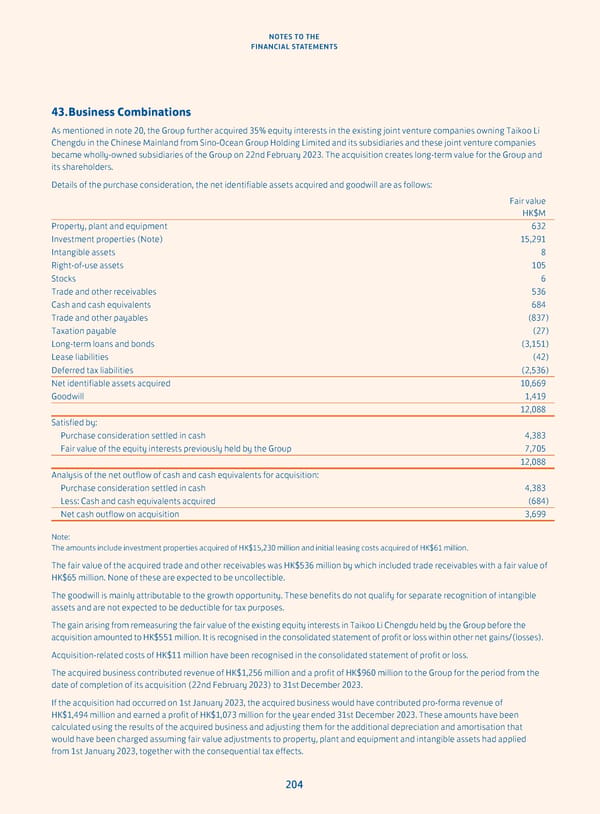

NOTES TO THE FINANCIAL STATEMENTS 43. Business Combinations As mentioned in note 20, the Group further acquired 35% equity interests in the existing joint venture companies owning Taikoo Li Chengdu in the Chinese Mainland from Sino-Ocean Group Holding Limited and its subsidiaries and these joint venture companies became wholly-owned subsidiaries of the Group on 22nd February 2023. The acquisition creates long-term value for the Group and its shareholders. Details of the purchase consideration, the net identifiable assets acquired and goodwill are as follows: Fair value HK$M Property, plant and equipment 632 Investment properties (Note) 15,291 Intangible assets 8 Right-of-use assets 105 Stocks 6 Trade and other receivables 536 Cash and cash equivalents 684 Trade and other payables (837) Taxation payable (27) Long-term loans and bonds (3,151) Lease liabilities (42) Deferred tax liabilities (2,536) Net identifiable assets acquired 10,669 Goodwill 1,419 12,088 Satisfied by: Purchase consideration settled in cash 4,383 Fair value of the equity interests previously held by the Group 7,705 12,088 Analysis of the net outflow of cash and cash equivalents for acquisition: Purchase consideration settled in cash 4,383 Less: Cash and cash equivalents acquired (684) Net cash outflow on acquisition 3,699 Note: The amounts include investment properties acquired of HK$15,230 million and initial leasing costs acquired of HK$61 million. The fair value of the acquired trade and other receivables was HK$536 million by which included trade receivables with a fair value of HK$65 million. None of these are expected to be uncollectible. The goodwill is mainly attributable to the growth opportunity. These benefits do not qualify for separate recognition of intangible assets and are not expected to be deductible for tax purposes. The gain arising from remeasuring the fair value of the existing equity interests in Taikoo Li Chengdu held by the Group before the acquisition amounted to HK$551 million. It is recognised in the consolidated statement of profit or loss within other net gains/(losses). Acquisition-related costs of HK$11 million have been recognised in the consolidated statement of profit or loss. The acquired business contributed revenue of HK$1,256 million and a profit of HK$960 million to the Group for the period from the date of completion of its acquisition (22nd February 2023) to 31st December 2023. If the acquisition had occurred on 1st January 2023, the acquired business would have contributed pro-forma revenue of HK$1,494 million and earned a profit of HK$1,073 million for the year ended 31st December 2023. These amounts have been calculated using the results of the acquired business and adjusting them for the additional depreciation and amortisation that would have been charged assuming fair value adjustments to property, plant and equipment and intangible assets had applied from 1st January 2023, together with the consequential tax effects. 204

Annual Report 2023 Page 205 Page 207

Annual Report 2023 Page 205 Page 207