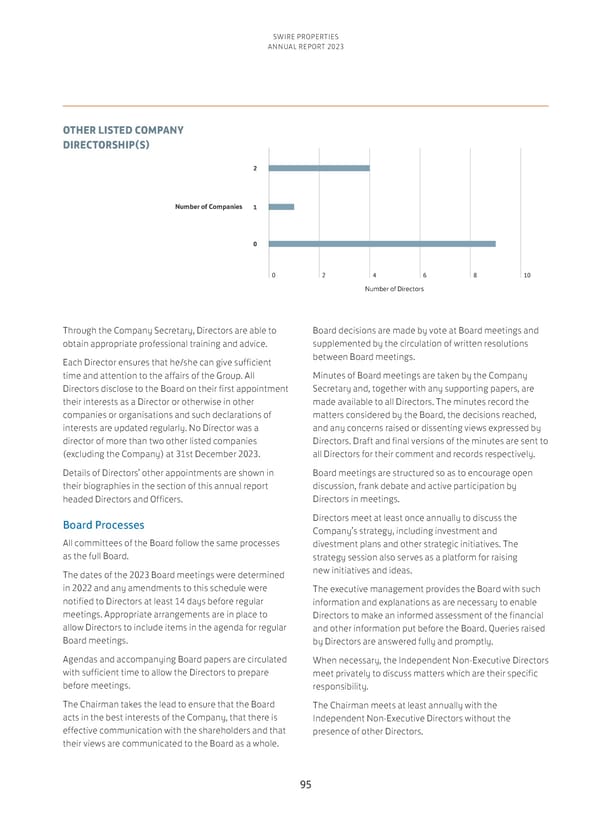

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS PACIFIC PLACE HONG KONG At 31st December 2023, the top ten office tenants (based At Six Pacific Place, tenants have committed (including on attributable gross rental income in the twelve months by way of letters of intent) to take approximately 40% ended 31st December 2023) together occupied of the space at 31st December 2023. Occupation permit approximately 21% of the Group’s total attributable office has been obtained in February 2024. Sotheby’s, area in Hong Kong. Pinebridge, British-American Tobacco and Maison Pacific Place Kayser agreed to lease spaces. The performance of the offices at One, Two, and Three Taikoo Place Pacific Place was resilient in 2023. These offices were 98% The performance of One Taikoo Place and One Island let at 31st December 2023. Standard Chartered Bank, ABN East (excluding the nine floors disposed of) at Taikoo Amro, Hong Kong Investment Corporation, FWD Life Place was resilient. These two offices towers were 98% Insurance, TF International Securities, Edrington, Asia and 89% let respectively at 31st December 2023. In Energy Logistics Group, Global Energy Corporation and Stat One Island East, CITIC Securities, Freshfields, SK hynix, Lab became tenants. CITIC Securities and NH Investment Tiffany & Co., Viatris and Zurich renewed their leases. Securities leased more spaces. Sino-Ocean, Guosen Meanwhile in One Taikoo Place, Spitalfields and Securities, Jason Pow Chambers, Poly Auction, Weihong Stephenson Harwood became tenants, and RPC Investment, Industrial Bank of Korea, Parkside Chambers, relocated within the same building. CTI Capital, Volant Trading and CDB Aviation renewed their leases. SAIF and Fidelity confirmed their relocation within the same portfolio upon the lease expiry. 38