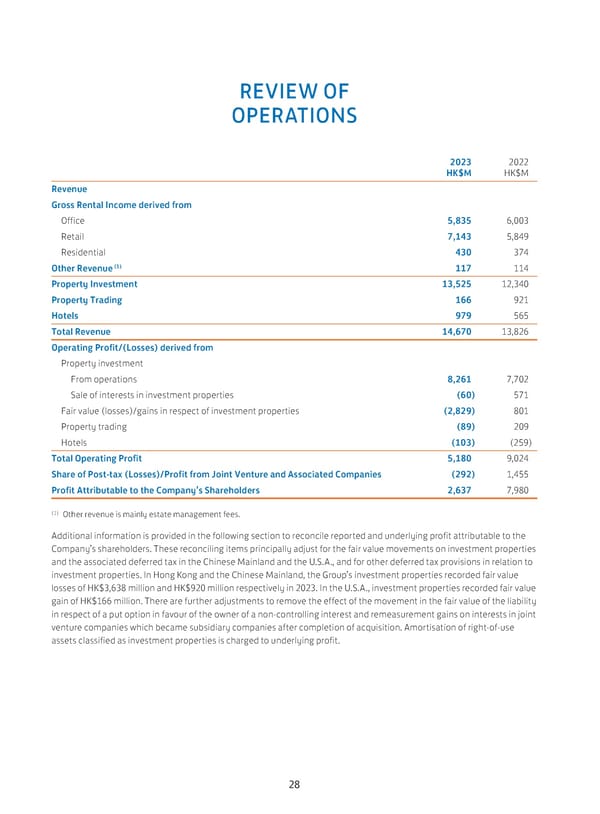

REVIEW OF OPERATIONS 2023 2022 HK$M HK$M Revenue Gross Rental Income derived from Office 5,835 6,003 Retail 7,143 5,849 Residential 430 374 (1) Other Revenue 117 114 Property Investment 13,525 12,340 Property Trading 166 921 Hotels 979 565 Total Revenue 14,670 13,826 Operating Profit/(Losses) derived from Property investment From operations 8,261 7,702 Sale of interests in investment properties (60) 571 Fair value (losses)/gains in respect of investment properties (2,829) 801 Property trading (89) 209 Hotels (103) (259) Total Operating Profit 5,180 9,024 Share of Post-tax (Losses)/Profit from Joint Venture and Associated Companies (292) 1,455 Profit Attributable to the Company’s Shareholders 2,637 7,980 (1) Other revenue is mainly estate management fees. Additional information is provided in the following section to reconcile reported and underlying profit attributable to the Company’s shareholders. These reconciling items principally adjust for the fair value movements on investment properties and the associated deferred tax in the Chinese Mainland and the U.S.A., and for other deferred tax provisions in relation to investment properties. In Hong Kong and the Chinese Mainland, the Group’s investment properties recorded fair value losses of HK$3,638 million and HK$920 million respectively in 2023. In the U.S.A., investment properties recorded fair value gain of HK$166 million. There are further adjustments to remove the effect of the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest and remeasurement gains on interests in joint venture companies which became subsidiary companies after completion of acquisition. Amortisation of right-of-use assets classified as investment properties is charged to underlying profit. 28

Annual Report 2023 Page 29 Page 31

Annual Report 2023 Page 29 Page 31