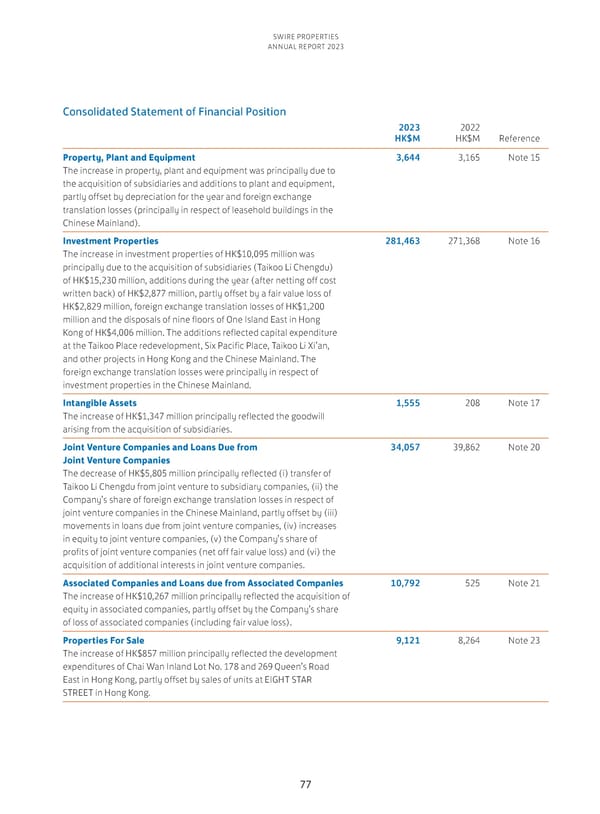

SWIRE PROPERTIES ANNUAL REPORT 2023 Consolidated Statement of Financial Position 2023 2022 HK$M HK$M Reference Property, Plant and Equipment 3,644 3,165 Note 15 The increase in property, plant and equipment was principally due to the acquisition of subsidiaries and additions to plant and equipment, partly offset by depreciation for the year and foreign exchange translation losses (principally in respect of leasehold buildings in the Chinese Mainland). Investment Properties 281,463 271,368 Note 16 The increase in investment properties of HK$10,095 million was principally due to the acquisition of subsidiaries (Taikoo Li Chengdu) of HK$15,230 million, additions during the year (after netting off cost written back) of HK$2,877 million, partly offset by a fair value loss of HK$2,829 million, foreign exchange translation losses of HK$1,200 million and the disposals of nine floors of One Island East in Hong Kong of HK$4,006 million. The additions reflected capital expenditure at the Taikoo Place redevelopment, Six Pacific Place, Taikoo Li Xi’an, and other projects in Hong Kong and the Chinese Mainland. The foreign exchange translation losses were principally in respect of investment properties in the Chinese Mainland. Intangible Assets 1,555 208 Note 17 The increase of HK$1,347 million principally reflected the goodwill arising from the acquisition of subsidiaries. Joint Venture Companies and Loans Due from 34,057 39,862 Note 20 Joint Venture Companies The decrease of HK$5,805 million principally reflected (i) transfer of Taikoo Li Chengdu from joint venture to subsidiary companies, (ii) the Company’s share of foreign exchange translation losses in respect of joint venture companies in the Chinese Mainland, partly offset by (iii) movements in loans due from joint venture companies, (iv) increases in equity to joint venture companies, (v) the Company’s share of profits of joint venture companies (net off fair value loss) and (vi) the acquisition of additional interests in joint venture companies. Associated Companies and Loans due from Associated Companies 10,792 525 Note 21 The increase of HK$10,267 million principally reflected the acquisition of equity in associated companies, partly offset by the Company’s share of loss of associated companies (including fair value loss). Properties For Sale 9,121 8,264 Note 23 The increase of HK$857 million principally reflected the development expenditures of Chai Wan Inland Lot No. 178 and 269 Queen’s Road East in Hong Kong, partly offset by sales of units at EIGHT STAR STREET in Hong Kong. 77

Annual Report 2023 Page 78 Page 80

Annual Report 2023 Page 78 Page 80