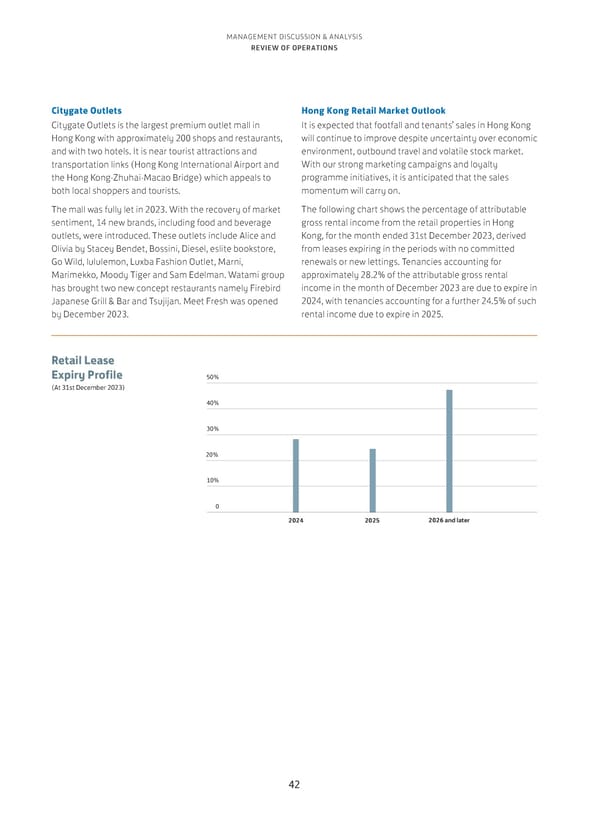

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Citygate Outlets Hong Kong Retail Market Outlook Citygate Outlets is the largest premium outlet mall in It is expected that footfall and tenants’ sales in Hong Kong Hong Kong with approximately 200 shops and restaurants, will continue to improve despite uncertainty over economic and with two hotels. It is near tourist attractions and environment, outbound travel and volatile stock market. transportation links (Hong Kong International Airport and With our strong marketing campaigns and loyalty the Hong Kong-Zhuhai-Macao Bridge) which appeals to programme initiatives, it is anticipated that the sales both local shoppers and tourists. momentum will carry on. The mall was fully let in 2023. With the recovery of market The following chart shows the percentage of attributable sentiment, 14 new brands, including food and beverage gross rental income from the retail properties in Hong outlets, were introduced. These outlets include Alice and Kong, for the month ended 31st December 2023, derived Olivia by Stacey Bendet, Bossini, Diesel, eslite bookstore, from leases expiring in the periods with no committed Go Wild, lululemon, Luxba Fashion Outlet, Marni, renewals or new lettings. Tenancies accounting for Marimekko, Moody Tiger and Sam Edelman. Watami group approximately 28.2% of the attributable gross rental has brought two new concept restaurants namely Firebird income in the month of December 2023 are due to expire in Japanese Grill & Bar and Tsujijan. Meet Fresh was opened 2024, with tenancies accounting for a further 24.5% of such by December 2023. rental income due to expire in 2025. Retail Lease Expiry Profile 50% (At 31st December 2023) 40% 30% 20% 10% 0 2024 2025 2026 and later 42

Annual Report 2023 Page 43 Page 45

Annual Report 2023 Page 43 Page 45