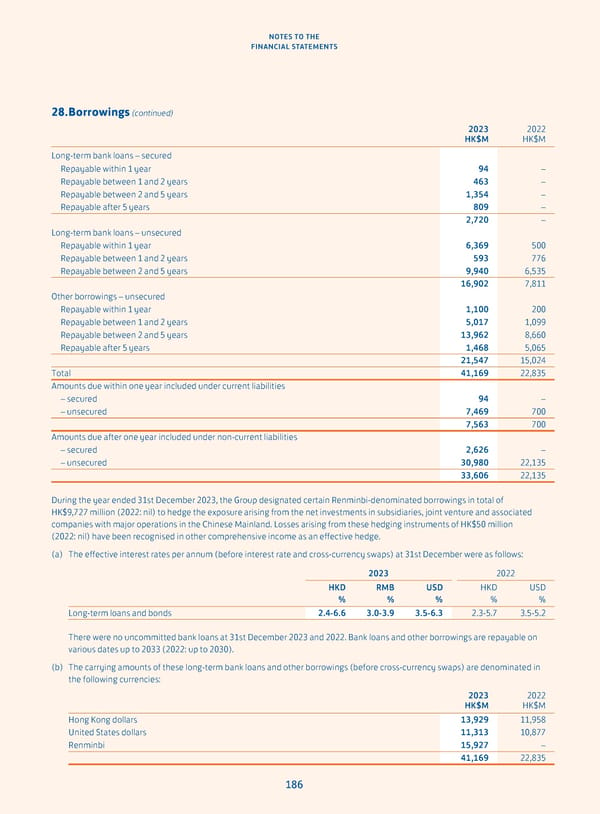

NOTES TO THE FINANCIAL STATEMENTS 28. Borrowings (continued) 2023 2022 HK$M HK$M Long-term bank loans – secured Repayable within 1 year 94 – Repayable between 1 and 2 years 463 – Repayable between 2 and 5 years 1,354 – Repayable after 5 years 809 – 2,720 – Long-term bank loans – unsecured Repayable within 1 year 6,369 500 Repayable between 1 and 2 years 593 776 Repayable between 2 and 5 years 9,940 6,535 16,902 7,811 Other borrowings – unsecured Repayable within 1 year 1,100 200 Repayable between 1 and 2 years 5,017 1,099 Repayable between 2 and 5 years 13,962 8,660 Repayable after 5 years 1,468 5,065 21,547 15,024 Total 41,169 22,835 Amounts due within one year included under current liabilities – secured 94 – – unsecured 7,469 700 7,563 700 Amounts due after one year included under non-current liabilities – secured 2,626 – – unsecured 30,980 22,135 33,606 22,135 During the year ended 31st December 2023, the Group designated certain Renminbi-denominated borrowings in total of HK$9,727 million (2022: nil) to hedge the exposure arising from the net investments in subsidiaries, joint venture and associated companies with major operations in the Chinese Mainland. Losses arising from these hedging instruments of HK$50 million (2022: nil) have been recognised in other comprehensive income as an effective hedge. (a) The effective interest rates per annum (before interest rate and cross-currency swaps) at 31st December were as follows: 2023 2022 HKD RMB USD HKD USD % % % % % Long-term loans and bonds 2.4-6.6 3.0-3.9 3.5-6.3 2.3-5.7 3.5-5.2 There were no uncommitted bank loans at 31st December 2023 and 2022. Bank loans and other borrowings are repayable on various dates up to 2033 (2022: up to 2030). (b) The carrying amounts of these long-term bank loans and other borrowings (before cross-currency swaps) are denominated in the following currencies: 2023 2022 HK$M HK$M Hong Kong dollars 13,929 11,958 United States dollars 11,313 10,877 Renminbi 15,927 – 41,169 22,835 186

Annual Report 2023 Page 187 Page 189

Annual Report 2023 Page 187 Page 189