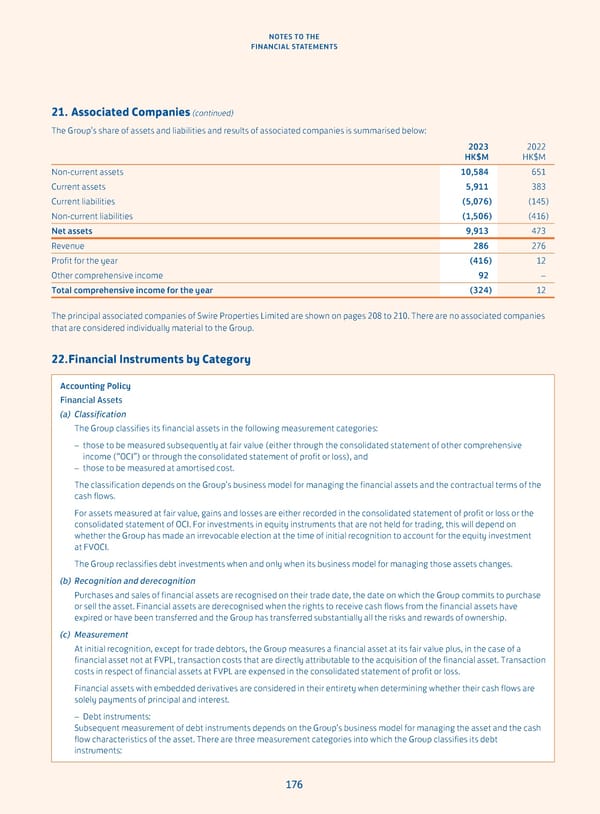

NOTES TO THE FINANCIAL STATEMENTS 21. Associated Companies (continued) The Group’s share of assets and liabilities and results of associated companies is summarised below: 2023 2022 HK$M HK$M Non-current assets 10,584 651 Current assets 5,911 383 Current liabilities (5,076) (145) Non-current liabilities (1,506) (416) Net assets 9,913 473 Revenue 286 276 Profit for the year (416) 12 Other comprehensive income 92 – Total comprehensive income for the year (324) 12 The principal associated companies of Swire Properties Limited are shown on pages 208 to 210. There are no associated companies that are considered individually material to the Group. 22. Financial Instruments by Category Accounting Policy Financial Assets (a) Classification The Group classifies its financial assets in the following measurement categories: – those to be measured subsequently at fair value (either through the consolidated statement of other comprehensive income (“OCI”) or through the consolidated statement of profit or loss), and – those to be measured at amortised cost. The classification depends on the Group’s business model for managing the financial assets and the contractual terms of the cash flows. For assets measured at fair value, gains and losses are either recorded in the consolidated statement of profit or loss or the consolidated statement of OCI. For investments in equity instruments that are not held for trading, this will depend on whether the Group has made an irrevocable election at the time of initial recognition to account for the equity investment at FVOCI. The Group reclassifies debt investments when and only when its business model for managing those assets changes. (b) Recognition and derecognition Purchases and sales of financial assets are recognised on their trade date, the date on which the Group commits to purchase or sell the asset. Financial assets are derecognised when the rights to receive cash flows from the financial assets have expired or have been transferred and the Group has transferred substantially all the risks and rewards of ownership. (c) Measurement At initial recognition, except for trade debtors, the Group measures a financial asset at its fair value plus, in the case of a financial asset not at FVPL, transaction costs that are directly attributable to the acquisition of the financial asset. Transaction costs in respect of financial assets at FVPL are expensed in the consolidated statement of profit or loss. Financial assets with embedded derivatives are considered in their entirety when determining whether their cash flows are solely payments of principal and interest. – Debt instruments: Subsequent measurement of debt instruments depends on the Group’s business model for managing the asset and the cash flow characteristics of the asset. There are three measurement categories into which the Group classifies its debt instruments: 176

Annual Report 2023 Page 177 Page 179

Annual Report 2023 Page 177 Page 179