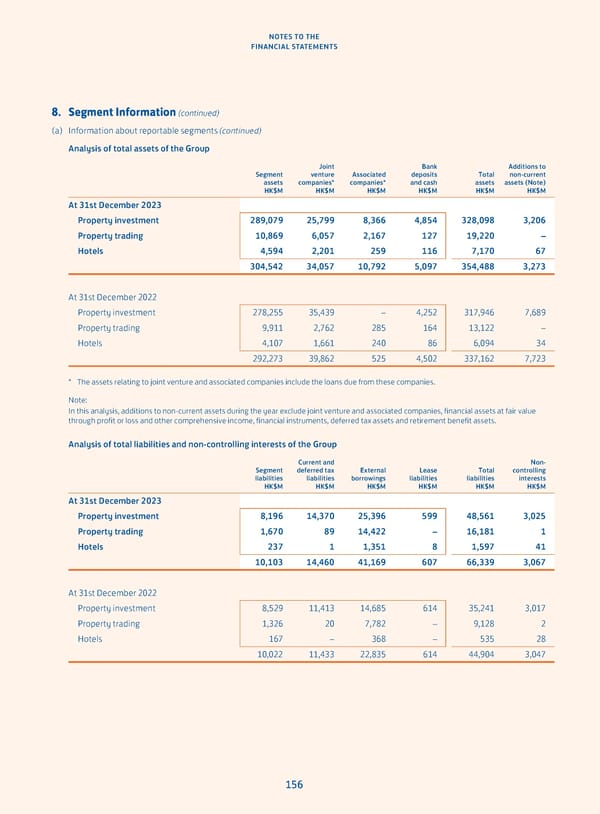

NOTES TO THE FINANCIAL STATEMENTS 8. Segment Information (continued) (a) Information about reportable segments (continued) Analysis of total assets of the Group Joint Bank Additions to Segment venture Associated deposits Total non-current assets companies* companies* and cash assets assets (Note) HK$M HK$M HK$M HK$M HK$M HK$M At 31st December 2023 Property investment 289,079 25,799 8,366 4,854 328,098 3,206 Property trading 10,869 6,057 2,167 127 19,220 – Hotels 4,594 2,201 259 116 7,170 67 304,542 34,057 10,792 5,097 354,488 3,273 At 31st December 2022 Property investment 278,255 35,439 – 4,252 317,946 7,689 Property trading 9,911 2,762 285 164 13,122 – Hotels 4,107 1,661 240 86 6,094 34 292,273 39,862 525 4,502 337,162 7,723 * The assets relating to joint venture and associated companies include the loans due from these companies. Note: In this analysis, additions to non-current assets during the year exclude joint venture and associated companies, financial assets at fair value through profit or loss and other comprehensive income, financial instruments, deferred tax assets and retirement benefit assets. Analysis of total liabilities and non-controlling interests of the Group Current and Non- Segment deferred tax External Lease Total controlling liabilities liabilities borrowings liabilities liabilities interests HK$M HK$M HK$M HK$M HK$M HK$M At 31st December 2023 Property investment 8,196 14,370 25,396 599 48,561 3,025 Property trading 1,670 89 14,422 – 16,181 1 Hotels 237 1 1,351 8 1,597 41 10,103 14,460 41,169 607 66,339 3,067 At 31st December 2022 Property investment 8,529 11,413 14,685 614 35,241 3,017 Property trading 1,326 20 7,782 – 9,128 2 Hotels 167 – 368 – 535 28 10,022 11,433 22,835 614 44,904 3,047 156

Annual Report 2023 Page 157 Page 159

Annual Report 2023 Page 157 Page 159