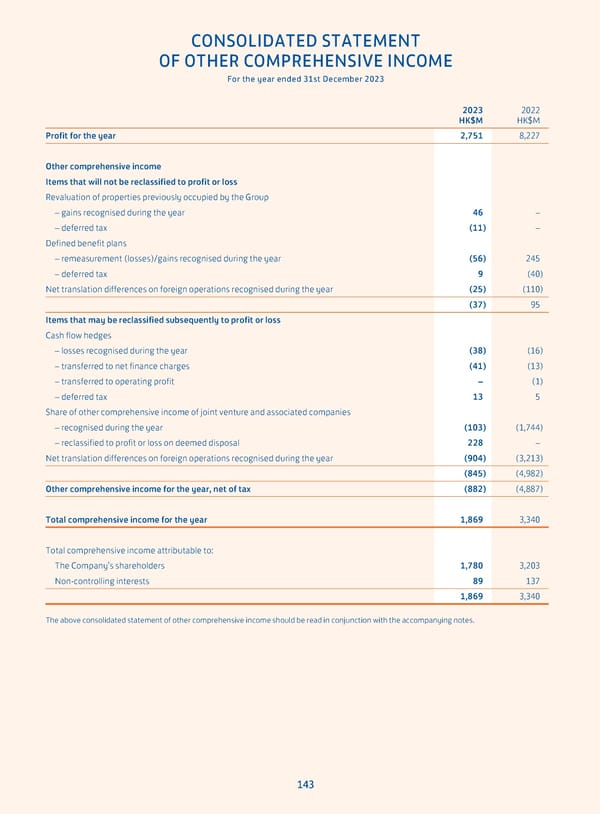

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME For the year ended 31st December 2023 2023 2022 HK$M HK$M Profit for the year 2,751 8,227 Other comprehensive income Items that will not be reclassified to profit or loss Revaluation of properties previously occupied by the Group – gains recognised during the year 46 – – deferred tax (11) – Defined benefit plans – remeasurement (losses)/gains recognised during the year (56) 245 – deferred tax 9 (40) Net translation differences on foreign operations recognised during the year (25) (110) (37) 95 Items that may be reclassified subsequently to profit or loss Cash flow hedges – losses recognised during the year (38) (16) – transferred to net finance charges (41) (13) – transferred to operating profit – (1) – deferred tax 13 5 Share of other comprehensive income of joint venture and associated companies – recognised during the year (103) (1,744) – reclassified to profit or loss on deemed disposal 228 – Net translation differences on foreign operations recognised during the year (904) (3,213) (845) (4,982) Other comprehensive income for the year, net of tax (882) (4,887) Total comprehensive income for the year 1,869 3,340 Total comprehensive income attributable to: The Company’s shareholders 1,780 3,203 Non-controlling interests 89 137 1,869 3,340 The above consolidated statement of other comprehensive income should be read in conjunction with the accompanying notes. 143

Annual Report 2023 Page 144 Page 146

Annual Report 2023 Page 144 Page 146