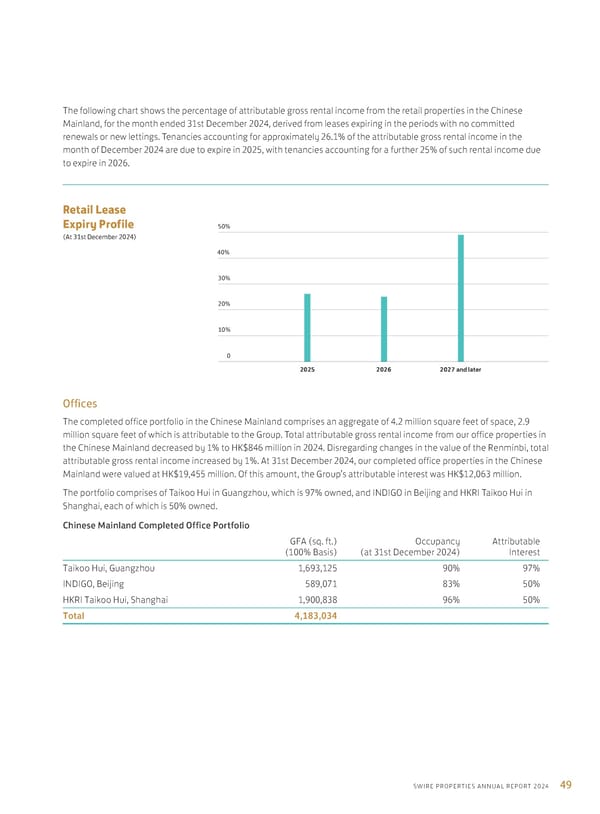

50% 40% 30% 10% 20% 0 2025 2026 Retail Lease Expiry Profile (At 31st December 2024) 2027 and later 49 SWIRE PROPERTIES ANNUAL REPORT 2024 The following chart shows the percentage of attributable gross rental income from the retail properties in the Chinese Mainland, for the month ended 31st December 2024, derived from leases expiring in the periods with no committed renewals or new lettings. Tenancies accounting for approximately 26.1% of the attributable gross rental income in the month of December 2024 are due to expire in 2025, with tenancies accounting for a further 25% of such rental income due to expire in 2026. Offices The completed office portfolio in the Chinese Mainland comprises an aggregate of 4.2 million square feet of space, 2.9 million square feet of which is attributable to the Group. Total attributable gross rental income from our office properties in the Chinese Mainland decreased by 1% to HK$846 million in 2024. Disregarding changes in the value of the Renminbi, total attributable gross rental income increased by 1%. At 31st December 2024, our completed office properties in the Chinese Mainland were valued at HK$19,455 million. Of this amount, the Group’s attributable interest was HK$12,063 million. The portfolio comprises of Taikoo Hui in Guangzhou, which is 97% owned, and INDIGO in Beijing and HKRI Taikoo Hui in Shanghai, each of which is 50% owned. Chinese Mainland Completed Office Portfolio GFA (sq. ft.) (100% Basis) Occupancy (at 31st December 2024) Attributable Interest Taikoo Hui, Guangzhou 1,693,125 90% 97% INDIGO, Beijing 589,071 83% 50% HKRI Taikoo Hui, Shanghai 1,900,838 96% 50% Total 4,183,034

Annual Report 2024 | EN Page 50 Page 52

Annual Report 2024 | EN Page 50 Page 52