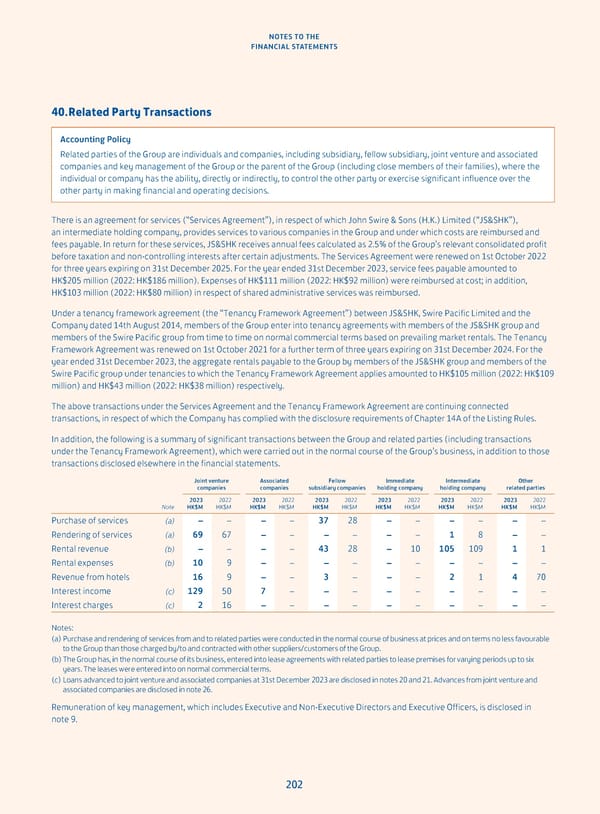

NOTES TO THE FINANCIAL STATEMENTS 40. Related Party Transactions Accounting Policy Related parties of the Group are individuals and companies, including subsidiary, fellow subsidiary, joint venture and associated companies and key management of the Group or the parent of the Group (including close members of their families), where the individual or company has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. There is an agreement for services (“Services Agreement”), in respect of which John Swire & Sons (H.K.) Limited (“JS&SHK”), an intermediate holding company, provides services to various companies in the Group and under which costs are reimbursed and fees payable. In return for these services, JS&SHK receives annual fees calculated as 2.5% of the Group’s relevant consolidated profit before taxation and non-controlling interests after certain adjustments. The Services Agreement were renewed on 1st October 2022 for three years expiring on 31st December 2025. For the year ended 31st December 2023, service fees payable amounted to HK$205 million (2022: HK$186 million). Expenses of HK$111 million (2022: HK$92 million) were reimbursed at cost; in addition, HK$103 million (2022: HK$80 million) in respect of shared administrative services was reimbursed. Under a tenancy framework agreement (the “Tenancy Framework Agreement”) between JS&SHK, Swire Pacific Limited and the Company dated 14th August 2014, members of the Group enter into tenancy agreements with members of the JS&SHK group and members of the Swire Pacific group from time to time on normal commercial terms based on prevailing market rentals. The Tenancy Framework Agreement was renewed on 1st October 2021 for a further term of three years expiring on 31st December 2024. For the year ended 31st December 2023, the aggregate rentals payable to the Group by members of the JS&SHK group and members of the Swire Pacific group under tenancies to which the Tenancy Framework Agreement applies amounted to HK$105 million (2022: HK$109 million) and HK$43 million (2022: HK$38 million) respectively. The above transactions under the Services Agreement and the Tenancy Framework Agreement are continuing connected transactions, in respect of which the Company has complied with the disclosure requirements of Chapter 14A of the Listing Rules. In addition, the following is a summary of significant transactions between the Group and related parties (including transactions under the Tenancy Framework Agreement), which were carried out in the normal course of the Group’s business, in addition to those transactions disclosed elsewhere in the financial statements. Joint venture Associated Fellow Immediate Intermediate Other companies companies subsidiary companies holding company holding company related parties 2023 2022 2023 2022 2023 2022 2023 2022 2023 2022 2023 2022 Note HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M HK$M Purchase of services (a) – – – – 37 28 – – – – – – Rendering of services (a) 69 67 – – – – – – 1 8 – – Rental revenue (b) – – – – 43 28 – 10 105 109 1 1 Rental expenses (b) 10 9 – – – – – – – – – – Revenue from hotels 16 9 – – 3 – – – 2 1 4 70 Interest income (c) 129 50 7 – – – – – – – – – Interest charges (c) 2 16 – – – – – – – – – – Notes: (a) Purchase and rendering of services from and to related parties were conducted in the normal course of business at prices and on terms no less favourable to the Group than those charged by/to and contracted with other suppliers/customers of the Group. (b) The Group has, in the normal course of its business, entered into lease agreements with related parties to lease premises for varying periods up to six years. The leases were entered into on normal commercial terms. (c) Loans advanced to joint venture and associated companies at 31st December 2023 are disclosed in notes 20 and 21. Advances from joint venture and associated companies are disclosed in note 26. Remuneration of key management, which includes Executive and Non-Executive Directors and Executive Officers, is disclosed in note 9. 202

Annual Report 2023 Page 203 Page 205

Annual Report 2023 Page 203 Page 205