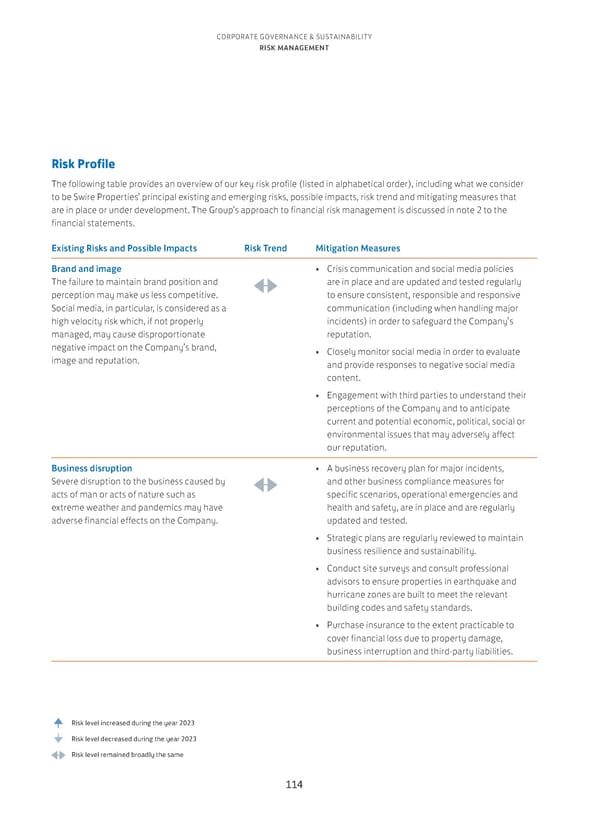

CORPORATE GOVERNANCE & SUSTAINABILITY RISK MANAGEMENT Risk Profile The following table provides an overview of our key risk profile (listed in alphabetical order), including what we consider to be Swire Properties’ principal existing and emerging risks, possible impacts, risk trend and mitigating measures that are in place or under development. The Group’s approach to financial risk management is discussed in note 2 to the financial statements. Existing Risks and Possible Impacts Risk Trend Mitigation Measures Brand and image • Crisis communication and social media policies The failure to maintain brand position and are in place and are updated and tested regularly perception may make us less competitive. to ensure consistent, responsible and responsive Social media, in particular, is considered as a communication (including when handling major high velocity risk which, if not properly incidents) in order to safeguard the Company’s managed, may cause disproportionate reputation. negative impact on the Company’s brand, • Closely monitor social media in order to evaluate image and reputation. and provide responses to negative social media content. • Engagement with third parties to understand their perceptions of the Company and to anticipate current and potential economic, political, social or environmental issues that may adversely affect our reputation. Business disruption • A business recovery plan for major incidents, Severe disruption to the business caused by and other business compliance measures for acts of man or acts of nature such as specific scenarios, operational emergencies and extreme weather and pandemics may have health and safety, are in place and are regularly adverse financial effects on the Company. updated and tested. • Strategic plans are regularly reviewed to maintain business resilience and sustainability. • Conduct site surveys and consult professional advisors to ensure properties in earthquake and hurricane zones are built to meet the relevant building codes and safety standards. • Purchase insurance to the extent practicable to cover financial loss due to property damage, business interruption and third-party liabilities. Risk level increased during the year 2023 Risk level decreased during the year 2023 Risk level remained broadly the same 114

Annual Report 2023 Page 115 Page 117

Annual Report 2023 Page 115 Page 117