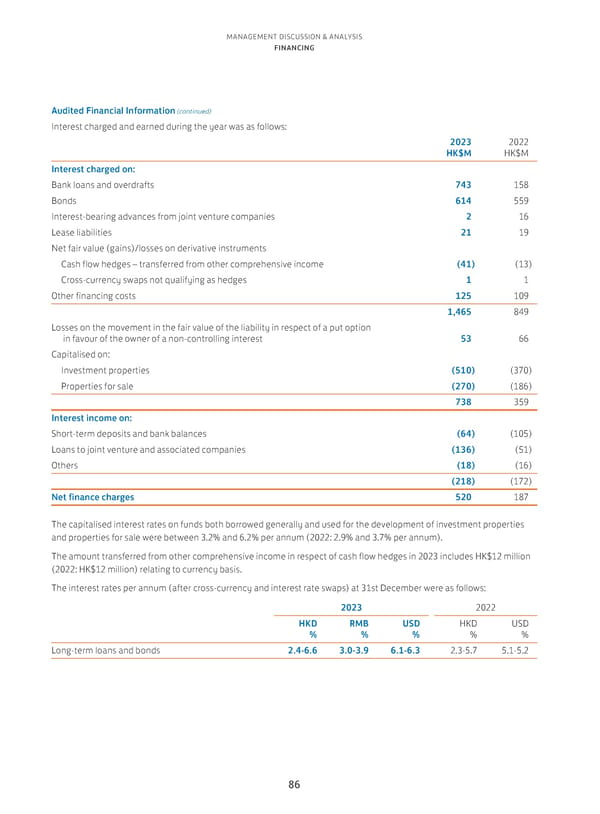

MANAGEMENT DISCUSSION & ANALYSIS FINANCING Audited Financial Information (continued) Interest charged and earned during the year was as follows: 2023 2022 HK$M HK$M Interest charged on: Bank loans and overdrafts 743 158 Bonds 614 559 Interest-bearing advances from joint venture companies 2 16 Lease liabilities 21 19 Net fair value (gains)/losses on derivative instruments Cash flow hedges – transferred from other comprehensive income (41) (13) Cross-currency swaps not qualifying as hedges 1 1 Other financing costs 125 109 1,465 849 Losses on the movement in the fair value of the liability in respect of a put option in favour of the owner of a non-controlling interest 53 66 Capitalised on: Investment properties (510) (370) Properties for sale (270) (186) 738 359 Interest income on: Short-term deposits and bank balances (64) (105) Loans to joint venture and associated companies (136) (51) Others (18) (16) (218) (172) Net finance charges 520 187 The capitalised interest rates on funds both borrowed generally and used for the development of investment properties and properties for sale were between 3.2% and 6.2% per annum (2022: 2.9% and 3.7% per annum). The amount transferred from other comprehensive income in respect of cash flow hedges in 2023 includes HK$12 million (2022: HK$12 million) relating to currency basis. The interest rates per annum (after cross-currency and interest rate swaps) at 31st December were as follows: 2023 2022 HKD RMB USD HKD USD % % % % % Long-term loans and bonds 2.4-6.6 3.0-3.9 6.1-6.3 2.3-5.7 5.1-5.2 86

Annual Report 2023 Page 87 Page 89

Annual Report 2023 Page 87 Page 89