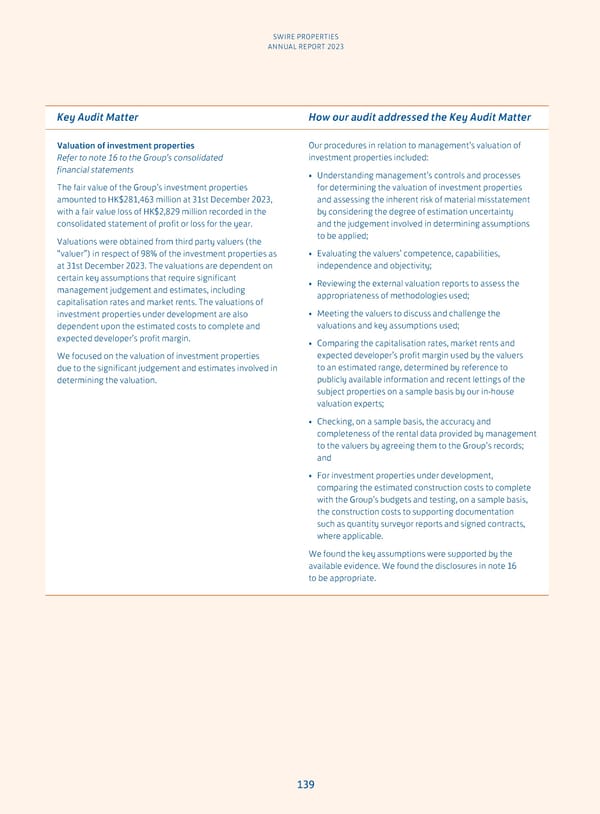

SWIRE PROPERTIES ANNUAL REPORT 2023 Key Audit Matter How our audit addressed the Key Audit Matter Valuation of investment properties Our procedures in relation to management’s valuation of Refer to note 16 to the Group’s consolidated investment properties included: financial statements • Understanding management’s controls and processes The fair value of the Group’s investment properties for determining the valuation of investment properties amounted to HK$281,463 million at 31st December 2023, and assessing the inherent risk of material misstatement with a fair value loss of HK$2,829 million recorded in the by considering the degree of estimation uncertainty consolidated statement of profit or loss for the year. and the judgement involved in determining assumptions Valuations were obtained from third party valuers (the to be applied; “valuer”) in respect of 98% of the investment properties as • Evaluating the valuers’ competence, capabilities, at 31st December 2023. The valuations are dependent on independence and objectivity; certain key assumptions that require significant • Reviewing the external valuation reports to assess the management judgement and estimates, including appropriateness of methodologies used; capitalisation rates and market rents. The valuations of investment properties under development are also • Meeting the valuers to discuss and challenge the dependent upon the estimated costs to complete and valuations and key assumptions used; expected developer’s profit margin. • Comparing the capitalisation rates, market rents and We focused on the valuation of investment properties expected developer’s profit margin used by the valuers due to the significant judgement and estimates involved in to an estimated range, determined by reference to determining the valuation. publicly available information and recent lettings of the subject properties on a sample basis by our in-house valuation experts; • Checking, on a sample basis, the accuracy and completeness of the rental data provided by management to the valuers by agreeing them to the Group’s records; and • For investment properties under development, comparing the estimated construction costs to complete with the Group’s budgets and testing, on a sample basis, the construction costs to supporting documentation such as quantity surveyor reports and signed contracts, where applicable. We found the key assumptions were supported by the available evidence. We found the disclosures in note 16 to be appropriate. 139

Annual Report 2023 Page 140 Page 142

Annual Report 2023 Page 140 Page 142