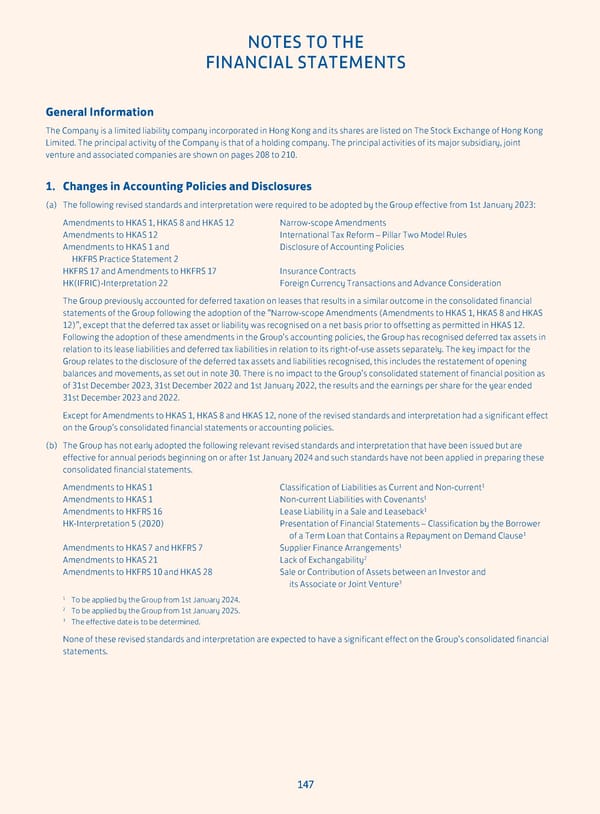

NOTES TO THE FINANCIAL STATEMENTS General Information The Company is a limited liability company incorporated in Hong Kong and its shares are listed on The Stock Exchange of Hong Kong Limited. The principal activity of the Company is that of a holding company. The principal activities of its major subsidiary, joint venture and associated companies are shown on pages 208 to 210. 1. Changes in Accounting Policies and Disclosures (a) The following revised standards and interpretation were required to be adopted by the Group effective from 1st January 2023: Amendments to HKAS 1, HKAS 8 and HKAS 12 Narrow-scope Amendments Amendments to HKAS 12 International Tax Reform – Pillar Two Model Rules Amendments to HKAS 1 and Disclosure of Accounting Policies HKFRS Practice Statement 2 HKFRS 17 and Amendments to HKFRS 17 Insurance Contracts HK(IFRIC)-Interpretation 22 Foreign Currency Transactions and Advance Consideration The Group previously accounted for deferred taxation on leases that results in a similar outcome in the consolidated financial statements of the Group following the adoption of the “Narrow-scope Amendments (Amendments to HKAS 1, HKAS 8 and HKAS 12)”, except that the deferred tax asset or liability was recognised on a net basis prior to offsetting as permitted in HKAS 12. Following the adoption of these amendments in the Group’s accounting policies, the Group has recognised deferred tax assets in relation to its lease liabilities and deferred tax liabilities in relation to its right-of-use assets separately. The key impact for the Group relates to the disclosure of the deferred tax assets and liabilities recognised, this includes the restatement of opening balances and movements, as set out in note 30. There is no impact to the Group’s consolidated statement of financial position as of 31st December 2023, 31st December 2022 and 1st January 2022, the results and the earnings per share for the year ended 31st December 2023 and 2022. Except for Amendments to HKAS 1, HKAS 8 and HKAS 12, none of the revised standards and interpretation had a significant effect on the Group’s consolidated financial statements or accounting policies. (b) The Group has not early adopted the following relevant revised standards and interpretation that have been issued but are effective for annual periods beginning on or after 1st January 2024 and such standards have not been applied in preparing these consolidated financial statements. 1 Amendments to HKAS 1 Classification of Liabilities as Current and Non-current 1 Amendments to HKAS 1 Non-current Liabilities with Covenants Amendments to HKFRS 16 Lease Liability in a Sale and Leaseback1 HK-Interpretation 5 (2020) Presentation of Financial Statements – Classification by the Borrower 1 of a Term Loan that Contains a Repayment on Demand Clause 1 Amendments to HKAS 7 and HKFRS 7 Supplier Finance Arrangements 2 Amendments to HKAS 21 Lack of Exchangability Amendments to HKFRS 10 and HKAS 28 Sale or Contribution of Assets between an Investor and 3 its Associate or Joint Venture 1 To be applied by the Group from 1st January 2024. 2 To be applied by the Group from 1st January 2025. 3 The effective date is to be determined. None of these revised standards and interpretation are expected to have a significant effect on the Group’s consolidated financial statements. 147

Annual Report 2023 Page 148 Page 150

Annual Report 2023 Page 148 Page 150