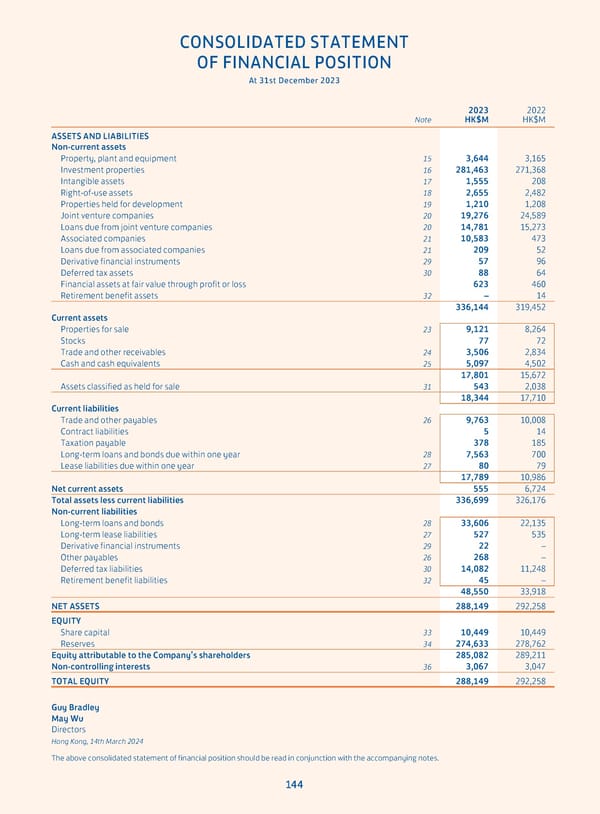

CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 31st December 2023 2023 2022 Note HK$M HK$M ASSETS AND LIABILITIES Non-current assets Property, plant and equipment 15 3,644 3,165 Investment properties 16 281,463 271,368 Intangible assets 17 1,555 208 Right-of-use assets 18 2,655 2,482 Properties held for development 19 1,210 1,208 Joint venture companies 20 19,276 24,589 Loans due from joint venture companies 20 14,781 15,273 Associated companies 21 10,583 473 Loans due from associated companies 21 209 52 Derivative financial instruments 29 57 96 Deferred tax assets 30 88 64 Financial assets at fair value through profit or loss 623 460 Retirement benefit assets 32 – 14 336,144 319,452 Current assets Properties for sale 23 9,121 8,264 Stocks 77 72 Trade and other receivables 24 3,506 2,834 Cash and cash equivalents 25 5,097 4,502 17,801 15,672 Assets classified as held for sale 31 543 2,038 18,344 17,710 Current liabilities Trade and other payables 26 9,763 10,008 Contract liabilities 5 14 Taxation payable 378 185 Long-term loans and bonds due within one year 28 7,563 700 Lease liabilities due within one year 27 80 79 17,789 10,986 Net current assets 555 6,724 Total assets less current liabilities 336,699 326,176 Non-current liabilities Long-term loans and bonds 28 33,606 22,135 Long-term lease liabilities 27 527 535 Derivative financial instruments 29 22 – Other payables 26 268 – Deferred tax liabilities 30 14,082 11,248 Retirement benefit liabilities 32 45 – 48,550 33,918 NET ASSETS 288,149 292,258 EQUITY Share capital 33 10,449 10,449 Reserves 34 274,633 278,762 Equity attributable to the Company’s shareholders 285,082 289,211 Non-controlling interests 36 3,067 3,047 TOTAL EQUITY 288,149 292,258 Guy Bradley May Wu Directors Hong Kong, 14th March 2024 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. 144

Annual Report 2023 Page 145 Page 147

Annual Report 2023 Page 145 Page 147