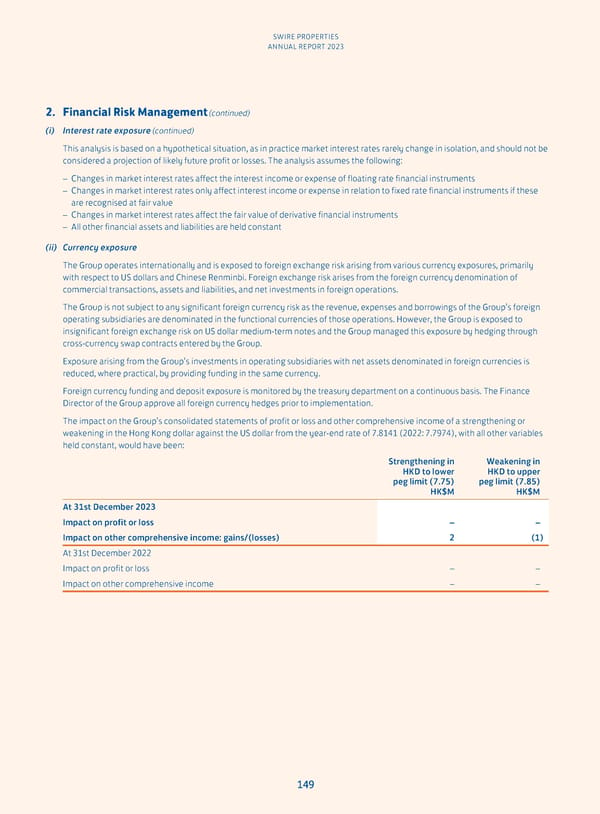

SWIRE PROPERTIES ANNUAL REPORT 2023 2. Financial Risk Management (continued) (i) Interest rate exposure (continued) This analysis is based on a hypothetical situation, as in practice market interest rates rarely change in isolation, and should not be considered a projection of likely future profit or losses. The analysis assumes the following: – Changes in market interest rates affect the interest income or expense of floating rate financial instruments – Changes in market interest rates only affect interest income or expense in relation to fixed rate financial instruments if these are recognised at fair value – Changes in market interest rates affect the fair value of derivative financial instruments – All other financial assets and liabilities are held constant (ii) Currency exposure The Group operates internationally and is exposed to foreign exchange risk arising from various currency exposures, primarily with respect to US dollars and Chinese Renminbi. Foreign exchange risk arises from the foreign currency denomination of commercial transactions, assets and liabilities, and net investments in foreign operations. The Group is not subject to any significant foreign currency risk as the revenue, expenses and borrowings of the Group’s foreign operating subsidiaries are denominated in the functional currencies of those operations. However, the Group is exposed to insignificant foreign exchange risk on US dollar medium-term notes and the Group managed this exposure by hedging through cross-currency swap contracts entered by the Group. Exposure arising from the Group’s investments in operating subsidiaries with net assets denominated in foreign currencies is reduced, where practical, by providing funding in the same currency. Foreign currency funding and deposit exposure is monitored by the treasury department on a continuous basis. The Finance Director of the Group approve all foreign currency hedges prior to implementation. The impact on the Group’s consolidated statements of profit or loss and other comprehensive income of a strengthening or weakening in the Hong Kong dollar against the US dollar from the year-end rate of 7.8141 (2022: 7.7974), with all other variables held constant, would have been: Strengthening in Weakening in HKD to lower HKD to upper peg limit (7.75) peg limit (7.85) HK$M HK$M At 31st December 2023 Impact on profit or loss – – Impact on other comprehensive income: gains/(losses) 2 (1) At 31st December 2022 Impact on profit or loss – – Impact on other comprehensive income – – 149

Annual Report 2023 Page 150 Page 152

Annual Report 2023 Page 150 Page 152