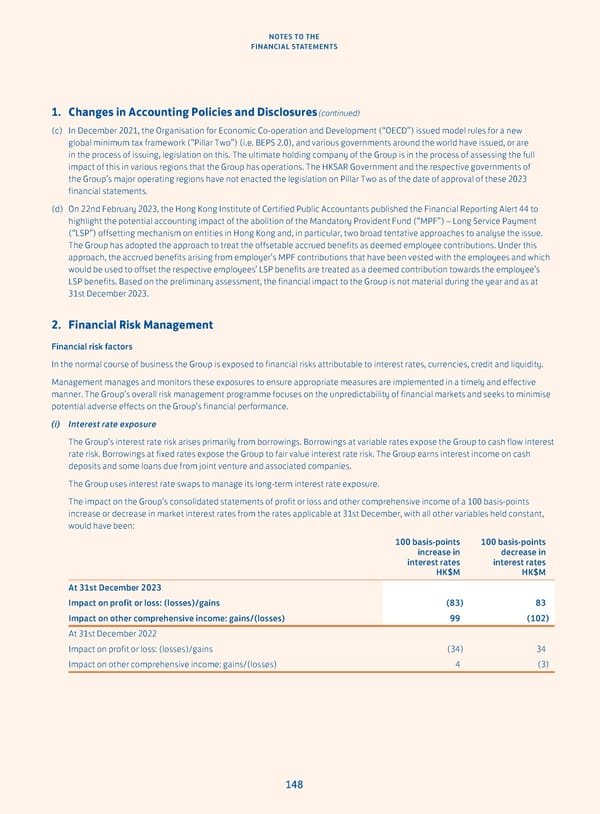

NOTES TO THE FINANCIAL STATEMENTS 1. Changes in Accounting Policies and Disclosures (continued) (c) In December 2021, the Organisation for Economic Co-operation and Development (“OECD”) issued model rules for a new global minimum tax framework (“Pillar Two”) (i.e. BEPS 2.0), and various governments around the world have issued, or are in the process of issuing, legislation on this. The ultimate holding company of the Group is in the process of assessing the full impact of this in various regions that the Group has operations. The HKSAR Government and the respective governments of the Group’s major operating regions have not enacted the legislation on Pillar Two as of the date of approval of these 2023 financial statements. (d) On 22nd February 2023, the Hong Kong Institute of Certified Public Accountants published the Financial Reporting Alert 44 to highlight the potential accounting impact of the abolition of the Mandatory Provident Fund (“MPF”) – Long Service Payment (“LSP”) offsetting mechanism on entities in Hong Kong and, in particular, two broad tentative approaches to analyse the issue. The Group has adopted the approach to treat the offsetable accrued benefits as deemed employee contributions. Under this approach, the accrued benefits arising from employer’s MPF contributions that have been vested with the employees and which would be used to offset the respective employees’ LSP benefits are treated as a deemed contribution towards the employee’s LSP benefits. Based on the preliminary assessment, the financial impact to the Group is not material during the year and as at 31st December 2023. 2. Financial Risk Management Financial risk factors In the normal course of business the Group is exposed to financial risks attributable to interest rates, currencies, credit and liquidity. Management manages and monitors these exposures to ensure appropriate measures are implemented in a timely and effective manner. The Group’s overall risk management programme focuses on the unpredictability of financial markets and seeks to minimise potential adverse effects on the Group’s financial performance. (i) Interest rate exposure The Group’s interest rate risk arises primarily from borrowings. Borrowings at variable rates expose the Group to cash flow interest rate risk. Borrowings at fixed rates expose the Group to fair value interest rate risk. The Group earns interest income on cash deposits and some loans due from joint venture and associated companies. The Group uses interest rate swaps to manage its long-term interest rate exposure. The impact on the Group’s consolidated statements of profit or loss and other comprehensive income of a 100 basis-points increase or decrease in market interest rates from the rates applicable at 31st December, with all other variables held constant, would have been: 100 basis-points 100 basis-points increase in decrease in interest rates interest rates HK$M HK$M At 31st December 2023 Impact on profit or loss: (losses)/gains (83) 83 Impact on other comprehensive income: gains/(losses) 99 (102) At 31st December 2022 Impact on profit or loss: (losses)/gains (34) 34 Impact on other comprehensive income: gains/(losses) 4 (3) 148

Annual Report 2023 Page 149 Page 151

Annual Report 2023 Page 149 Page 151