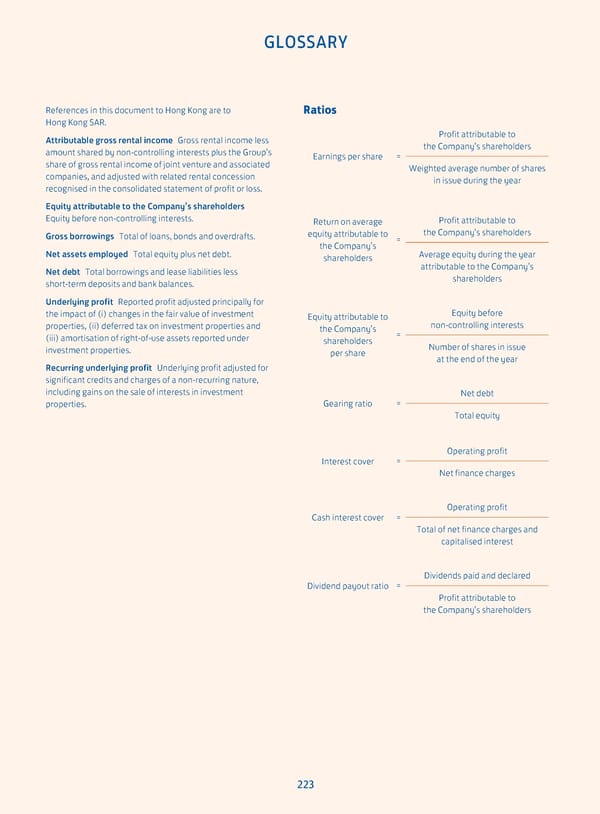

GLOSSARY References in this document to Hong Kong are to Ratios Hong Kong SAR. Attributable gross rental income Gross rental income less Profit attributable to amount shared by non-controlling interests plus the Group’s the Company’s shareholders share of gross rental income of joint venture and associated Earnings per share = companies, and adjusted with related rental concession Weighted average number of shares recognised in the consolidated statement of profit or loss. in issue during the year Equity attributable to the Company’s shareholders Equity before non-controlling interests. Return on average Profit attributable to Gross borrowings Total of loans, bonds and overdrafts. equity attributable to = the Company’s shareholders Net assets employed Total equity plus net debt. the Company’s Average equity during the year shareholders attributable to the Company’s Net debt Total borrowings and lease liabilities less shareholders short-term deposits and bank balances. Underlying profit Reported profit adjusted principally for the impact of (i) changes in the fair value of investment Equity attributable to Equity before properties, (ii) deferred tax on investment properties and the Company’s non-controlling interests (iii) amortisation of right-of-use assets reported under shareholders = investment properties. per share Number of shares in issue Recurring underlying profit Underlying profit adjusted for at the end of the year significant credits and charges of a non-recurring nature, including gains on the sale of interests in investment Net debt properties. Gearing ratio = Total equity Operating profit Interest cover = Net finance charges Operating profit Cash interest cover = Total of net finance charges and capitalised interest Dividends paid and declared Dividend payout ratio = Profit attributable to the Company’s shareholders 223

Annual Report 2023 Page 224 Page 226

Annual Report 2023 Page 224 Page 226