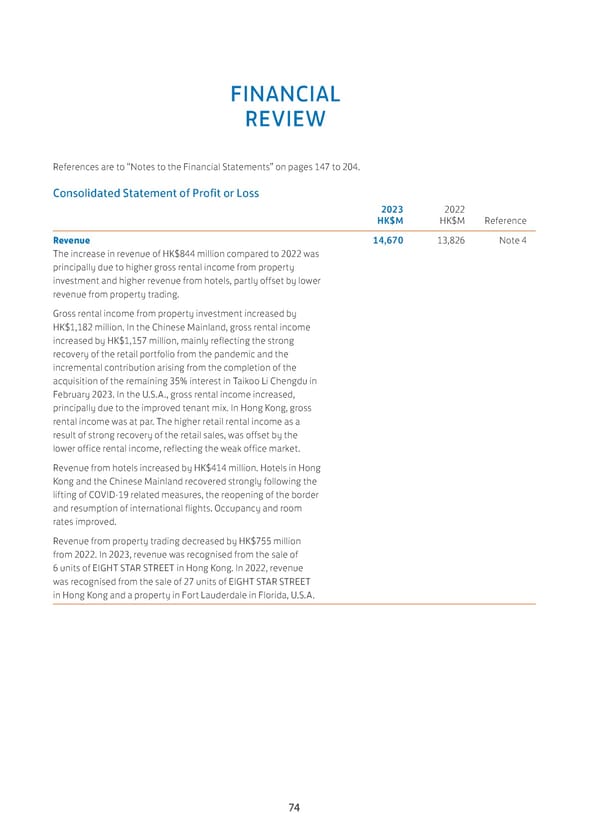

FINANCIAL REVIEW References are to “Notes to the Financial Statements” on pages 147 to 204. Consolidated Statement of Profit or Loss 2023 2022 HK$M HK$M Reference Revenue 14,670 13,826 Note 4 The increase in revenue of HK$844 million compared to 2022 was principally due to higher gross rental income from property investment and higher revenue from hotels, partly offset by lower revenue from property trading. Gross rental income from property investment increased by HK$1,182 million. In the Chinese Mainland, gross rental income increased by HK$1,157 million, mainly reflecting the strong recovery of the retail portfolio from the pandemic and the incremental contribution arising from the completion of the acquisition of the remaining 35% interest in Taikoo Li Chengdu in February 2023. In the U.S.A., gross rental income increased, principally due to the improved tenant mix. In Hong Kong, gross rental income was at par. The higher retail rental income as a result of strong recovery of the retail sales, was offset by the lower office rental income, reflecting the weak office market. Revenue from hotels increased by HK$414 million. Hotels in Hong Kong and the Chinese Mainland recovered strongly following the lifting of COVID-19 related measures, the reopening of the border and resumption of international flights. Occupancy and room rates improved. Revenue from property trading decreased by HK$755 million from 2022. In 2023, revenue was recognised from the sale of 6 units of EIGHT STAR STREET in Hong Kong. In 2022, revenue was recognised from the sale of 27 units of EIGHT STAR STREET in Hong Kong and a property in Fort Lauderdale in Florida, U.S.A. 74

Annual Report 2023 Page 75 Page 77

Annual Report 2023 Page 75 Page 77