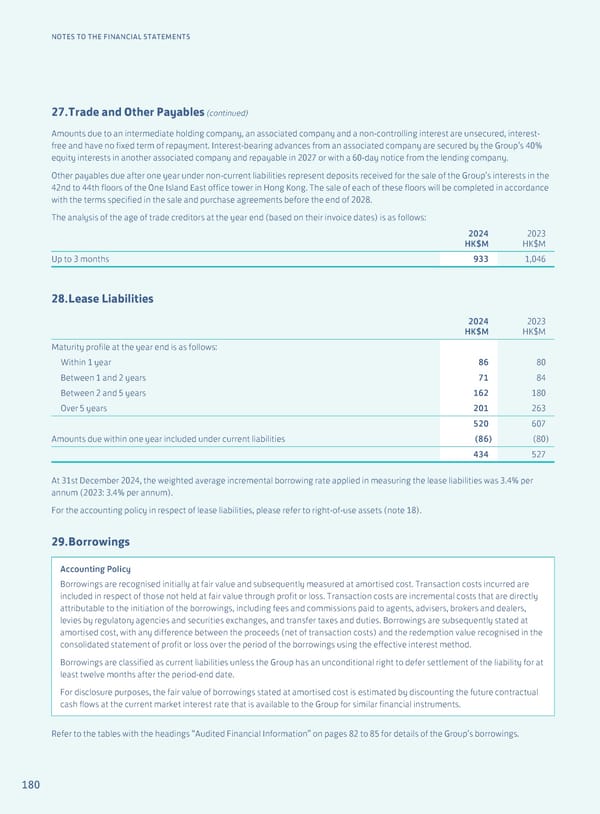

180 NOTES TO THE FINANCIAL STATEMENTS 27. Trade and Other Payables (continued) Amounts due to an intermediate holding company, an associated company and a non-controlling interest are unsecured, interest- free and have no fixed term of repayment. Interest-bearing advances from an associated company are secured by the Group’s 40% equity interests in another associated company and repayable in 2027 or with a 60-day notice from the lending company. Other payables due after one year under non-current liabilities represent deposits received for the sale of the Group’s interests in the 42nd to 44th floors of the One Island East office tower in Hong Kong. The sale of each of these floors will be completed in accordance with the terms specified in the sale and purchase agreements before the end of 2028. The analysis of the age of trade creditors at the year end (based on their invoice dates) is as follows: 2024 HK$M 2023 HK$M Up to 3 months 933 1,046 28. Lease Liabilities 2024 HK$M 2023 HK$M Maturity profile at the year end is as follows: Within 1 year 86 80 Between 1 and 2 years 71 84 Between 2 and 5 years 162 180 Over 5 years 201 263 520 607 Amounts due within one year included under current liabilities (86) (80) 434 527 At 31st December 2024, the weighted average incremental borrowing rate applied in measuring the lease liabilities was 3.4% per annum (2023: 3.4% per annum). For the accounting policy in respect of lease liabilities, please refer to right-of-use assets (note 18). 29. Borrowings Accounting Policy Borrowings are recognised initially at fair value and subsequently measured at amortised cost. Transaction costs incurred are included in respect of those not held at fair value through profit or loss. Transaction costs are incremental costs that are directly attributable to the initiation of the borrowings, including fees and commissions paid to agents, advisers, brokers and dealers, levies by regulatory agencies and securities exchanges, and transfer taxes and duties. Borrowings are subsequently stated at amortised cost, with any difference between the proceeds (net of transaction costs) and the redemption value recognised in the consolidated statement of profit or loss over the period of the borrowings using the effective interest method. Borrowings are classified as current liabilities unless the Group has an unconditional right to defer settlement of the liability for at least twelve months after the period-end date. For disclosure purposes, the fair value of borrowings stated at amortised cost is estimated by discounting the future contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments. Refer to the tables with the headings “Audited Financial Information” on pages 82 to 85 for details of the Group’s borrowings.

Annual Report 2024 | EN Page 181 Page 183

Annual Report 2024 | EN Page 181 Page 183