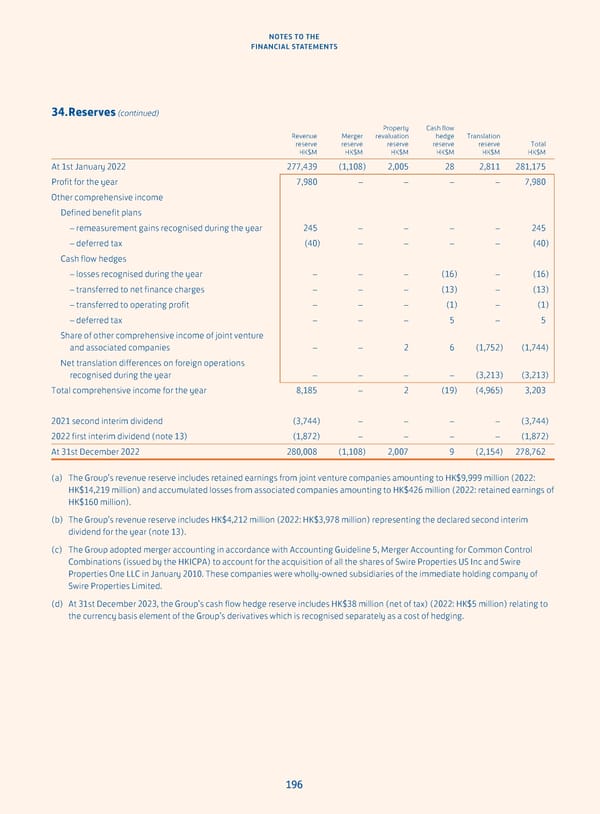

NOTES TO THE FINANCIAL STATEMENTS 34. Reserves (continued) Property Cash flow Revenue Merger revaluation hedge Translation reserve reserve reserve reserve reserve Total HK$M HK$M HK$M HK$M HK$M HK$M At 1st January 2022 277,439 (1,108) 2,005 28 2,811 281,175 Profit for the year 7,980 – – – – 7,980 Other comprehensive income Defined benefit plans – remeasurement gains recognised during the year 245 – – – – 245 – deferred tax (40) – – – – (40) Cash flow hedges – losses recognised during the year – – – (16) – (16) – transferred to net finance charges – – – (13) – (13) – transferred to operating profit – – – (1) – (1) – deferred tax – – – 5 – 5 Share of other comprehensive income of joint venture and associated companies – – 2 6 (1,752) (1,744) Net translation differences on foreign operations recognised during the year – – – – (3,213) (3,213) Total comprehensive income for the year 8,185 – 2 (19) (4,965) 3,203 2021 second interim dividend (3,744) – – – – (3,744) 2022 first interim dividend (note 13) (1,872) – – – – (1,872) At 31st December 2022 280,008 (1,108) 2,007 9 (2,154) 278,762 (a) The Group’s revenue reserve includes retained earnings from joint venture companies amounting to HK$9,999 million (2022: HK$14,219 million) and accumulated losses from associated companies amounting to HK$426 million (2022: retained earnings of HK$160 million). (b) The Group’s revenue reserve includes HK$4,212 million (2022: HK$3,978 million) representing the declared second interim dividend for the year (note 13). (c) The Group adopted merger accounting in accordance with Accounting Guideline 5, Merger Accounting for Common Control Combinations (issued by the HKICPA) to account for the acquisition of all the shares of Swire Properties US Inc and Swire Properties One LLC in January 2010. These companies were wholly-owned subsidiaries of the immediate holding company of Swire Properties Limited. (d) At 31st December 2023, the Group’s cash flow hedge reserve includes HK$38 million (net of tax) (2022: HK$5 million) relating to the currency basis element of the Group’s derivatives which is recognised separately as a cost of hedging. 196

Annual Report 2023 Page 197 Page 199

Annual Report 2023 Page 197 Page 199