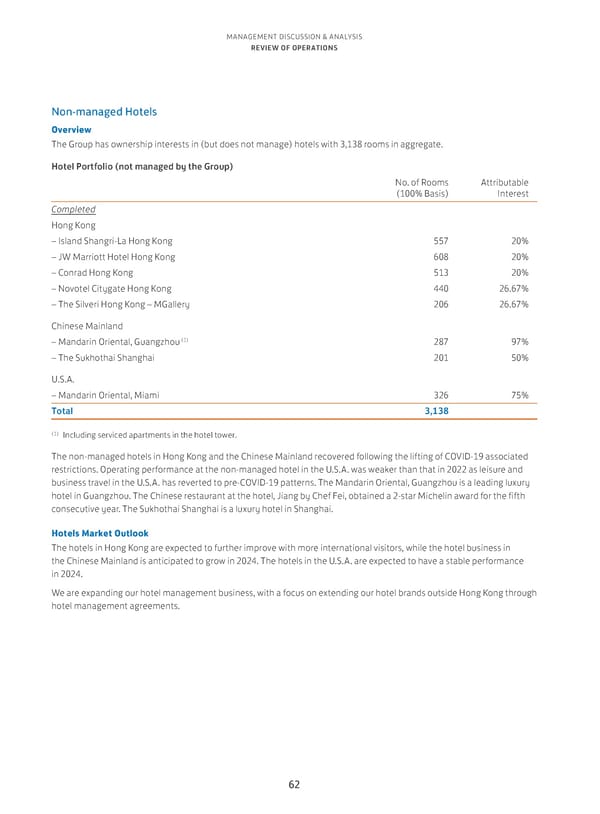

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS Non-managed Hotels Overview The Group has ownership interests in (but does not manage) hotels with 3,138 rooms in aggregate. Hotel Portfolio (not managed by the Group) No. of Rooms Attributable (100% Basis) Interest Completed Hong Kong – Island Shangri-La Hong Kong 557 20% – JW Marriott Hotel Hong Kong 608 20% – Conrad Hong Kong 513 20% – Novotel Citygate Hong Kong 440 26.67% – The Silveri Hong Kong – MGallery 206 26.67% Chinese Mainland (1) – Mandarin Oriental, Guangzhou 287 97% – The Sukhothai Shanghai 201 50% U.S.A. – Mandarin Oriental, Miami 326 75% Total 3,138 (1) Including serviced apartments in the hotel tower. The non-managed hotels in Hong Kong and the Chinese Mainland recovered following the lifting of COVID-19 associated restrictions. Operating performance at the non-managed hotel in the U.S.A. was weaker than that in 2022 as leisure and business travel in the U.S.A. has reverted to pre-COVID-19 patterns. The Mandarin Oriental, Guangzhou is a leading luxury hotel in Guangzhou. The Chinese restaurant at the hotel, Jiang by Chef Fei, obtained a 2-star Michelin award for the fifth consecutive year. The Sukhothai Shanghai is a luxury hotel in Shanghai. Hotels Market Outlook The hotels in Hong Kong are expected to further improve with more international visitors, while the hotel business in the Chinese Mainland is anticipated to grow in 2024. The hotels in the U.S.A. are expected to have a stable performance in 2024. We are expanding our hotel management business, with a focus on extending our hotel brands outside Hong Kong through hotel management agreements. 62

Annual Report 2023 Page 63 Page 65

Annual Report 2023 Page 63 Page 65