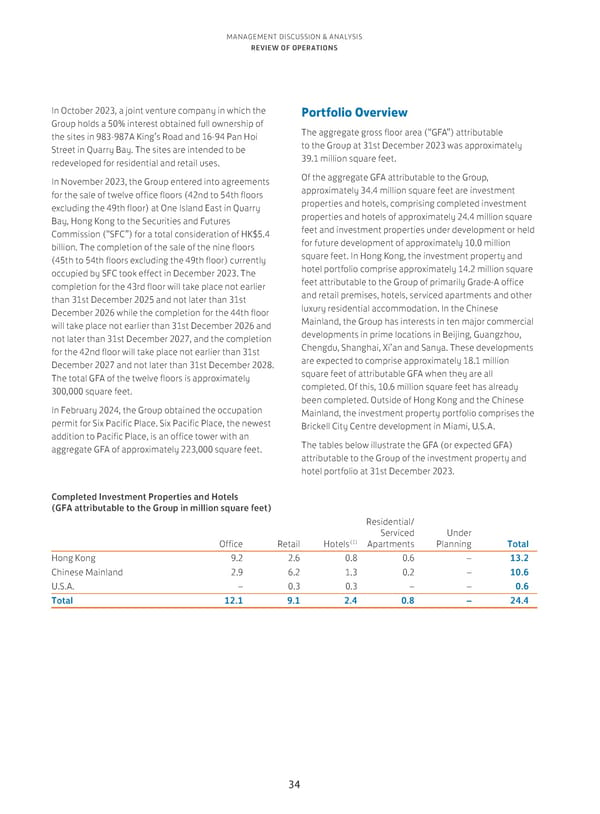

MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS In October 2023, a joint venture company in which the Portfolio Overview Group holds a 50% interest obtained full ownership of The aggregate gross floor area (“GFA”) attributable the sites in 983-987A King’s Road and 16-94 Pan Hoi to the Group at 31st December 2023 was approximately Street in Quarry Bay. The sites are intended to be 39.1 million square feet. redeveloped for residential and retail uses. In November 2023, the Group entered into agreements Of the aggregate GFA attributable to the Group, for the sale of twelve office floors (42nd to 54th floors approximately 34.4 million square feet are investment excluding the 49th floor) at One Island East in Quarry properties and hotels, comprising completed investment Bay, Hong Kong to the Securities and Futures properties and hotels of approximately 24.4 million square Commission (“SFC”) for a total consideration of HK$5.4 feet and investment properties under development or held billion. The completion of the sale of the nine floors for future development of approximately 10.0 million (45th to 54th floors excluding the 49th floor) currently square feet. In Hong Kong, the investment property and occupied by SFC took effect in December 2023. The hotel portfolio comprise approximately 14.2 million square completion for the 43rd floor will take place not earlier feet attributable to the Group of primarily Grade-A office than 31st December 2025 and not later than 31st and retail premises, hotels, serviced apartments and other December 2026 while the completion for the 44th floor luxury residential accommodation. In the Chinese will take place not earlier than 31st December 2026 and Mainland, the Group has interests in ten major commercial not later than 31st December 2027, and the completion developments in prime locations in Beijing, Guangzhou, for the 42nd floor will take place not earlier than 31st Chengdu, Shanghai, Xi’an and Sanya. These developments December 2027 and not later than 31st December 2028. are expected to comprise approximately 18.1 million The total GFA of the twelve floors is approximately square feet of attributable GFA when they are all 300,000 square feet. completed. Of this, 10.6 million square feet has already been completed. Outside of Hong Kong and the Chinese In February 2024, the Group obtained the occupation Mainland, the investment property portfolio comprises the permit for Six Pacific Place. Six Pacific Place, the newest Brickell City Centre development in Miami, U.S.A. addition to Pacific Place, is an office tower with an The tables below illustrate the GFA (or expected GFA) aggregate GFA of approximately 223,000 square feet. attributable to the Group of the investment property and hotel portfolio at 31st December 2023. Completed Investment Properties and Hotels (GFA attributable to the Group in million square feet) Residential/ Serviced Under Office Retail Hotels(1) Apartments Planning Total Hong Kong 9.2 2.6 0.8 0.6 – 13.2 Chinese Mainland 2.9 6.2 1.3 0.2 – 10.6 U.S.A. – 0.3 0.3 – – 0.6 Total 12.1 9.1 2.4 0.8 – 24.4 34

Annual Report 2023 Page 35 Page 37

Annual Report 2023 Page 35 Page 37