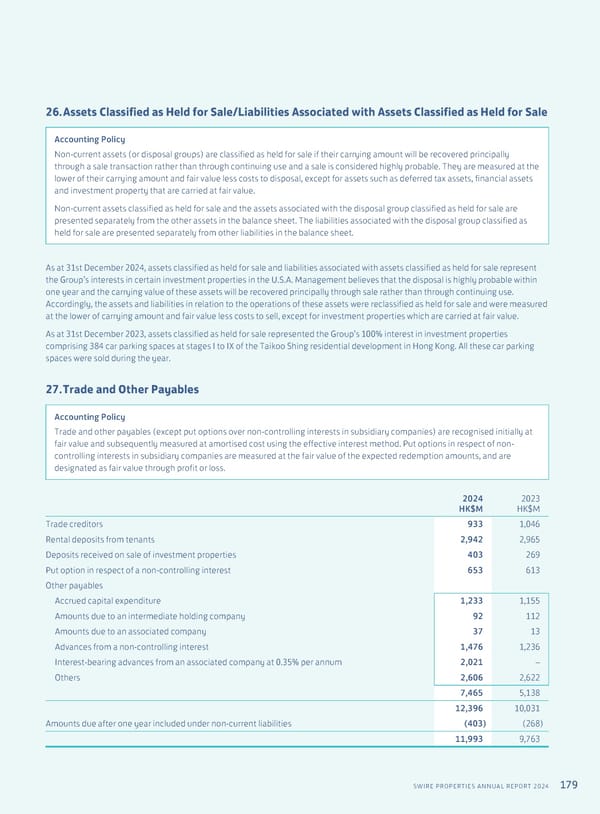

179 SWIRE PROPERTIES ANNUAL REPORT 2024 26. Assets Classified as Held for Sale/Liabilities Associated with Assets Classified as Held for Sale Accounting Policy Non-current assets (or disposal groups) are classified as held for sale if their carrying amount will be recovered principally through a sale transaction rather than through continuing use and a sale is considered highly probable. They are measured at the lower of their carrying amount and fair value less costs to disposal, except for assets such as deferred tax assets, financial assets and investment property that are carried at fair value. Non-current assets classified as held for sale and the assets associated with the disposal group classified as held for sale are presented separately from the other assets in the balance sheet. The liabilities associated with the disposal group classified as held for sale are presented separately from other liabilities in the balance sheet. As at 31st December 2024, assets classified as held for sale and liabilities associated with assets classified as held for sale represent the Group’s interests in certain investment properties in the U.S.A. Management believes that the disposal is highly probable within one year and the carrying value of these assets will be recovered principally through sale rather than through continuing use. Accordingly, the assets and liabilities in relation to the operations of these assets were reclassified as held for sale and were measured at the lower of carrying amount and fair value less costs to sell, except for investment properties which are carried at fair value. As at 31st December 2023, assets classified as held for sale represented the Group’s 100% interest in investment properties comprising 384 car parking spaces at stages I to IX of the Taikoo Shing residential development in Hong Kong. All these car parking spaces were sold during the year. 27. Trade and Other Payables Accounting Policy Trade and other payables (except put options over non-controlling interests in subsidiary companies) are recognised initially at fair value and subsequently measured at amortised cost using the effective interest method. Put options in respect of non- controlling interests in subsidiary companies are measured at the fair value of the expected redemption amounts, and are designated as fair value through profit or loss. 2024 HK$M 2023 HK$M Trade creditors 933 1,046 Rental deposits from tenants 2,942 2,965 Deposits received on sale of investment properties 403 269 Put option in respect of a non-controlling interest 653 613 Other payables Accrued capital expenditure 1,233 1,155 Amounts due to an intermediate holding company 92 112 Amounts due to an associated company 37 13 Advances from a non-controlling interest 1,476 1,236 Interest-bearing advances from an associated company at 0.35% per annum 2,021 – Others 2,606 2,622 7,465 5,138 12,396 10,031 Amounts due after one year included under non-current liabilities (403) (268) 11,993 9,763

Annual Report 2024 | EN Page 180 Page 182

Annual Report 2024 | EN Page 180 Page 182