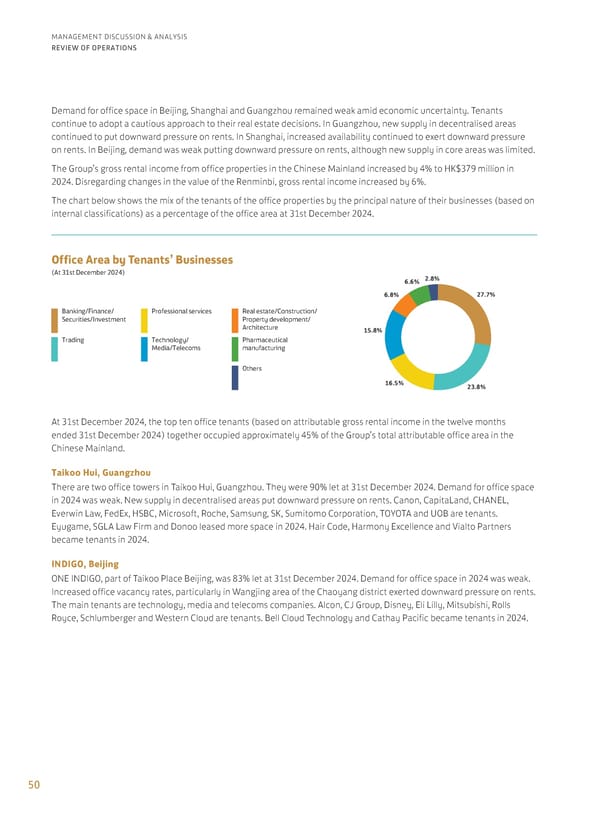

27.7% 15.8% 6.8% 23.8% 16.5% 6.6% 2.8% Banking/Finance/ Securities/Investment Trading Professional services Technology/ Media/Telecoms Real estate/Construction/ Property development/ Architecture Pharmaceutical manufacturing Others Office Area by Tenants’ Businesses (At 31st December 2024) 50 MANAGEMENT DISCUSSION & ANALYSIS REVIEW OF OPERATIONS At 31st December 2024, the top ten office tenants (based on attributable gross rental income in the twelve months ended 31st December 2024) together occupied approximately 45% of the Group’s total attributable office area in the Chinese Mainland. Taikoo Hui, Guangzhou There are two office towers in Taikoo Hui, Guangzhou. They were 90% let at 31st December 2024. Demand for office space in 2024 was weak. New supply in decentralised areas put downward pressure on rents. Canon, CapitaLand, CHANEL, Everwin Law, FedEx, HSBC, Microsoft, Roche, Samsung, SK, Sumitomo Corporation, TOYOTA and UOB are tenants. Eyugame, SGLA Law Firm and Donoo leased more space in 2024. Hair Code, Harmony Excellence and Vialto Partners became tenants in 2024. INDIGO, Beijing ONE INDIGO, part of Taikoo Place Beijing, was 83% let at 31st December 2024. Demand for office space in 2024 was weak. Increased office vacancy rates, particularly in Wangjing area of the Chaoyang district exerted downward pressure on rents. The main tenants are technology, media and telecoms companies. Alcon, CJ Group, Disney, Eli Lilly, Mitsubishi, Rolls Royce, Schlumberger and Western Cloud are tenants. Bell Cloud Technology and Cathay Pacific became tenants in 2024. Demand for office space in Beijing, Shanghai and Guangzhou remained weak amid economic uncertainty. Tenants continue to adopt a cautious approach to their real estate decisions. In Guangzhou, new supply in decentralised areas continued to put downward pressure on rents. In Shanghai, increased availability continued to exert downward pressure on rents. In Beijing, demand was weak putting downward pressure on rents, although new supply in core areas was limited. The Group’s gross rental income from office properties in the Chinese Mainland increased by 4% to HK$379 million in 2024. Disregarding changes in the value of the Renminbi, gross rental income increased by 6%. The chart below shows the mix of the tenants of the office properties by the principal nature of their businesses (based on internal classifications) as a percentage of the office area at 31st December 2024.

Annual Report 2024 | EN Page 51 Page 53

Annual Report 2024 | EN Page 51 Page 53