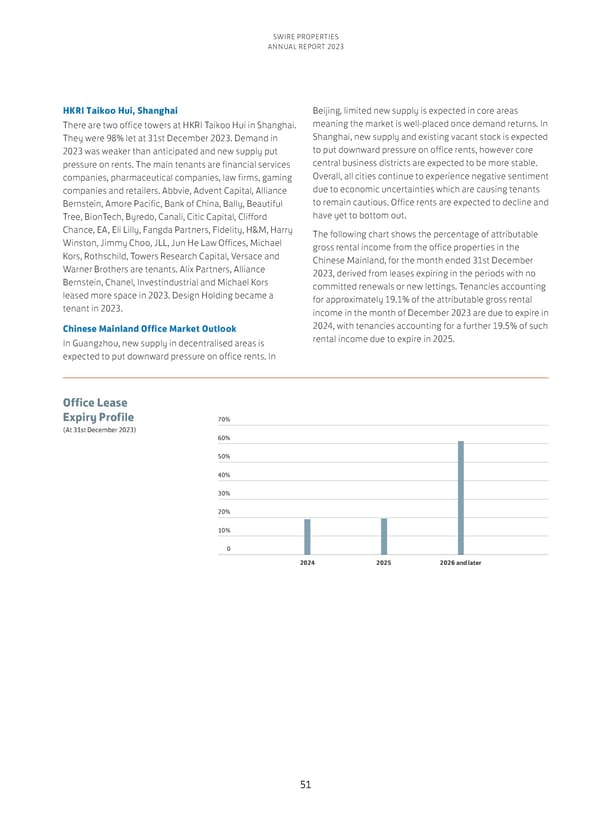

SWIRE PROPERTIES ANNUAL REPORT 2023 HKRI Taikoo Hui, Shanghai Beijing, limited new supply is expected in core areas There are two office towers at HKRI Taikoo Hui in Shanghai. meaning the market is well-placed once demand returns. In They were 98% let at 31st December 2023. Demand in Shanghai, new supply and existing vacant stock is expected 2023 was weaker than anticipated and new supply put to put downward pressure on office rents, however core pressure on rents. The main tenants are financial services central business districts are expected to be more stable. companies, pharmaceutical companies, law firms, gaming Overall, all cities continue to experience negative sentiment companies and retailers. Abbvie, Advent Capital, Alliance due to economic uncertainties which are causing tenants Bernstein, Amore Pacific, Bank of China, Bally, Beautiful to remain cautious. Office rents are expected to decline and Tree, BionTech, Byredo, Canali, Citic Capital, Clifford have yet to bottom out. Chance, EA, Eli Lilly, Fangda Partners, Fidelity, H&M, Harry The following chart shows the percentage of attributable Winston, Jimmy Choo, JLL, Jun He Law Offices, Michael gross rental income from the office properties in the Kors, Rothschild, Towers Research Capital, Versace and Chinese Mainland, for the month ended 31st December Warner Brothers are tenants. Alix Partners, Alliance 2023, derived from leases expiring in the periods with no Bernstein, Chanel, Investindustrial and Michael Kors committed renewals or new lettings. Tenancies accounting leased more space in 2023. Design Holding became a for approximately 19.1% of the attributable gross rental tenant in 2023. income in the month of December 2023 are due to expire in Chinese Mainland Office Market Outlook 2024, with tenancies accounting for a further 19.5% of such In Guangzhou, new supply in decentralised areas is rental income due to expire in 2025. expected to put downward pressure on office rents. In Office Lease Expiry Profile 70% (At 31st December 2023) 60% 50% 40% 30% 20% 10% 0 2024 2025 2026 and later 51

Annual Report 2023 Page 52 Page 54

Annual Report 2023 Page 52 Page 54